It's Alive! Well, Ben at least made the frog jump in response to repeated jolts of the dollar electric.

It's Alive! Well, Ben at least made the frog jump in response to repeated jolts of the dollar electric.

As you may have already heard, the US Non-Farm Payrolls Report for November came in better than expected with a loss of only 11,000 jobs, as compared to expectations of a loss of 111,000. And on cue, right after the Jobs Summit. The One is in Pennsylvania today claiming Economic Mission Accomplished. Now that's entertainment!

The economy has responded to Ben's monetary lightning. It has moved after an expansion of the monetary base that has not been seen since the early stage Great Depression, and a dollar devaluation which is still working its way through the system.

More importantly this sets the trend that the government wishes to sustain. Remember, we are not adding jobs, and especially permanent jobs that pay a solid living wage; we are losing jobs less quickly, and adding back marginal and temporary jobs for manufacturing jobs that continue to bleed out.

But for now that is enough for the markets it appears.

Most importantly it creates a definite bottom in the long term jobs trend.

The imaginary jobs report, aka the BLS Birth Death Model, is ticking along as a 'plug' in the numbers without a corresponding reaction to the underlying economy. The number did have an inordinate impact this month of November because of the slight seasonal adjustment. As you know the Birth Death model is added to the raw number prior to seasonality.

This chart makes the trends clear, but also shows the convergence between the raw and adjusted numbers in November. This is divergence is going to become a yawning gap as the BLS adjusts for seasonal hiring. There is a lot of temporary hiring for the holiday season in the US, and these jobs are eliminated in January. So the BLS adjusts the raw number significantly higher.

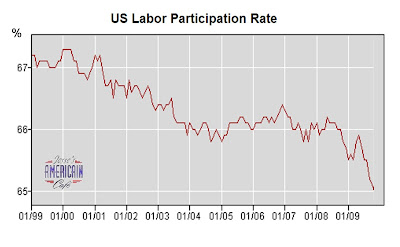

The improvement in the unemployment rate was largely due to people dropping off the radar of the government as their benefits run out. You can see this if you look at their estimate of the population of available workers. The number is shrinking, and the people drop into the 'discouraged' category.

This is revealed by what is called the "Labor Participation Rate." It dropped in November from 65.1% to 65%. Less people are working against a more stable measure of the population, civilian workers over the age of 16 that have not disappeared, at least as far as the government is concerned.

The question now is sustainability. The Fed and Treasury have jolted the corpse of the US economy back into a semblance of life. But can it sustain itself without a continuing printing of money to the point of hyperinflation?Watch the median wage, and the actual spending numbers. This will tell us if the monster has a pulse of its own, and can be taken off the Fed's lightning. And if it is, what is it most likely to do once it gains momentum?

Deflation is rather unlikely unless there is an exogenous shock or a major policy error of tightening rates too quickly, almost deliberately. As this would be economic suicide we assume Ben will not jump off the ledge.

We also assume this will help Ben's nomination for a second term. And will make it highly difficult for Obama to wring another stimulus out of the Congress.

But, has the Bernanke Fed discovered the means to permanent prosperity for all? Is it enough to print money and through it from helicopters, if even to only a select few corporations? What are the unintended consequences yet to emerge?

The stage is being set for stagflation, if not a hyperinflation as John Williams puts forward fairly well in his latest special report from 2 December. We are still skeptical of that outcome.

04 December 2009

November Non-Farm Payroll Report - It's Alive!

03 December 2009

Gold Daily Chart

We had a dead hit on the target of 1225, and the market seems to be withdrawing with stocks ahead of the US Non-Farm Payrolls Report.

If this is to be a normal pullback in this uptrend, then we would expect to see the 1190 level hold on the daily close. We would then look for a consolidation.

If this is to be a correction of the rally, then a pullback no greater than 50% of the breakout would be normal.

If there is to be a test of the breakout support around 1170, then it could be a rare buying opportunity if it holds and forms a bottom.

Our longer term target for gold is much higher than this.

02 December 2009

Gold Chart Weekly Updated - Taking Some Profits

Gold bullion is nearing our intermediate price objective for the breakout which we have been following since US$1,020 per ounce. Here is the updated chart. Please note that these chart formations set minimum measuring objectives, but not 'tops' as in limits.

