“Participants in our US markets deal with a technological arms race, conflicts of interest, fleeting liquidity in times of stress, and an ever increasing amount of trading taking place in a vast network of opaque darkness.

The public markets are considered ‘toxic’ by varied participants. Studies point out that institutional bids and offers result in too much price movement. High frequency market makers lament that the orders sent to the exchange, outside their own, tend to be orders that have been ‘exhausted’ everywhere else.

Is this a desirable outcome of modern market structure? Did the Commission envision this when it crafted Reg NMS?”

Joe Saluzzi

Maybe we should call this period in our nation's history 'The Carney Wars.'

Stocks pretty much floundered around today, with the two or three tech stock heavy Nasdaq showing a little more spine.

But they did manage to squeeze out another lipstick-smeared crackhead valued IPO, so mission accomplished.

Light volumes, narrow advances, uncertain global situation, looming recession in Europe and weak domestic economy?

Let's buy. Monkey rally, yay!!

Hey, we *might* get a rally into the FOMC meeting in December, or into year end to plump up those Wall Street bonuses.

Hey, we *might* get a rally into the FOMC meeting in December, or into year end to plump up those Wall Street bonuses.US financials have been cast adrift from the fundamentals of economic performance for some time now.

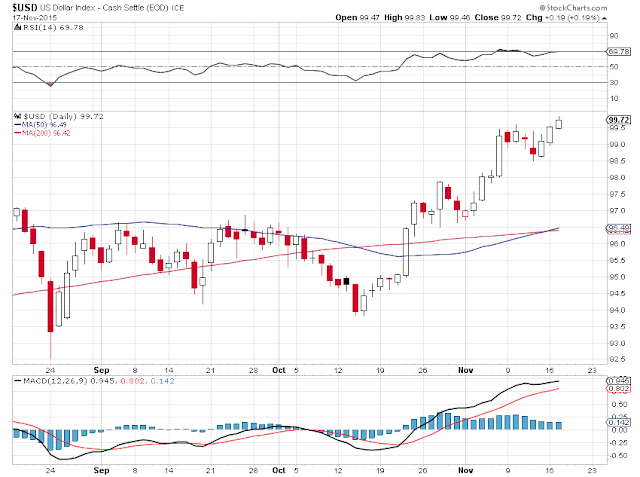

Chart-wise if the SP cannot make a higher high here, it will start to be looking for another wash and rinse lower.

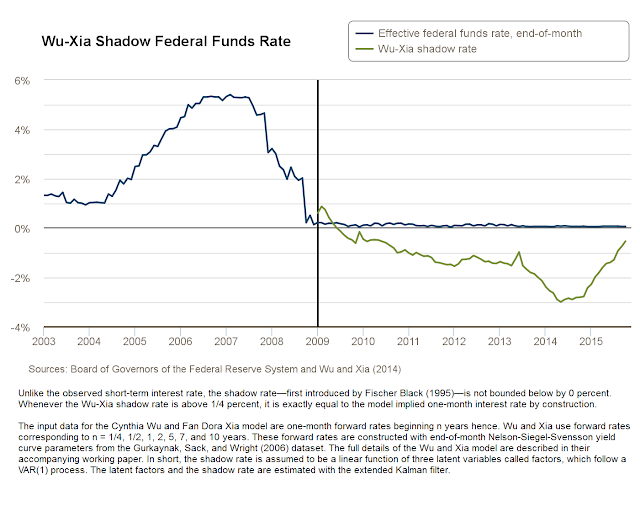

Some fellows on financial TV were pointing to the Shadow Fed Fund Rate from the Atlanta Fed below, and making the case that the Fed is already tightening, so the rate increase in December will make no difference.

Well, that is one point of view. Personally I will be looking at what they are paying the Banks for their essentially free reserves, and what the size of their Balance Sheet is doing more than anything coming out of a highly distorted financial market.

I am sitting on cash, waiting to pull on something. We do have a potential for stocks to go a LOT higher IF this 'cup and handle' formation works. And if it fails, we could go down to test support in the channel, or a LOT lower depending on what exogenous events may encourage stocks lower.

But these are just scenarios and possibilities for now. And I think that covers all the major possibilities. LOL. This is what the guys who charge you money do, but with more certitude and a very eraseable set of past predictions. The hits are carved in marble, and the misses, well they are chalk dust.

Let's see what the market has to say, if anything.

Have a pleasant evening.