skip to main |

skip to sidebar

Non-Farm Payrolls for March tomorrow.

Its the kind of report where they will be adjusting the raw numbers DOWN for seasonality, so there is plenty of room to fudge the numbers.

Unemployment claims came in higher than expected today.

This has every appearance of a phony, desperate recovery. But that does not mean that they cannot go on trying to 'muddle through' this to the next election.

The overhead resistance levels are around 1450 and 38 respectively, and are being strongly defended by the paper bulls and bullion bears.

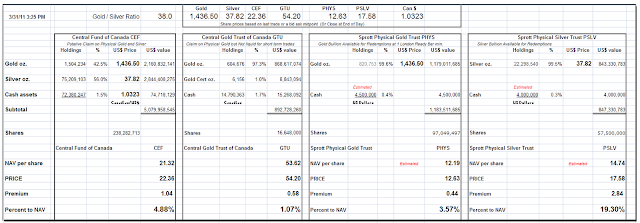

The price of the Central Fund of Canada is likely to remain a bit depressed relative to its NAV and historical averages until their recent additional unit offering is absorbed and the bullion is added to the trust's holdings. The price at which the underwriters obtained their additional shares may act as a short term 'magnet' for the price.

TORONTO, Ontario (March 29, 2011) – Central Fund of Canada Limited (“Central Fund”) of Calgary, Alberta announced today that it plans to offer Class A Shares of Central Fund to the public in Canada (except Québec) and in the United States under its existing U.S.$1,000,000,000 base shelf prospectus dated September 8, 2009 and filed with the securities commissions in each of the provinces and territories of Canada, except Québec, and under the multijurisdictional disclosure system in the United States pursuant to a proposed underwritten offering by CIBC. Central Fund will only proceed with the offering if it is non-dilutive to the net asset value of the Class A Shares owned by the existing Shareholders of Central Fund.

The remaining amount of approximately U.S.$394,295,000 of the original U.S.$1,000,000,000 provided for in the base shelf prospectus is available for this offering. Substantially all of the net proceeds of the offering will be used for gold and silver bullion purchases, in keeping with the asset allocation policies established by the Board of Directors of Central Fund. Any additional capital raised by this offering is expected to assist in reducing the annual expense ratio in favour of the Shareholders of Central Fund...

TORONTO, Ontario (March 30, 2011) - The Central Fund of Canada Limited (“Central Fund”) is pleased to announce that a syndicate of underwriters (the “Underwriters”) led by CIBC have exercised their right to purchase an additional 1,800,000 Class A Shares at a price of U.S.$22.30 per Class A Share, for additional gross proceeds of approximately U.S.$40,000,000 to Central Fund. The Underwriters agreed earlier this morning to purchase 14,350,000 Class A Shares for gross proceeds of approximately U.S.$320,005,000.

The purchase price of U.S.$22.30 per Class A Share is non-dilutive and accretive for the existing Shareholders of Central Fund. The additional net proceeds have been committed to purchase gold and silver bullion for settlement at closing, in keeping with the asset allocation policies established by the Board of Directors of Central Fund. This offering is expected to assist in reducing the annual expense ratio in favour of the Shareholders of Central Fund."

"There is a place. Like no place on Earth. A land full of wonder, mystery, and danger! Some say to survive it: You need to be as mad as a hatter."

End of quarter antics, and of course Obama went before the nation and put forward his plan for US oil independence.

Although he said he wanted to reduce the use of foreign oil by 1/3, he was a bit sketchy on details. Annexing Libya and Iraq?

Natural gas companies caught a bid, and they are getting the oil drilling rigs fitted out for tundra and wetlands.

Blythe threw her best stuff at silver today, to little avail. It looks ready to take another leg up again unless equities fall apart.

If gold breaks through the big neckline this could be impressive.

Non-farm Payrolls on Friday. ADP came in pretty much as expected today.

Given that it was the end of quarter, and the bonuses of the wiseguys are heavily dependent on making their targets, I doubt anything short of Tokyo melting into the Marianas Trench could have stopped a stock market rally today.

And gold and silver must go down to make Ben and Timmy look good, if just for a day.

Speaking of a pliantly available pig belly, I am still trying to regain my equilibrium after reading Greenspan's Op-Ed in the Financial Times on the danger of financial reform and too much banking regulation. It is as if there was a seminar on customer service and proper hair cutting techniques for the trade being given by Sweeney Todd, the demon barber of Fleet Street. Are these people really that tone deaf or just that arrogant? What next, a personal financial advice column by Bernie Madoff?

At long last, Mr. Greenspan, have you no decency, no sense of shame?