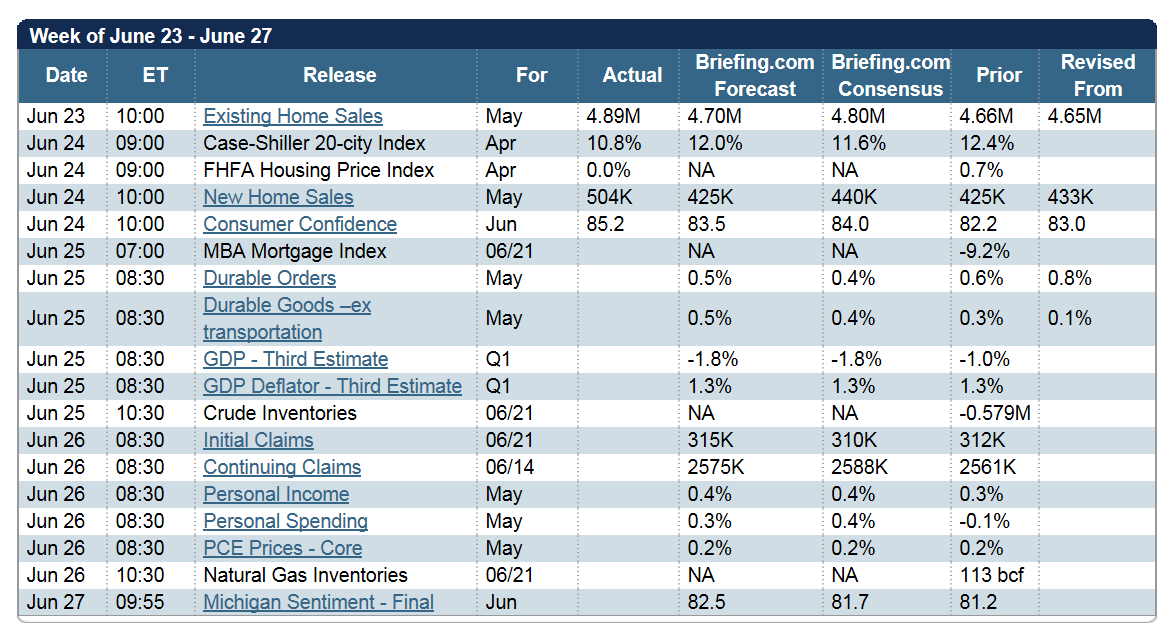

Stocks were rallying this morning on the 'better than expected' news about housing and consumer confidence.

As the day wore on, the punters apparently looked behind those numbers and did not like what they saw, and stocks ended up selling off on the day.

VIX has climbed back up a bit to a more 'normal' level of risk.

I had played an advantageous short position from last night, and cleared it out near the close.

The Dubai stock market crashed yesterday. Add that to the list, along with Argentina.

There is risk in these markets. It is just a question of what the trigger event might be, and of course when.

Have a pleasant evening.