"Listen, and I will tell you a mystery: we will not all fall sleep, but we will all be changed, in a moment, in the twinkling of an eye, at the call of the last trumpet. For that trumpet will sound, and the dead will be raised imperishable, and we, we will be changed.

Bertramka Villa, Prague

For the perishable must clothe itself with the imperishable, and the mortal with immortality. And when the perishable has been clothed with the imperishable, and the mortal with immortality, then shall come to pass the words which have been written: ‘Death has been swallowed up in victory.’"

1 Corinthians 15:51-54

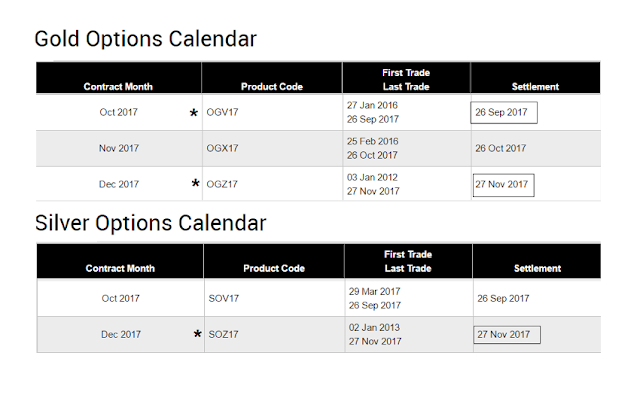

There will be an options expiration on the Comex for precious metals next week on Tuesday the 26th. Given that it is for the October contracts it could be more important for gold than silver.

Late this afternoon Senator McCain indicated he cannot vote for the latest form of GOP healthcare repeal.

Pictured to the right is the Bertramka Villa in Prague. I visited it with Mary when I was attending business school classes in Prague in 1991. It is associated with Mozart and I believe he wrote his 'Prague Symphony' there as well. They had a small Mozart exhibition and I still have a small bust of the composer as a young boy in my study that I purchased there.

The day is absolutely beautiful outside, and so I will be leaving a bit early today.

Have a pleasant weekend.