"The world is ours, we are its lords, and ours it shall remain. As for the host of labor, it has been in the dirt since history began, and I read history aright. And in the dirt it shall remain so long as I and mine and those that come after us have the power.There is the word. It is the king of words—Power. Not God, not Mammon, but Power. Pour it over your tongue till it tingles with it. Power.”Jack London, The Iron HeelAt the devil's booth are all things sold. Each ounce of dross, costs its ounce of gold.James Russell Lowell

05 March 2015

Gold Daily and Silver Weekly Charts - Walkabout

SP 500 and NDX Futures Daily Charts - Killing Floor Blues

"We have sort of become a nation of whiners. You just hear this constant whining, complaining about a loss of competitiveness, America in decline despite a major export boom that is the primary reason that growth continues in the economy."Phil Gramm, 11 July 2008"Charles Munger, the billionaire vice chairman of Berkshire Hathaway Inc., defended the U.S. financial-company rescues of 2008 and told students that people in economic distress should 'suck it in and cope.'"Bloomberg, Sept 20, 2010

04 March 2015

Gold Daily and Silver Weekly Charts - Justice For Some - Currency Wars - ECB Deposit Rates To -3%

Eurozone on road to deflation, and bonds remain [an] attractive asset because high demand meets scarce supply

ECB will reduce interest for cash deposits to minus 3% and the dollar [will] appreciate by 20%, reaching parity with euro in 2015.

This evening Zerohedge reports that there is speculation that the ECB will cut interest rates paid to MINUS THREE PERCENT, and that the intention is to bring the dollar 20% higher to dollar parity. That should do wonders for The Recovery.™

Currency wars. And your meager savings and wages will be the cannon fodder.

This is not official, but it makes a great headline and a vector of things to come. Maybe JPM is trying to make us feel better about their plans for charging us a single percent to hold our cash, ex fees. Or maybe they are just snorting the ketamine of their own moral hazard, and riding the buzz into a k-hole.

This is hard to believe.

But it is also hard to believe that the Fed slipped a back door bailout in the trillions to the Banks. Nothing is as stupid as the bureaucratic desperation of the pampered princes, when they see the long awaited day of reckoning coming across the horizon. So I am keeping an open mind.

An interest rate on savings deposits of negative three percent is a euphemism for the confiscation of the middle class' remaining funds. The one percent are parked in subsidized rentier assets and tax havens.

These jokers are jumping up and down on a land mine, just to see what happens.

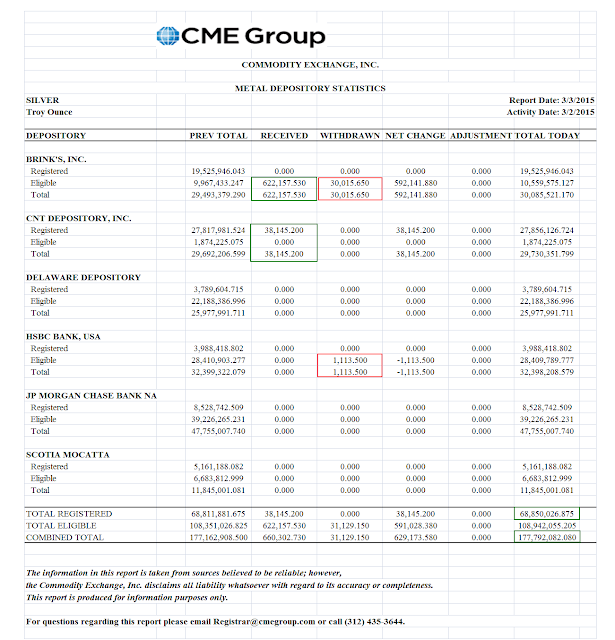

Silver continues to be the more interesting story for now in March, with the delivery notices continuing, although the warehouse inventories are more than adequate.

Gold is inactive this month, at least in the Comex bucket shop precincts. Asia is another story.

How interesting were the markets today? I apparently have some Greek heritage on my paternal great grandmother's side, via Italy. Bohemia and Austria, with Prussia on the maternal side, I knew about, but not the Greek. Yo, Demetrios.

That was how interesting the markets were today. I spent the afternoon perusing the old census records and family papers.

This market is t - h - i - n, and heavily gamed by the bots.

The Department of Justice report on law enforcement in Ferguson, Missouri was released today, and it was interesting. The report shows that Ferguson systematically used its law enforcement responsibilities to turn a minority, African Americans, into an ongoing revenue stream.

When you read this damning report, keep in mind that this abusive use of the law may be where the financial system is heading in its relationship with the ninety nine percent, with rents, fees, penalties, usurious loans and student debts, rigged markets, and of course, an unequal system of justice for some.

