“When the system is rigged, when ordinary citizens are powerless, and when whistle-blowers are pariahs at best, three things happen. First, the worst people rise to the top. They behave appallingly, and they wreak havoc. Second, people who could make productive contributions to society are incented to become destructive, because corruption is far more lucrative than honest work. And third, everyone else pays, both economically and emotionally; people become cynical, selfish, and fatalistic. Often they go along with the system, but they hate themselves for it. They play the game to survive and feed their families, but both they and society suffer.”

Charles H. Ferguson, Inside Job

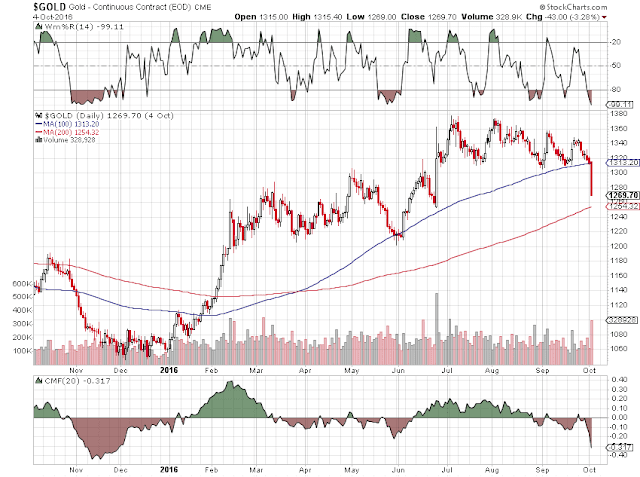

Gold and silver were hammered lower today, with gold losing 3.2% and silver 5.2%.

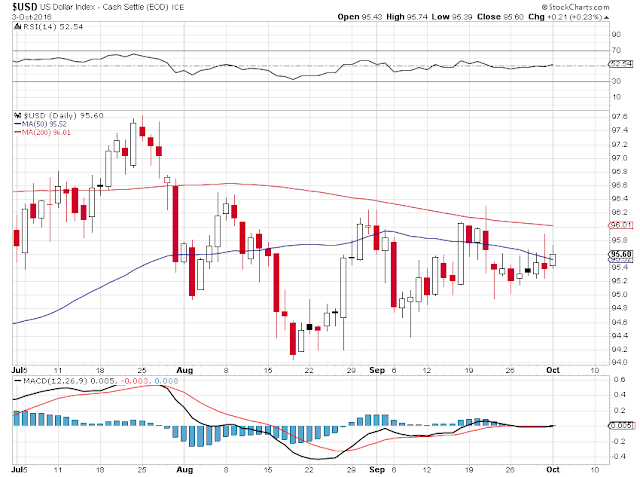

The dollar moved much higher as you can see from the chart below.

There was some brief intraday commentary on the premiums in some of the Trusts and Funds

here.

We may move lower if you look at the charts carefully, especially since we have a Non-Farm Payrolls event coming up, that is like a ringing dinner bell cue for the bears. Having said that, I put some cash that I had taken out last week back to work today. Let's say that this move was not entirely unexpected given the setup.

The 'precipitant' for today's action was

a very hawkish speech on interest rates this morning by Jeff Lacker, President of the Richmond Fed.

Given the estimates I have been getting on the state of the 'free float' of bullion in the key market in London, it seems just as likely to me that this was a trading gambit devised to dampen the offtake of gold in the October contract, knock down the leveraged bets of paper to physical bullion, and to shake some additional gold lose from the ETFs where it has been accumulating.

As it comes to the breaking point of this long running metals pool, we can expect to see more volatile movements in the price of the metals.

I personally think that Lacker may be sincere in his statements. After all, he is looking at the economy from the perspective of someone who has spent the last 27 years at the Fed, a period which is hardly distinguished by sound monetary policy and reliable economic forecasting. It is most noteworhty for the most reckless abuse of the public trust by the Banks since the 1920s.

Or as Charles Ferguson puts it so well,

"In addition to the behaviour that caused the crisis, major US and European banks have been caught assisting corporate fraud by Enron and others, laundering money for drug cartels and the Iranian military, aiding tax evasion, hiding the assets of corrupt dictators, colluding in order to fix prices, and committing many forms of financial fraud. The evidence is now overwhelming that over the last thirty years, the US financial sector has become a rogue industry.”

It beggars belief that the Fed would now feel the need to urgently raise rates.

Wages and real income are still stagnant, unemployment is greatly understated by taking the long term unemployed out of the labor pool calculations, and the evidence is that the US GDP is still going to be weak going forward, with the IMF just revising their forecasted growth in the US to 1.6%.

The majority of Americans have less then $1,000 in the bank, and retail establishments like restaurants see slowing demand and lower sales.

So the idea of going 'pre-emptive' against inflation by raising rates aggressively now seems a bit obtuse. There is no comparison between now and 1994 when Greenspan raised rates 'pre-emptively.'

The only people who would favor higher interest rates and a stronger dollar

now are the financiers, and those who are already sitting on a pile of cash thanks to the serial asset bubbles policy created by the Fed.

And for those who live on the East coast of the US, you may wish to keep an eye on Hurricane Matthew. A most recent projection of its path is included below. Let's see how that one progresses, and hope that it moves more out to see as some models suggest.

Have a pleasant evening.

Update: Latest forecast shows it going out further to sea earlier.