"Since the earliest stages of human history, of course, there have been bazaars, rialtos, and trading posts—all markets. But The Market was never God, because there were other centers of value and meaning, other "gods." The Market operated within a plethora of other institutions that restrained it. As Karl Polanyi has demonstrated in his classic work The Great Transformation, only in the past two centuries has The Market risen above these demigods and chthonic spirits to become today's First Cause...

Does anyone doubt that if the True Cross were ever really discovered, it would eventually find its way to Sotheby's? The Market is not omnipotent—yet. But the process is under way and it is gaining momentum."

Harvey Cox, The Market As God: Living In the New Dispensation

Today was the Comex option expiration for November futures for both gold and silver.

Since November is not an active month for either metal it did not impact the prices significantly.

December is the next big month for both precious metals that I track.

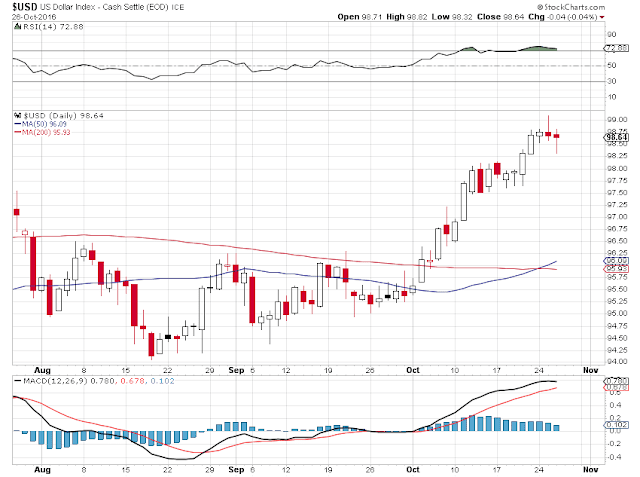

The dollar index was off a little bit in forex trading, and stocks were a bit wobbly.

The data continues to confirm that The Recovery is a thin facade over misgovernance and the mispricing of risk due to a pernicious corruption of the balances in the system.

People have been asking me how I think one candidate or another might be for gold and silver.

I am not sure I can frame a good answer for that, because there are so many variables besides a particular candidate. I can make a decent case either way.

Personally I have been thinking a bit harder about how each candidate might react to opposition since the electorate is so clearly polarized, and both candidates have historically high disapproval ratings.

It is, after all, 'the choice between two evils' whether one is lesser or not, as the media likes to say.

And I hate to say it, but despite the trappings of religion or supremely benevolent ideology in which some of our new evils like to cloak themselves, it does seem in practice to be more of a form of self worship, a kind of neo-Paganism, than any acknowledgement of a higher morality and sense of obligation to a greater power than our own selves.

But as you know, my 'model' of the Imperial Presidency is expecting a type of a Nero to appear on the seen, marked by growing excess and over-reactions to even perceived resistance in pursuit of their own goals.

In our parlance, that would be someone

Nixonian to a fault, or at least I would hope it would not be much more than that. Perhaps bolder and more shameless.

Again, either one of the front runners may step up, or rather down, to meet and exceed that mark. I would hope not, but I do believe the possibility is there.

This is not to say that I am trafficking in eschatology. I think that is mostly prideful and distracting, and we have certainly been through times like this here before. We just forget about them. We think that we are somehow different, exceptional, and more put upon than our parents and grandparents.

Like gold and silver, goodness is precious because of its relative scarcity. And these days it does seem to be particularly hard to find. The economist Pierre Rinfret told me that a few months before he passed away, as he reflected on his life and experience in politics.

But goodness is not constrained by nature, but rather by the toxic drought of our hardened hearts.

Have a pleasant evening.