SP 500 September Futures Daily Chart

Still standing at the crossroads.

Gold Daily Chart

Hanging on to its active formation in the face of some determined resistance and repeated bear raids.

US Dollar Intermediate (monthly) Chart

A Bull Rally in the Dollar? Maybe, but spikes higher on euro short squeezes are not a stable platform for a sustained currency rally. Has to break out through overhead resistance and put the spike into thie trading range.

Silver Daily Chart

Bouncing along the 200 DMA looking for the strength for a sustainable rally. Interestingly enough the 50 DMA is overhead resistance. Personally I think this is a possible marker for a multi-party price manipulation. Seems rather convenient.

Mining Stocks HUI Index Weekly Chart

21 July 2010

Gold Daily Chart; SP 500 September Futures Chart: US Dollar Long Term Chart

07 July 2010

Charts: Gold, SP 500, Silver, HUI, Gold/Euro

Gold Daily Chart

Gold Weekly Chart

SP 500 September Futures Daily Chart

Silver Weekly Chart

Miner's Index (HUI)

Gold / Euro Correlation

29 June 2010

Gold: Chart Updates - Gold is a Counter Trade to Currency Risk

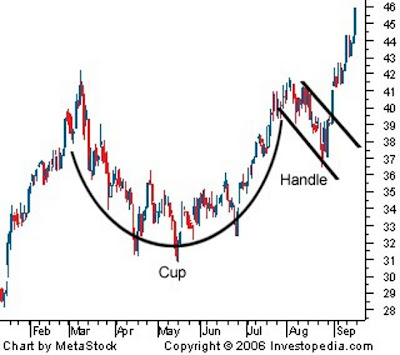

Although the gold bulls took a severe 'gut check' today, the cup and handle formation ultimately proved too powerful for the bears and bullion banks to break. It is an epic struggle, with much broader, perhaps even historic, implications than most of us can now realize, being too close to the event to see its true dimensions.

The weekly chart shows that gold is in a bull market. Anyone who does not acknowledge this, especially any metals analysts, are talking their books and private agendas. I can think of no other profession that allows for such blatant deceptions as the US financial sector.

The hysteria that accompanies every minor, albeit somewhat sharp, pullback in the price of gold borders on the ridiculous. It is often a 'psych job' by hedge funds, and unfortunately a mass of the deluded who simply do not understand currency markets and money. They think they do, but they don't, and in this case a little knowledge is a dangerous thing for their accounts.

Gold is a counter trade to currency risks. Monetary inflation is only one example of that risk. So the simplistic model is bewildered when gold rockets in the face of deflation caused by credit destruction and weak aggregate demand. What it fails to account for is the dramatic deterioration in the backing for the currency due to the corrosive decay of its underlying assets, the degraded ability to tax and service debt, and the actual assets held by the central bank.

And this is why at times some governments seek to control rival currencies such as gold. It is the economic equivalent of rolling back the odometer, or putting sawdust in the crankcase of a car which you wish to sell to the unsuspecting. It is a means to a control fraud, the deliberate hiding of the dilution of your currency to support a set of political and personal objectives. And this is why the citizenry, if they are wise, will insist on transparency in the metals markets and the asset holdings of their country.

The miners are doing reasonably well all things considered, but may not stand up well IF there is a sell off in the general equity markets.

You may as well hear it all now, because in the event of war, the truth will be the first victim.

24 June 2010

Silver, the Shiva of the Trading Pits: Gold and the SP 500 Futures Daily Charts Updated at 5:30 PM

Once again gold is rising with stocks falling, strongly indicating that gold is riding on the crest of the risk trade, and an underlying slow but steady short squeeze on the physical offtake, most likely driven by foreign central banks and large investors. The paper trade is another thing altogether.

Gold is attempting to break out, but needs to clear 1250 and 'stick it.'

It would not surprise me to see a breakaway gap to the upside on some overnight or weekend.

Someone asked me why I have so much interest in gold at this time.

Simply put, it is because I think gold is on the verge of an historic move, and a shift in the geopolitical money structure that will be talked about for many years to come. But I could be wrong. It could just be another leg up in the bull market.

Silver is poised to break out of a very large inverse H&S formation perhaps. I think we will learn quite a bit of market insight, depending on which metal leads the way, silver or gold.

Then again, of course, the breakouts may not come. But I think they will. The silver formation is so big and so powerful looking that the breakout, when it eventually comes, might well look like a shaped charge sending out a jet of hot plasma vaporizing a hole through stop losses and short positions.

