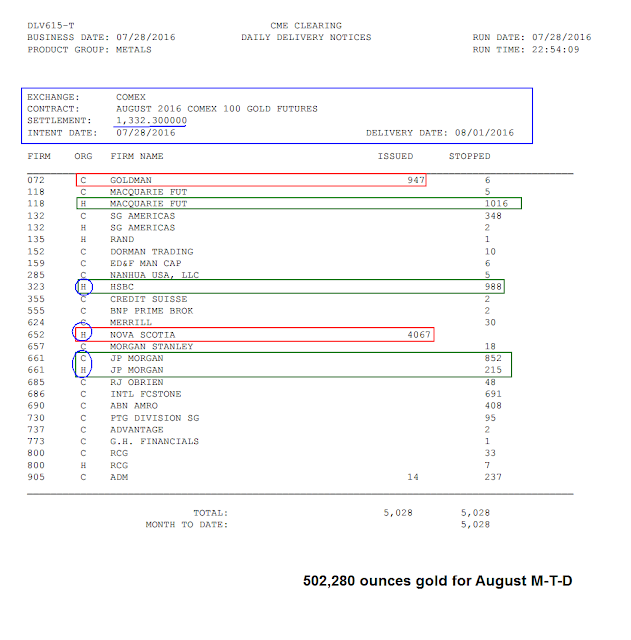

Nova Scotia offered up 406,700 ounces of gold from their house account for the first delivery day in August. That is the biggest number I have seen in some time.

And they sold it at what was close to the low for yesterday at $1,332. That's what one gets when they sell big in an active month which August is for gold. What were they thinking?

The silver deliveries were fairly inconsequential for August, so I did not bother to update them.

Uncle Buck, aka la douleur du monde, took the gas pipe on that horrible GDP number, at 1.2% versus 2.6% expected, with a downward revision to 0.8% in the prior period. No wonder the Fed balked at even a fairly symbolic rate increase this week. They may play dumb, but they know.

Gold is on the threshold of breaking out as you can see on the chart below, and silver is looking fairly positive as well.

But, and isn't there always a but these days, next week will be the July Non-Farm Payrolls Report. as indicated in the preview of next week's economic news below.

So let's see how the precious metals sort their way through that next hurdle on their way higher.

Have a pleasant weekend.

Le Père Jacques Hamel, un martyr de la Foi, 26 Juillet 2016

At 85, Rev. Jacques Hamel was well past retirement age.

But he kept in shape and kept on going — baptizing infants, celebrating Mass, and tending to the parishioners of St.-Étienne-du-Rouvray, a working-class town in Normandy where he had spent much of his life.

Father Hamel’s throat was cut, while he was offering the sacrifice of the Mass, by a young man claiming allegiance to the Islamic State.