21 December 2015

18 December 2015

Shanghai Gold Exchange On the Way to Record Withdrawals of Gold Bullion

Shanghai Gold Exchange withdrawals for the week were about 46 tonnes.

That is about 1,478,516 troy ounces.

Year to date withdrawals are about 2,451 tonnes, compared to 2,074 in 2013 which was the previous high for withdrawals.

Koos Jansen, The Chinese Gold Market Essentials

Gold bullion is moving from West to East, in increasing amounts.

At these price levels this is not sustainable.

"Gresham's law is an economic principle that states that when an official market or cartel overvalues one type of money or asset and undervalues another with respect to its fair market value and risks, the undervalued money or asset will leave the country as best it can, or will disappear from circulation into hoards, while the overvalued money or assets will flood into circulation."

Gold Daily and Silver Weekly Charts - And It Is

Gold and silver moved sharply higher today, after having moved sharply lower the day before.

And so were the antics into the options expiration. Smash gold and silver lower, and then cash in the short positions and pick up the intermarket bargains in the miners and the ETFs.

There was intraday commentary here on the unseen but formidable risks which I see in the financial markets and why.

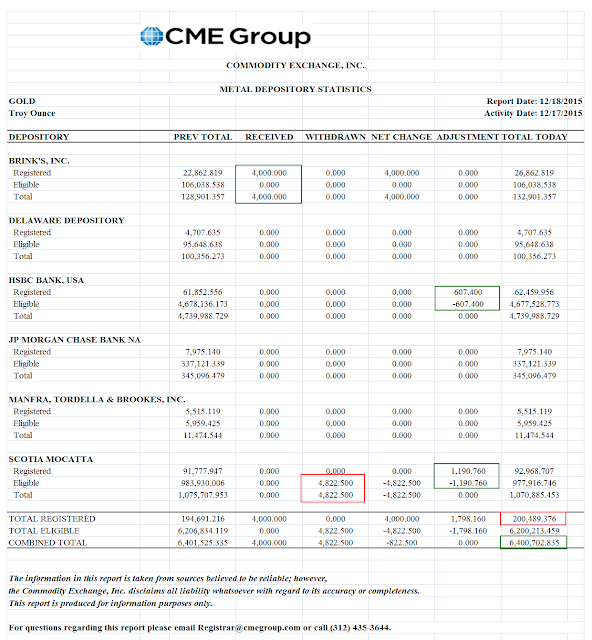

The Bucket Shop was again relatively quiet during the 'active month' of December.

JPM took down a little more gold bullion deliveries. I have not calculated it, but I believe that have taken most of all the gold delivered this month for their house account.

After a brisk start, silver deliveries have been shut down to a trickle.

Of course, this is the phenomenon in the synthetic metals markets of NYC and London. The actual trade in real bullion has never been more brisk in the East, with China well on the way for a year of record gold purchases.

As a reminder, next week will be the observance of the Christmas holiday on Friday 25 December.

I still have not heard from the monarch of the household how many and who will be coming to dinner next Friday. Fish on the eve and prime rib roast on the day are the usual fare.

Speaking of El Niño, we are expecting continued warm, wet weather in the high 60s, and I may have to take the lawnmower out of storage for the day after Christmas. The poor snowblower is feeling neglected. It seems like winter has not been arriving around here until January of late, and then it comes with a vengeance.

At any rate I do hope to be otherwise occupied than watching these jokers pick over the carcass of the real economy, but I should be posting at least once per day.

Have a pleasant weekend.

SP 500 and NDX Futures Daily Charts - Out On the Lows For Option Expiry

The Current Account Balance came in worse than expected due in part to the stronger dollar, which like rate increases is one of the lesser things one might prescribe for a shallow and fragile recovery.

If there is to be a late year push higher next week is when it must begin to at least stabilize for a rally into the New Year, and fatter bonuses. Unless of course the Street has been taking The Big Short.

Have a pleasant weekend.

Subscribe to:

Posts (Atom)