"It is not so much anymore that the public does not trust their brokers. They do not trust the markets, the exchanges, or the regulators either. And why should they, given our showing the past few years?

To the public the financial markets may increasingly seem like a casino, except that the casino is more transparent and simpler to understand...

It is vitally important that we bring an end to this crisis of trust before it spreads any further. That we bring back order, fair dealing, and trust in the marketplace. The financial markets of ... the world's developed countries are at a turning point."

Thomas Peterffy, Founder Interactive Brokers

Technology is not the problem. Not at all. Technology is merely another tool, another means by which a financial system grown corrupt and wildly self-serving and pathologically deceptive can seek its own destruction through unbridled greed.

The US financial system is a disgrace, and the technology is just another instrument of their control frauds. Thomas Peterffy, like too many others in that system, is too close to see the problem. It is a culture of criminality that keeps defeating those who would save it. And it is spiraling out of control.

When the next break in confidence comes that cuts to the heart of the monetary system, they will act surprised, just as they did when the financial crisis brought the commercial credit system to the brink. MF Global was a microcosm of the astonishingly frail nature of their pyramids of wealth.

Gold and silver were under some modest pressure today after the run they had on Friday.

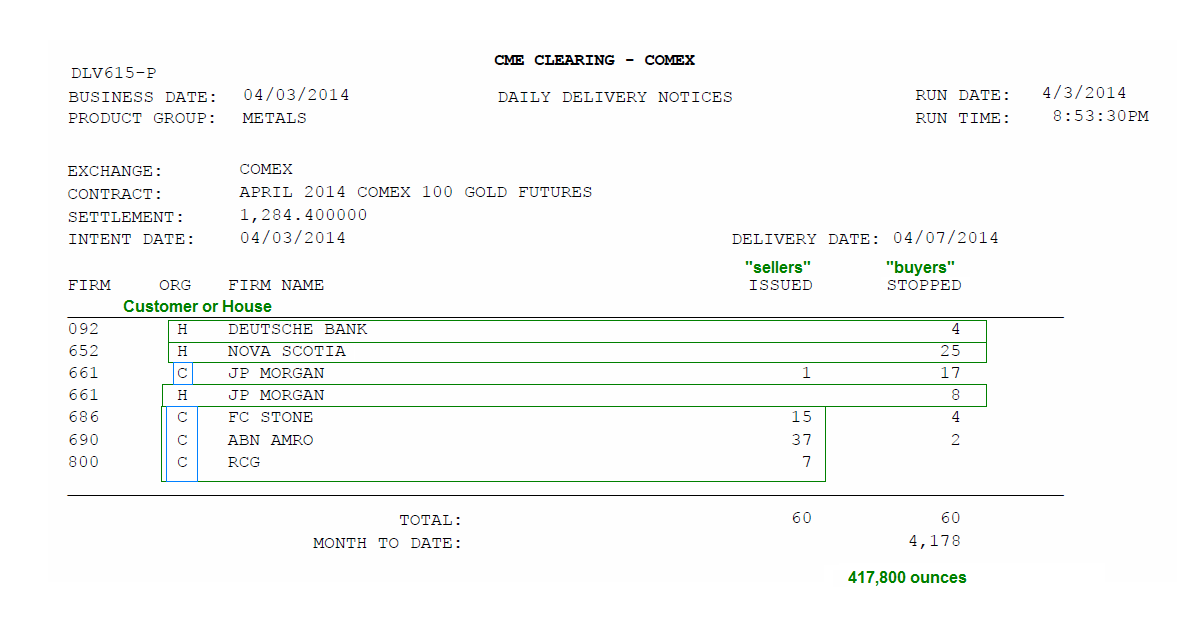

There is still little substantial movement in the warehouses and a daily trickle of those standing for delivery on the April contract.

For those fans amongst us, the season premiere of Game of Thrones was last night, and off cable watchers swarmed the 'HBO TO GO' application bringing it to its knees for a time.

I am also informed by my studious children that George R. R. Martin has 'leaked' a new chapter from the much awaited Book Six for those who arereading the books on his website.

Have a pleasant evening.