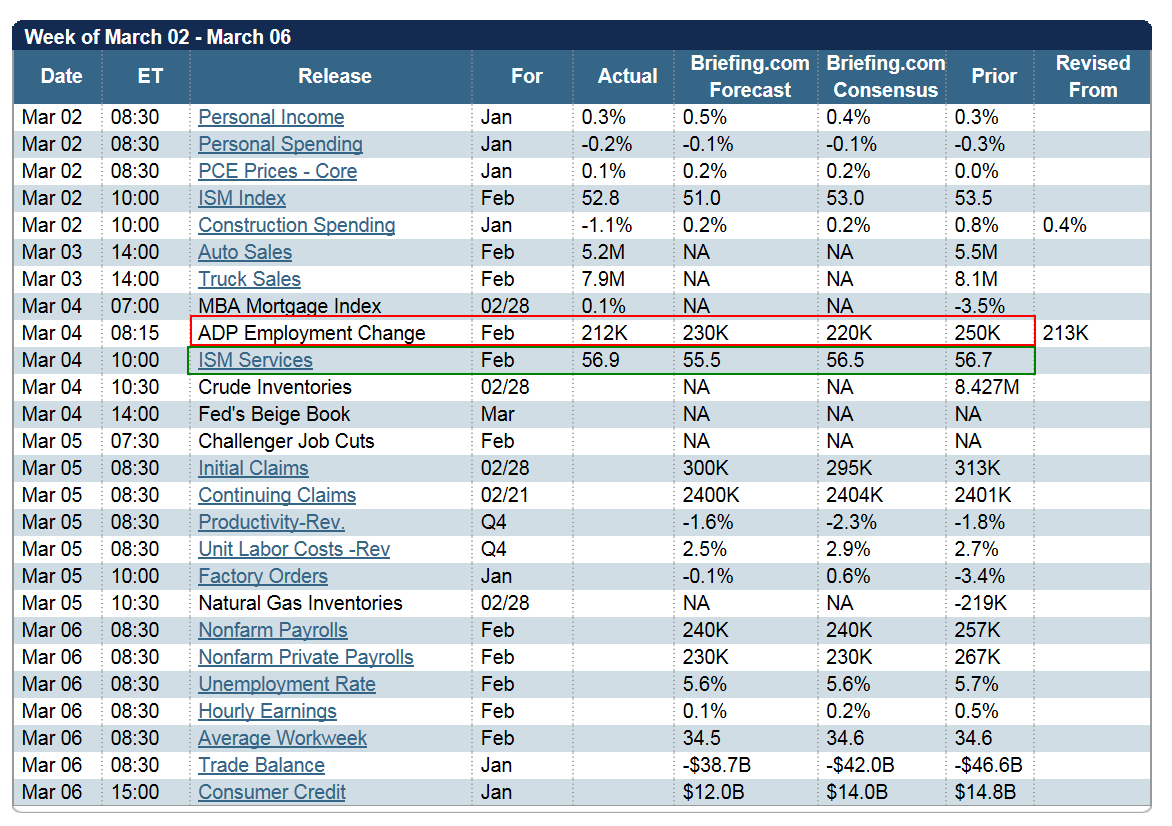

Non-farm payrolls on Friday. This is an inactive month for gold.

I am continuing to watch the Sprott Silver fund to see what they do about their cash situation for expenses. They have several options. I do not know all of them, or which one they may pursue.

Currency wars, bitchez.

And almost no one is talking about it. Or the corrosive role of the Banks.

In 1999, on signing Gramm-Leach-Bliley into law, Clinton said, “This is a day we can celebrate as an American day” and that ” the Glass-Steagall law is no longer appropriate for the economy in which we live” and “today what we are doing is modernizing the financial services industry, tearing down these antiquated laws and granting banks significant new authority” and “This is a very good day for the United States.”

Columbia Journalism Review, Bill Clinton on Deregulation

Have a pleasant evening.

Category:

currency wars,

justice for some,

rentier economy

SP 500 and NDX Futures Daily Charts - Fading Recovery, Skittish Market, Asset Bubble

It can keep drifting while there is no adverse geopolitical or economic news.

But the economic recovery is faltering. Or perhaps it would be more correct to say that the illusion is fading.

Zerohedge had an interesting article today about the ratio of Net Worth/GDP that may be signaling an asset bubble has already formed in the US. The Fed's propensity to create asset bubbles in order to continue to sustain an inefficient and parasitical financial sector provides plenty of room for concern. Their inability to provide the necessary reform because they are caught in a credibility trap is a recurring theme here.

It is a bit off the topic of markets, but Glenn Greenwald has an interesting story of how the US media manufacturers stories, and then tailors the narrative of the subsequent discussion of those 'stories' on their talk shows and panels to keep putting forward certain false and misleading propositions to the public.

I have seen some bloggers and internet trolls doing this, 'exposing' people as 'charlatans' but it is a bit jarring to see this done so readily by the mainstream media.

Have a pleasant evening.

03 March 2015

Gold Daily and Silver Weekly Charts - Silver Remains Actively Sought for Delivery

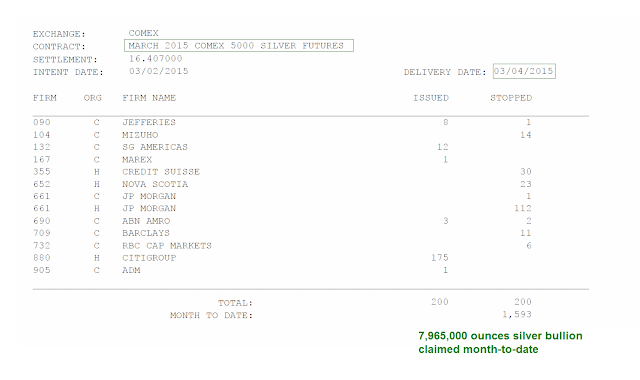

As the latest clearing report from the Comex suggest, silver is getting an active declaration for delivery, with over 7 million ounces claimed so far in March.

The latest Comex delivery report is below.

It may be a bucket shop for gold, but for some reason the Comex silver warehouses remain active, with bullion actually changing hands now and then, despite the obvious price antics practiced there.

The gold held at the Comex seems to have become largely symbolic, a reminder of what the pyramid of paper is said to represent. It is like an old pier left in a bay that has silted over. The gold markets have headed East.

Otherwise it was the same old, same old.

Gold and silver are bid up on the overnight, and then slammed down with the London PM fix and then the opening of the NY Comex trade.

There is a message in this repetition. And they continue on, despite the gathering storms on the horizon.

Have a pleasant evening.

Subscribe to:

Posts (Atom)