skip to main |

skip to sidebar

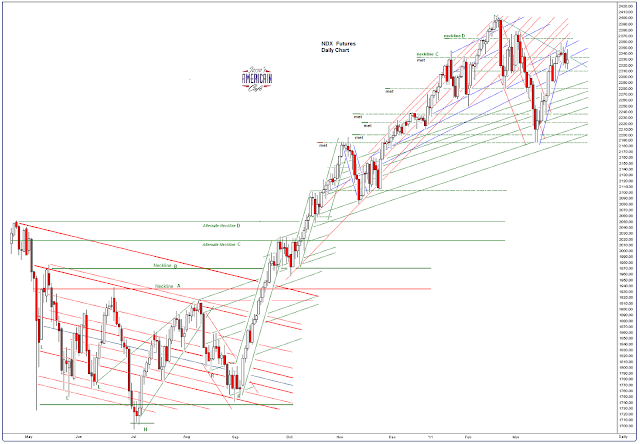

Looked a little wobbly in a relatively wide ranging, low volume day.

The wiseguys are the primarily the ones trading in this market, selling shares back and forth to one another in a Ponzi like manner, and using positioning advantage to skin any specs brave enough to venture in for a trade.

That is why it has a bias to drift higher when nothing happens, but is still a tough market for a non-professional without insider knowledge and tools.

At the first serious whiff of smoke, they will hit the exits and these markets will break hard and fast to the downside. But that's just my opinion and I could be wrong.

There is no sustainable economic recovery. This is opera buffa, a stage managed farce run by the one percent, and for the one percent.

Looked like consolidation today.

Equities appeared to be a little wobbly overall, but they did shake off another large earthquake in Japan and an ECB rate hike.

Let's see how we go into the weekend.

7.4 Earthquake 60 miles east of Sendai. One to two meter tsunami alert. Fukushima workers evacuated.

US equity futures took a plunge on the news, breaking the morning ramp, but have since regained some of today's gains as the market consider the implications.

I would expect the market to try and shrug this off at least until after the European close, and probably until about 11 PM Central Europe Time.

My heartfelt sympathy to all my friends in Japan. Tokyo was shaken but not damaged as Sendai is quite some distance to the northeast.

The full impact of these natural (and manmade) disasters is not fully factored in to the markets in this interconnected global economy, being smothered at least for now by monetary expansion and excess liquidity, the almost euphoric complacency of the Bernanke put.

At some point reality and the markets will converge.

90 minutes later: Bloomberg reports the tsunami warning has been called off.

Late breaking news that Portugal will be seeking economic aid.

The volumes remain light, and the market vulnerable to a correction if something should happen which will cause a pickup in selling that overwhelms the Fed's monetary lift.

Marc Faber had an interesting interview with KWN: Bernanke Is Killing the Middle Class.

I am not sure it is Bernanke that is killing the middle class, as much as they are committing suicide to please the top one percent, and differentiate themselves from the poor, who they see as hopeless victims. Nothing else explains why ordinarily intelligent people spout slogans and support ridiculous notions and theories that are designed to reduce themselves and their own children to perpetual servitude. The politicians and pundits are obviously paid to say and act as they do. But why do the many willingly march to their own doom?

It tends to support the theory of Bernays, that the great bulk of people do not act on reason, but on emotions which are easily controlled and influenced, and therefore subject to manipulation. I can think of no better example of this than the manner in which the Tea Party was turned away from its initial cause of financial reform and put to the task of plundering the weak, the victims of the Wall Street and governing class frauds, upholding the very abuses by Wall Street that they had originally organized to protest. As propaganda campaigns go, it does not get much better this. No wonder the monied interests are so emboldened of late.