Trading discipline would suggest taking the initial investment off the table here, but let at least some, if not most, of the trading profits run. The daily chart has a higher objective of around US$1,250 and we may very well see an intra-week push up to that level before the end of the year.

Tim and Ben seem determined to inflate an asset bubble, and a continuation into the year end and beyond is certainly not out of the question. The Fed established its repuation for recklessness in the bubble which they inflated from 2003 to 2007, which manifested in stocks and housing. Have they learned any lessons? It seems like only new ways of doing the same old things, and on a grander scale. Larry and Ben have not had an original thought since 1994, and Timmy is a 'useful pair of hands.'

We are entering the period when we would start to anticipate a pullback and consolidation, at least, if not a correction in what has been an extraordinary run. We would prefer this, than a parabolic high. But we have to emphasize that the formation on the charts is a measuring objective, a target if you will, but not necessarily a top.

Mitigating our outlook is the apparent attempt by the US monetary powers to inflate the equity bubble, possibly into year end. Otherwise the fundamentals on many of the financial instruments are looking a bit frothy.

While we do not touch our long term metals positions, as we have not done since 2001, we will vary the trades and leverage as the intermediate situation indicates. But it should be clear that our trading suits our particular age and outlook, and financial condition and needs, and quite frankly, nerves.

And our nerves are getting old, and the markets in general seem a bit 'on the edge.' Le Patron's capacity for risk tolerance is not as vibrant as in day's long past. Although we do confess to a restless desire to short the US equity market, and waiting is becoming an act of will.

Investors who are more aggressive or conservative, with differing time frames, will best seek individual investment advice as always from a qualified advisor (especially if you can find one who is thinking 'out of the box' that is.) We cannot and do not give any individual counsel, and merely look at the markets themselves, and discuss generic trading tactics, and sometimes our own positions.

Despite a very recent surge in popularity, gold and silver are hardly mainstream investments, and few understand them. This will change. But it has not changed yet.

We want to emphasize that 1225 is NOT our ultimate price objective or a top call. This is a minimum measuring objective from the breakout from an ascending triangle of 1225 on the weekly chart. IF you accept that an inverse H&S pattern can be a consolidation pattern, then 1275 is the minimum measuring objective.

What is our ultimate price? Well, to answer that, we would have to know how thoroughly the Fed and Treasury intend to debase the dollar. Further, we would need to have a honest accounting of the gold holdings of the US, and any allocations or encumbrances on them from leasing activity.

Without such knowledge forecasting a 'top' is difficult. But for now here is one target price from a favorite analyst, David Rosenberg.

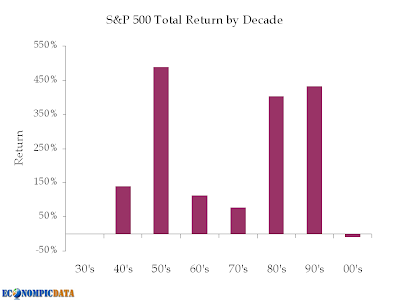

America's Lost Decade in Equities

For the first time since the 1930's this decade represents negative returns for the SP500. Remarkably this chart represents nominal total returns.

Adjusted for the weaker dollar and inflation, the 'buy and hold' philosophy, especially for those nearing their retirements, has been a disaster. But it has been great times for speculators and insiders and the productive economy.

Part of the problem is with the 401k concept as a supplement if not replacement for pensions and savings, as well as portfolios for educational purposes. Their implementation offers too few choices for the average person. Do you wish to buy corporate stocks or corporate bonds? Or money market funds where the value is not guaranteed? Short term Treasuries, if you are fortunate.

The piling into corporate bonds in the US today may be in part driven by this lack of genuine choice, the seeking for 'conservative choices' and is setting up the many for staggering losses in the event that stagflation does indeed occur. Bond funds are no safe havens.

Two tax reforms, or at least stimulus, that the US might consider is increasing the annual allowance of $3,000 which the taxpayer may claim from prior capital losses against current income. The amount has been the same for many years, and an increase would help the average person clean their books up a bit. A second program might be stimulus, in allowing the average person to take for example $10,000 out of their IRA or 401k tax free for one time.

The Reformer will not do anything that does not benefit Wall Street, but if the US wishes to obtain some serious reforms in its financial system there is a rich ground to sow the seeds of renewal, given the neglect and abuse of the last twenty years.

The banks must be restrained, and the financial system reformed, and balance restored to the economy before there can be any sustained recovery.