"Remember, my brothers and sisters, that few of you were wise in the world’s eyes or powerful or wealthy when God called you. God chooses those that the world considers foolish in order to shame those who think they are wise. And He chooses those that are powerless to shame those who are powerful.

God has chosen things despised by the world, small things counted as nothing at all, and has used them to bring to nothing what the world considers important. As a result, no one can ever presume to boast in the presence of God."

1 Corinthians 1:26-29

"In Egypt's sandy silence, all alone,

Stands a gigantic Leg, which far off throws

The only shadow that the Desert knows:

I am great Ozymandias, saith the stone,

The King of Kings; this mighty City shows

The wonders of my hand. — The City's gone,

Nought but the Leg remaining to disclose

The site of this forgotten Babylon."

Horace Smith, Ozymandias

"Do not consider his appearance or his height, for I have rejected him. The Lord does not look at the things people look at. People judge by outward appearance, but the Lord looks into the heart.”

1 Samuel 16:7

“We have been called to heal wounds, to unite what has fallen apart, and to bring home those who have lost their way.”

Francis of Assisi, Fioretti di San Francesco

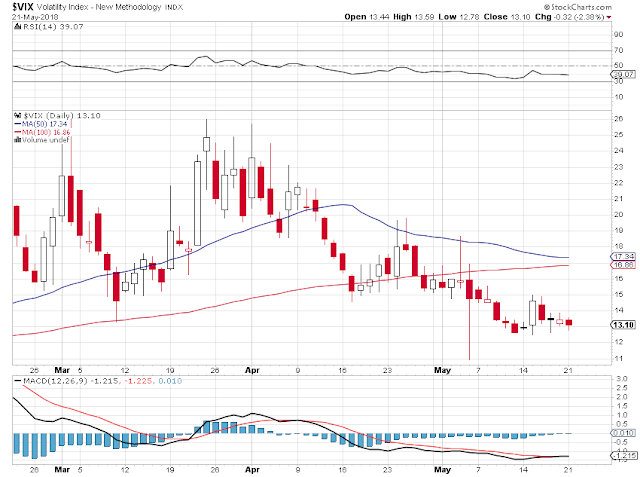

Stocks were weak in the early going, but caught quite a bid after the release of the Fed minutes. The Fed is determined to keep raising rates, but made sufficiently dovish noises to make stock punters feel frisky.

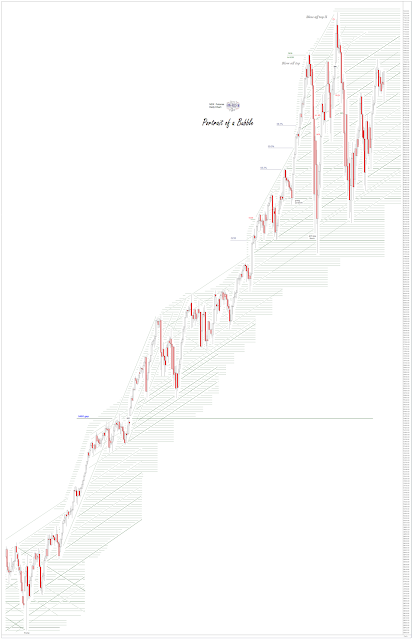

This is no surprise here, because the Fed is raising rates to give themselves some room to perform policy actions with rates when this latest asset bubble which they have created implodes. And it will.

The Dollar also was higher, bumping up against the 94 handle.

Surprisingly enough gold not only held its ground but moved a little higher. It had a funny little dipsey doodle in the early going which is a classic trading move designed to shake out the stop loss orders.

Tomorrow is an expiration for precious metals on the Comex.

Need little, want less, love more.

Have a pleasant evening.