The silver formation is so big and so powerful looking that the breakout, when it eventually comes, might well look like a shaped charge sending out a jet of hot plasma vaporizing a hole through stop losses and short positions.

"Now I am become death, Destroyer of Shorts, pinned on the wrong side of my trade. Lord of the cruel forces of nature."

JPM will get bailed out by the CFTC / Fed most likely, but they will be burning specs and tossing hedge funds onto the bonfire of the vanities.

Watch for a surprise trading house that slithers out of the dark pools to vampirically feed on the trapped shorts when the time comes. They won't be able to use stretchers to haul them out of the pits; they will have to use dust pans.

The actual timing of the event will be tough to forecast precisely. But we are getting closer.

What I find particularly fascinating about this chart is that it is such a good visual representation of the tension between the capping of price by paper shorting, the big line of resistance, and the steady rise in price driven by physical offtake, and the shrinking pool of physical supply against a growing demand for 'the real thing.' The shorts like JPM and HSBC can only push the price down so far using their paper tricks, but the metal keeps coming back.

23 June 2010

Gold: Cup and Handle Formation Update

This chart formation has been well behaved so far.

The dip today hit our target of 1225 right on the nose.

Let's see if the price can now consolidate and then begin its breakout.

Classic Example

18 June 2010

Gold, Silver, and SP 500 Futures Daily Charts

Gold made a new all time high on the weekly close, and the handle is now broken to the upside. Some have been trying to spot a rising wedge in this handle formation, but as you can see it is more of an uptrending channel, as the cup and handle dominates the longer term chart. There is plenty of room for another retracement, and do not expect this to be easy. The premiums on the trusts and funds are low, and there is quite a bit of stubborn bearish sentiment.

Silver is trying to break out above resistance around the 20 level. I suspect it will do so fairly soon.

It is obvious that the SP 500 needs to move higher to break out of this diagonal trading range.

There are so many cats out there talking their books that it is no wonder that the average investor prefers to sit on the sidelines. They do not know whom to trust or believe even on the basics f the economy.

05 May 2010

Jim Rickards: Gold, Silver, and a May 11 Meeting to Discuss Global Currency Issues

Gold is showing a potential inverse H&S pattern.

Silver is in a well-defined uptrend.

As are the miners.

But all bets are off for the miners and silver most likely if US equities head south.

Jim Rickards on CNBC discusses the May 11th IMF meeting in Switzerland

to discuss the dollar alternatives, the SDR and gold.

And it is worth watching the reactions of the CNBC anchors to what their guests

have to say, and the elegantly polite way that Rickards deals with Joe Kernen.

It's kind of sad that after all these years Joe Kernen is Becky Quick's assistant.

Doesn't he have seniority or something? Can't Immelt throw him a bone?

09 April 2010

The Intra-Day Pattern in Gold Trading

Nick Laird at sharelynx.com was kind enough to share this chart with us.

It shows the average pattern of gold trading intraday.

Nick has an amazing array of current and historic charts at his site, including many vintage charts from a variety of markets.

The pattern here seems a big regular. I have found it to be useful in picking entry points in certain positions.

05 January 2010

Three Charts: Gold, Silver, Dollar

It will be interesting to see how the Fed and Treasury juggle the various markets that do not play well together, being stocks, dollar, and Treasuries, and of course those nasty reminders of dollar mortality, gold and silver. Although the ADP report tomorrow may be a bit light, we think the BLS will do its duty and show us a jobs positive report on Friday.

Gold Daily

The objective for gold is obviously to break back above its 40 day moving average, and take out 1140. The bear are defending this area with a vengance, shorting every rally.

Silver Daily

If silver can take out 18.40 it's off to the races and a new high.

US Dollar (DX) Daily

The dollar needs to take out 78.50 to label this rally as more than a dead cat bounce and keep going. If it takes out 77 and the moving average to the downside then we are looking at a key support test at 76.

US Dollar Commitments of Traders

Dollar is severely overbought by the funds and specs.

h/t jsmineset for the COT dollar chart

10 December 2009

Gold Charts

Gold is attempting to make a bottom here, looking to consolidate in the 1100 - 1120 area. The selling was a series of bear raids determined to shake out the new buyers and weak hands from a short term very overbought condition.

The bulls were asking for it, leading with their chins a bit as they say. Newbies tend to buy high, panic early, buy back in abruptly and stupidly, and get taken down again in the normal overbought correction cycle. Its a greed-fear thing.

