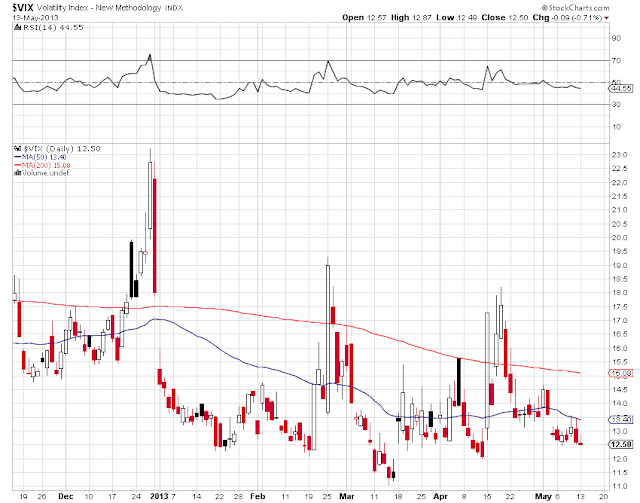

Here is the 'bullish case for stocks' from Ralph Dillon at Global Financial Data, in quotes below. The chart is also from their site.

Calculating the Equity Risk Premium Tutorial is here.

Those of us who stood by and watched the Fed blow asset bubbles in financial paper and the housing market from 2003 to 2007, after the bubble in tech stocks from 1998 to 2001, are understandably appalled that the Fed has seen fit to follow essentially the same game plan again, matched by a lack of reform in the financial system.

Bernanke's policy failure is, in my humble opinion, going to cause another financial crisis if he continues on. There are much more effective ways of reflating and stimulating the economy than creating paper asset bubbles for Wall Street, and hoping that the Banks allow for a trickle down effect to the real economy. Not a chance when gaming the markets can produce outsized profits and perfect trading records. Where is the downside, where is the risk? And where are the regulators?

I think I understand the rationale for leaving the TBTF Banks in place, and making them even bigger. It was two parts craven self-interest and one part backstop for the eventual unwinding of the Fed's Balance Sheet, when someone has to help them to absorb the trillions in mispriced paper.

In my opinion Bernanke is literally fighting a new kind financial crisis, of the Fed's own making, with the last war's tactics and weapons, in the manner of the French generals at the beginning of the Second World War. Therefore the next crisis could be quite impressive and pervasive, affecting sovereign debt and currencies to an even great degree than the last two or three bubble/crises, depending how one is keeping score.

The failure points, or limits if you will, are the valuation of the bonds and the US dollar. And Bernanke looks to be giving those limits, and the theories of risk and valuation therein, a rather rigorous stress test.

"At 85 Billion a month, massive amounts of liquidity are driving the markets higher each day. While we are closely watching the FED for signs of an exit strategy, I heard a very interesting piece from David Tepper at Appaloosa Management this morning that put todays markets in a much better perspective. According to David, The FED will have a 368 Billion dollar surplus this year! That is 368 Billion in more liquidity that “has to go somewhere”.

With the Dow and the S&P 500 trading at or near all time highs and 10yr paper trading at historic lows, you would think that we have run our course and we may want to pull some money off the table. Think again? Do you fight the FED? Do you create the MOAS? (Mother of all shorts)….Or do you stay long?

In this chart, we look at the Equity Risk Premium Index versus the DJIA, S&P 500 and the US 10yr to 1885. The red line represents the Equity Risk Premium Index and by all accounts, looks like it is ready to breakout and make a move to new highs.

Provided that the FED follows through to 2014 with the QE program, one would have to assume that the respective equity indices will all move higher with the massive amounts of liquidity that are in the pipeline.

That has proven wise, as long as the FED stays your partner."