Gold and silver gave up a little today, which was not as much as one might have expected from the little rally up in the US

douleur du monde.

Gold in particular has an interesting formation in the making, and as can be seen on its chart, is approaching an area of key support.

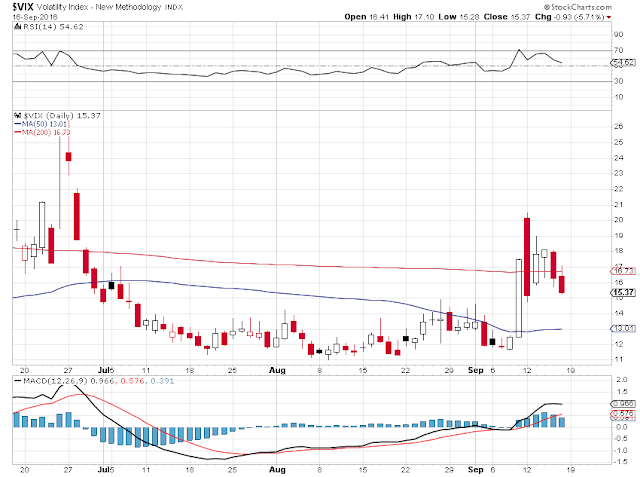

Next week could be 'interesting.'

I won't assign odds to what the Fed might do next week. There are obviously two factions on the board, the hawks and the doves. Yellen is the dove-in-chief, with Fischer presumably the hawks'.

The warehouses and clearing were relatively quiet for the precious metals.

The currency war continues. That rather impressive fine levied on Deutsche Bank by the DoJ was clearly a shot in the war of some sort. Perhaps Frau Merkel is not toeing the line sufficiently.

The US election is an interesting one, with both candidates having very high unfavorable ratings. This is sure to be a divided, contentious four years ahead no matter who wins.

One twist, which may not seem likely now, is that for some reason the lady Hillary would have to drop out, presumably for health reasons. The Democrats would have to show their true colors then.

As for the Republicans, they are stilll the loyal servants of the corporate moneyed interests as they have long been, only for a different faction of the one percent compared to the Wall Street Democrats. In corrupting the DNC, the Clintons did a great damage to the political balance of the country and government by the lesser of two evils.

These two candidates remind might remind one more of Lord and Lady Macbeth, rather than the standard bearers of ideological contrasts. Or in keeping with the current tastes in literature, like

Little Finger and

Cersei. All the people seem to need to decide is a lot of name-calling and a good show, and the caricature of their humanity to beat upon.

We have only just begun to sit down and eat at that banquet of consequences.

The weather is taking on a definite flavor of Autumn, and at night it is even a bit chilly. There are plenty of leaves already on the ground, not from the changing of the weather, but from the almost unbearable heat and lack of rain we have had over the past few weeks.

Well, it will be raining here on Sunday. And it will be welcome. All good things come to those who wait.

Winter is coming.

Have a pleasant weekend.