The US financial crisis is always and everywhere caused by the triumph of short term greed in support of Ponzi schemes and frauds, perpetrated by a handful of Wall Street bankers and their accomplices in the political process and the media, facilitated by the wholesale weakening of the American mind and character and European and Asian greed and gullibility.Everything else is commentary.

21 October 2009

Jesse's Grand Unified Theory of the American Financial Crisis

Trend Change: Official Purchases from Central Banks Supporting Gold Price

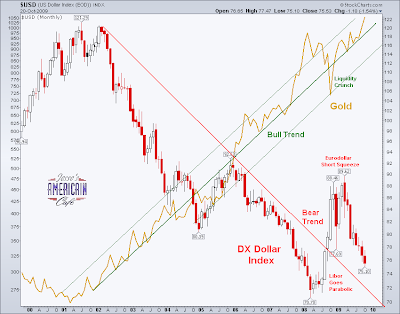

Starting in 1989, the world's Central Banks became steady net sellers of their gold reserves which had been accumulated over the years.

Starting in 1989, the world's Central Banks became steady net sellers of their gold reserves which had been accumulated over the years.

In addition to official gold sales, the banks also began to engage in gold leasing contract with bullion banks such as J. P. Morgan, Goldman Sachs, et al. The gold was leased, and the bullion bank sells it in the market, paying the lease difference in a sort of gold carry trade.

And now for something completely different, it appears that the world's central banks may once again become net buyers of gold, after a twenty year campaign of selling gold from their vaults into the public markets, creating a steady downward pressure on the price of gold, that contributed to its long bear market.

There is some thought that the central bank gold sales had been designed to support the strong dollar as the reserve currency of the central banks. Gold had been viewed as a threat. Documents which have been disclosed and quotations from the transcripts of central bank meetings do support a concern that the price of gold could rise, destabilizing the fiat regime which had been in place since the US went off the international gold standard in 1971.

Starting in 2001, gold began a bull market based in part by the decline of the US dollar as the undisputed reserve currency of the world. And now the banks are reconsidering their position, and in some cases nervous central bankers seeking to recover their leased bullion, even adding to their reserves by new purchases.

This is not to imply that gold will replace the dollar. Rather, if the intended target is indeed the SDR, which comes up for rebalancing in 2010, banks may need to have gold on hand since it is thought to be favored as a component of the basket of currencies of which the new SDR will be created.

With regard to the proposed IMF sale of 403 tons of gold, there is speculation that this amount may be spoken for already by a few central banks who wish to convert some of their existing US dollar reserves to gold. At a market price of $1,050 per ounce, that would be a total sale of about $13.7 billion. That would barely make a dent in China's dollar reserves should be they so inclined to cut a check.

And of course there are the usual rumours of bullion banks who are heavily 'naked short' gold, having sold the leased product, and are unable to buy physical bullion in size with which to deliver it. There is also some talk of bullion banks having engaged in 'fractional gold' sales to customers holding unallocated bullion. This is cited as one reason why the COMEX in the US has a rule that allows deliver in the futures markets to be made in paper,

Whatever the truth may actually turn out to be, there can be no disputing that an end to twenty years of steady selling of gold, a relatively small and tight market compared to most others, in which central gold reserves represent a significant source of supply, is significant news indeed.

"In its just released Gold Survey 2009 GFMS suggested that the official sector in aggregate became a net buyer in the second quarter of 2009 and forecast that the second half of the year would see further net purchases. This represents a remarkable change of direction for a market that has been used to absorbing substantial volumes of gold sold by central banks over the last decade."GFMS Report

"Over the next year or two this new trend may be obscured somewhat by the planned sales of 403 tonnes of IMF gold, assuming, of course, that there is no off-market transfer of some or all of this bullion to an official sector buyer, something we think improbable but by no means impossible. Once the IMF sales programme is completed, however, we would expect the official sector as a whole to have a broadly neutral impact on the market. This would represent a return to the situation prevailing in the 1970s and 1980s when the official sector was a net buyer in some years and a net seller in others. Besides the obvious supply/demand implications for gold, such a change from net sales to something close to ‘neutrality’ would be highly positive for gold prices, as it ought to provide a major boost to sentiment and confidence in the yellow metal."

“Central banks stand ready to lease gold in increasing quantities should the price rise.” Alan Greenspan, July 24, 1998

A 'fractional reserve' bullion bank would be unnerved by this trend, with visions of potential insolvency if it continues and they are not able to cover their obligations. Talking their book would require them to be quite negative, in the hopes of creating supply in the form of a decent pullback, allowing them to cover their 'short positions' and failed to hedge them adequately.

The biggest forward hedger in the sector, Barrick Gold, was recently forced to capitulate and announce the need to raise billions to buy out of their forward obligations. This still does not help those who are in need of the physical product.