Now that the easy gains have been made, the bears start running into physical problems, and attempts to push down the price become harder to obtain and less 'sticky.' Dips are met with buying. Its a funny seesaw really, with the price increases overnight when the BRIC's and the Mideast buy, and then decline when Wall Street and the City of London paper hangers move into action.

Remember, anything can happen. It's not over until it is over, and we cannot say it is over yet. Still, the overbought condition has been substantially worked off, if in a rather precipitous manner. If one took the chart's counsel to take profits on December 2, then the portfolio has cash to now buy back some trading positions. Remember we do not touch the long term positions while the bull trend is intact.

We are back up to 1/6 position, having made a small purchase at 1150, another at 1140, both with hedges for more downside, and a larger purchase in the 1120's.

Now we wait, and buy weakness in dips to 1100 while the trend remains intact. There is downside risk to 1070, with the long term trend remaining sound. There really is no need to rush into this. Most markets look like they are rangebound at the moment, and quite possibly into year end. Waiting for a break one way or the other makes compelling sense. No one knows the future.

We have taken the hedges off, at least for now, as holdings in miners are slight. Mining stocks are correlated with both bullion and the SP 500 and should be considered levered positions. What is funny here is that gold bullion and the SP 500 are moving together, which is not the usual relationship. It can be deceptive if it changes.

Unless the markets melt down which is not likely but which is always a possibility, the risk probability is much more favorable now. If you wish to guard against a meltdown, a hedge for a stock decline is easy enough to obtain. Watch your leverage. A change in trend is ALWAYS possible.

And if 'traders' come clumsily piling back into paper gold here, the trading desks will see it and skin them alive, charts or no charts. That is how markets overshoot targets.

A much more deliberate and long term approach to the markets is preferable for those who are not traders. That is about 90% of the people who read these blogs. For them, there should only be four or five trades per year, if that.

We have to look at all markets within the context of the economy in which they operate. As we have stated, our outlook for the real economy is still very gloomy. This is not a cyclical recession we are experiencing. We are in dangerous waters.

It really is going to come down to the willingness of the Fed and Treasury to monetize the next wave of bad debt that comes rolling in from the Commercial Real Estate markets, and fresh rounds of residential foreclosures.

That is what makes the difference between inflation and deflation in a fiat regime of the world's reserve currency: a policy decision, and the willingness or timidity of the rest of the world to challenge the status quo.

The middle ground between Scylla (monetization) and Charybdis (deflation) without a serious systemic reform looks like a nasty stagflation with a few big winners and many smaller players losing big, so that's the target, for now at least.

P.S. Around 3:20 NY Time some downside hedges went back on (gold 1130ish and SP futs 1105). The stock market is bifurcated between big caps and the broad index. Probably year end shenanigans but it makes me edgy. Probably another little cut and bleed, but it helps me sleep.

Gold Daily

Gold Weekly

03 December 2009

Gold Daily Chart

We had a dead hit on the target of 1225, and the market seems to be withdrawing with stocks ahead of the US Non-Farm Payrolls Report.

If this is to be a normal pullback in this uptrend, then we would expect to see the 1190 level hold on the daily close. We would then look for a consolidation.

If this is to be a correction of the rally, then a pullback no greater than 50% of the breakout would be normal.

If there is to be a test of the breakout support around 1170, then it could be a rare buying opportunity if it holds and forms a bottom.

Our longer term target for gold is much higher than this.

15 November 2009

Long Term Gold Chart Updated (And An Addendum Showing Detail)

The character of this move of the breakout will tell us how far gold will correct when it hits an intermediate top and consolidates or corrects.

Gold is in a bull market. One never gives up all their position in a bull market. Rather, you hold it while the bull is running. If you are an aggressive 'trader' you can buy on support and sell at resistance around a stable position to improve your cost basis, taking some of your own money 'off the table' but letting your profits run.

Otherwise it is better to just hang on and enjoy the ride.

As always, in a general market crash the liquidation will also hit gold and silver, and may set up an exceptional buying opportunity. But do not count on it. Never give up your seat completely on a bull market train while it is running, because it may take an extraordinary act of will to get it back again.

Last Update November 4, 2009

Sept. 16 Addendum: Someone asked for a 'picture of Scenario 1.' Here is what it might look like. With regard to timing, I am expecting gold and the SP 500 to make some sort of a short term top together, and for SP 500 DEC futures to peak out about 1117 before they correct back down to trend support. So you can see my dilemma in trying to synchronize these two views and charts. I think a market 'crash' is off the table unless there is an event, but who can predict something like that reliably?

