From now until the end of the year, the precious metals markets may be very interesting to watch indeed. This is the sense I have of the market from watching the tape, and the formation of the market and the trading action.

Silver on the left and gold on the right. Not sure which one carries the knockout punch.

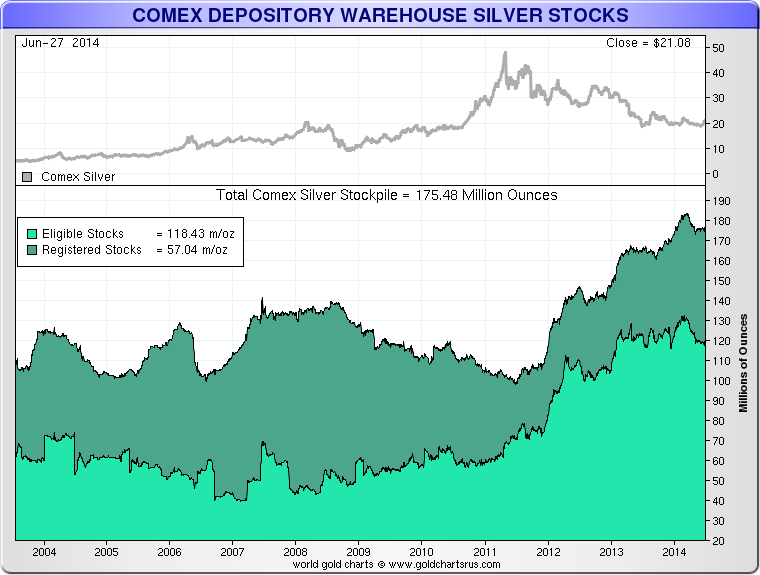

Given that this is now the active month for silver on the Comex I will be spending more time on that market.

There was some commentary on that today.

There's something happening here.

Have a pleasant evening.