"Gold has worked down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory."

Bernard M. Baruch

"Gold is unique among assets, in that it is not issued by any government or central bank, which means that its value is not influenced by political decisions or the solvency of one institution or another."

Salvatore Rossi, Central Bank of Italy, 30 Sept 2013

“Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort.”

— Antony C. Sutton

From a practical and a technical standpoint very little happened in the precious metals today.

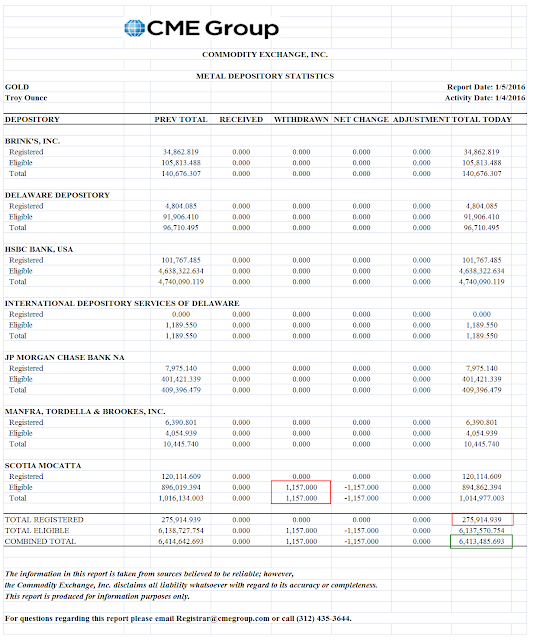

There were no deliveries at The Bucket Shop yesterday, and as for the warehouses, even CME Hong Kong looked more like New York than its hard core metalhead self.

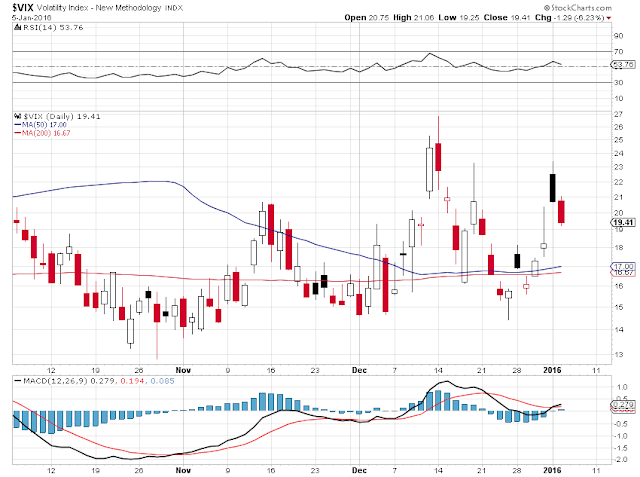

Prices had a bit of a lift higher, which is impressive if you look at the manner in which the US dollar has been gaining in a 'flight to safety' of its own.

Still, I suspect we will see much of the same sort of coverup and inventory management to go with the price tinkering and its supporting pile of synthetic gold claims until the market resolves itself to the reality of the market behind the paper market, and then it will 'clear,' and perhaps impressively so.

Have a pleasant evening.