The situation in the silver market is even more potentially explosive, since the CFTC has allowed two or three banks to assume enormous short positions, unprecedented for any other commodity market, amounting to a massive naked short without any conceivable hope of being supplied at today's market prices. But as long as they can keep a few steps ahead of the need to deliver the goods, the game can go on.

A truly remarkable financial system, which can only serve to puzzle future generations. "What were they thinking?"

When the Financial Journalists Were Indeed 'Pimping' for Wall Street

Here is a interesting moment in US financial journalism on CNBC. It does not describe the basis of the lawsuit very well, and does become a bit surreal at times. There is a nearly priceless moment at the end when the frustrated Attorney General of California Jerry Brown asks Dennis Kneale and Michelle Caruso-Cabrera, "Are you pimping for (State Street Bank) the defendant?"

You can watch the video and assess things for yourselves.

This question of the role of financial journalism brings to mind a little remembered vignette from the 1930's. After the Crash and the slide into Depression, there were a number of government investigations conducted into the varieties of financial fraud, of which there were many, and became the basis for a number of laws, most of which were overturned just prior to our current series of crises starting in 2000.

There was a particularly colorful character named A. Newton Plummer. He was a culprit, a bagman I think they were called, but also had become a whistle blower, a witness, after having been apprehended.

And a right effective witness he proved to be, since he had kept a suitcaseful of cancelled checks that showed that a great many, if not most, of the financial journalists in the major eastern media were regularly 'on the take' from Wall Street, in promoting certain ideas, certain stocks, legislation, whatever was required. Apparently in those days of stock operators and pools, prior to the SEC, it was a common practice to deceive the small investor through the manipulation of price action and news. Can you imagine that. And in less-regulated, naturally efficient markets.

We do not hear much about A. Newton Plummer. But he did write a book about what he had done as the bagman, after his testimony was buried, deeply. Probably to help restore public confidence in the troubled financial markets of the Great Depression.

The Great American Swindle Incorporated

Plummer, A. Newton

A. Newton Plummer, 1932. 2,000 copies.

I have a copy of his privately published book. It is an interesting read. Everything he said was documented. It was a time when the news media was undoubtedly 'pimping for Wall Street.' And they helped to create a credit bubble, the bubble that broke the world, and blamed it on a spontaneous mass delusion, and financial innovations like consumer credit.

While CNBC has its journalistic standards, this does not seem to be their finest moment. Both Dennis and Michelle are seasoned journalists. But Jerry Brown is a consummate politician, and is to be baited carefully, and at your peril.

CNBC Interview with the California Attorney General

Things are much more sophisticated these days, and the times of 'yellow journalism' with moguls like W. Randoph Hearst starting wars and promoting causes using the power of their media conglomerates are a thing of the past.

But journalists who specialize in a specific sector all the time, whether it be finance or politicians, must be on their guard not to closely identify with the industry which they are supposed to be objectively covering. An emotional attachment can develop, a mindset can be imprinted, when you spend all day speaking with people who have a particular viewpoint of the world based on their own needs and objectives and biases.

And it still bothered me that I came away from this interview without understanding the nature of the lawsuit, and obtaining no real facts about it. Dennis Kneale seems to imply that the Pension funds were promised a specific price and it was delivered, and California was merely griping about the deal unjustifiably. And then Michelle engaged in what might be charitably called an ad hominem attack.

So here are the facts as reported by The New York Times:

Still, the lawsuit raises troubling questions about the bank’s practices and controls. It grew out of an inquiry by California state investigators who were looking into claims made against State Street by unidentified whistle-blowers that accused the bank of adding a secret and substantial markup to the price of their currency trades. The whistleblowers alleged that the scheme cost State Street clients about $400 million annually and dated back to 1998.It sounds to me that State is being accused of conducting trades for a fee, but then padding the associated trades to skim a bit extra. This is not an unheard of practice, especially when a trading firm is dealing with what they consider to be a 'dumb client.' There is a mindset among some trading groups that says if you are dumb enough to do business with me, I am justified in ripping your face off, even if it is a little bit at a time. We will have to see how the court case proceeds to find out if the accusations are true.

According to the California Attorney General, State Street executed about $35.2 billion in currency trades for Calpers, the California Public Employees’ Retirement System, and Calstrs, the California State Teachers’ Retirement System, from 2001 to this fall.

State Street tellingly referred to the state pension funds as “dumb” clients since they allowed the bank to handle foreign exchange transactions for them, according to a complaint filed by the whistleblowers. Smart clients, it said, traded directly with the bank and obtained better rates.

The lawsuit contends that State Street concealed fraudulent pricing practices by entering false exchange rates into electronic trading databases and reporting false prices in the account statements that it provided Calpers and Calstrs. The lawsuit also accuses State Street of deliberately failing to include time stamp data in its reports so that the pension funds could not verify the actual cost of the trade.

Now, would it have been so hard for CNBC to find these facts out and ask about them rather than take such a stumbling and ill-prepared stance into the interview, and then insult the interviewee and disparage his motives?

They are capable of doing much better professional work than this.