04 November 2009

Long Term Weekly Gold Chart Targets 1275

Now that gold seems to have successfully broken out from its continuation pattern (ascending triangle or inverse H&S) we should be able to chart its targets more precisely than the chart from 24 September that at least successfully projected the breakout.

If there is a major liquidation event, such as an equity market dislocation, gold will likely be hit as well, but will provide an exceptional buying opportunity and would historically rebound more sharply than equities and most other investments.

As always, this is a forecast with some probablities of success, rather than a prediction.

Basically, the ascending triangle calls out 1275 and an inverse H&S targets 1300ish. A confirmed breakdown below 1000 deactivates the formations. We will know more about the first pullback when we see how far this current leg goes. It has moved much more quickly so far than most have imagined, but the short term trend is quite apparent on the chart.

24 September 2009

Daily Charts for Gold, Silver, Miners and Oil

Gold call options were expiring today, and there was a concentration of options with a strike price of 1000. Let's see if the metals can find a footing or if this correction from a short term overbought condition must continue further.

From UBS:

"October options expiry on Comex will take place at 2000 GMT today, and the greatest nearby open interest for October gold is at the $1000/oz strike... $950 and $1050 strikes also have very large open interest - and that open interest between $950 and $1000 is larger than that between $1000 and $1050. We believe this is a consequence of the recent quick move higher in gold from $950/oz rather than options traders explicitly expressing a preference for the downside. Given the large open interest at the $1000/oz strike, we would not be surprised if gold remains close to this level today, barring a sharp move in EURUSD. To the extent that long October-expiration positioning in the market may have been constraining the range, however, the rolling off of October options should free gold to make larger moves."

16 September 2009

Long Term Gold Chart Targets 1325

Someone asked for a long term chart in gold.

Projecting this leg in the gold bull market has been of keen interest to us on one dimension, since we do have some trading activity in our own account. However, on the long term for our core positions it is of no more interest now than it was when gold was trading at 550, 450, or even 250. Gold is in a bull market, and you never give up your core positions in a bull market. You can trade around them if you are an aggressive trader.

As an aside, to anyone who can read a chart and as you can plainly see for youself, gold is in an obvious bull market. If you are dealing with someone who says it is not then they can only a) be incapable of reading a chart, b) be blinded by a mistaken belief, or c) be talking their or someone else's book. There seem to be a few analysts, never bullish on gold in a spectacular bull market, working for major gold trading houses, that fit into this last category.

So, gold appears to be targeting somewhere just north of 1300 for this leg of its bull market. As it says on the chart, this is a LONG term projection, and it should therefore be expected to play out over the LONG term.

The lower bound on gold on these formations is higher than 925 so we would not expect gold to trade lower than that while these formations are 'working.'

Every bull market has its 'wall of worry.' Gold certainly has its own. Its price increases are being met with fierce opposition by four or five US Wall Street banks who are increasing their paper shorts against it to record numbers.

The game of Wall Street is misdirection and mischief using paper and the control of information. Yesterday's US retail sales data was a nice example of the partnership in deception between Wall Street and Washington to deceive the people for a variety of motives, some well-intentioned and some merely venal.

For this reason the Bankers and the statists hate gold, because it defies their control, and that of the money manipulators, those who would control nations and the many by controlling their money.

01 July 2009

11 February 2009

The Stock Index - Gold Ratios and a Brief Aside on Japan

The Stock Index - Gold Ratios are important in gauging significant stock market declines.

Stocks may go nominally lower or gold can increase to make the ratios go lower in their reversion to a more sustainable pre-bubble level. Gold is the anti-bubble which is why it is so detested by the bubblemaniacs.

A key question of course is when did the bubble begin? Many would say almost certainly with the advent of the Greenspan Fed Chairmanship in 1987. There is a case to be made for Reaganomics and supply side experimentation.

Estimates of nominal levels are probably not valid based on pre-1971 examples because of the constraints on monetary policy imposed by the gold standard.

As you know we dislike the facile comparisons with Japan because their recent economic experience was driven by some outrageous policy errors that could only occur in a kereitsu dominated economy with a heavily bureaucratic political structure. Japan has been essentially a one-party electoral system since their adoption of democracy, and remains widely misunderstood in the West, and perhaps even by themselves. Japan is in the process of becoming, which is why we prefer to think of its 'lost decades' as its cocoon years. It will be interesting to see what emerges.

10 February 2009

The Gold Bull In Retrospect

"Last, the short-term strokes. You already knew this anyway. We’re just repeating it for drill. The technical areas of support and resistance are self-apparent. Gold is Mother Nature. Gold is Father Time. Parents who we believe will never let us down."