"I can strongly recommend Jonathan Tepper's The Myth of Capitalism, opening our minds to see the steep decline in competition in America in recent years and the growing concentration of economic power in fewer and fewer hands, in oligarchies with similarities to those in Russia and China."

Dr. Harald Malmgren

"The problem with movies and books is they make evil look glamorous, exciting, when it's no such thing. It's boring and it's depressing and it's stupid. Criminals are all after cheap thrills and easy money, and when they get them, all they want is more of the same, over and over.

They're shallow, empty, boring people who couldn't give you five minutes of interesting conversation if you had the poor luck to be at a party full of them. Maybe some can be monkey-clever, some of the time, but they aren't hardly ever smart."

Dean Koontz

"And each of you this morning in some way is building some kind of temple. The struggle is always there. It gets discouraging sometimes. It gets very disenchanting sometimes. Some of us are trying to build a temple of peace. We speak out against war, we protest, but it seems that your head is going against a concrete wall. It seems to mean nothing. And so often as you set out to build the temple of peace you are left lonesome; you are left discouraged; you are left bewildered.

Well, that is the story of life. And the thing that makes me happy is that I can hear a voice crying through the vista of time, saying: "It may not come today or it may not come tomorrow, but it is well that it is within thine heart. It’s well that you are trying." You may not see it. The dream may not be fulfilled, but it’s just good that you have a desire to bring it into reality. It’s well that it’s in thine heart.

Thank God this morning that we do have hearts to put something meaningful in...

And this brings me to the basic point of the text. In the final analysis, God does not judge us by the separate incidents or the separate mistakes that we make, but by the total bent of our lives. In the final analysis, God knows that his children are weak and they are frail. In the final analysis, what God requires is that your heart is right. Salvation isn’t reaching the destination of absolute morality, but it’s being in the process and on the right road."

Martin Luther King

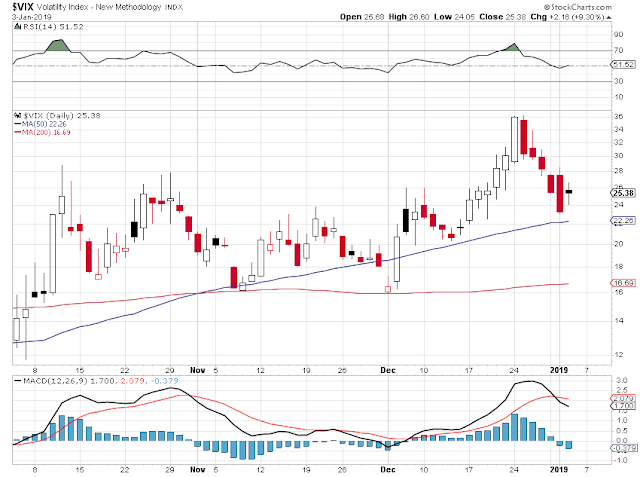

It was 'risk on' today, although the risk impulse seemed a bit subdued at least compared to the rip snorting rally sparked by that wonder of a Jobs Report.

Stocks did finish off their highs, but managed to extend the rebound a little closer to the fifty percent Fibonacci retracement level.

Almost half the companies who have come out with revisions to fourth quarter results have lowered guidance.

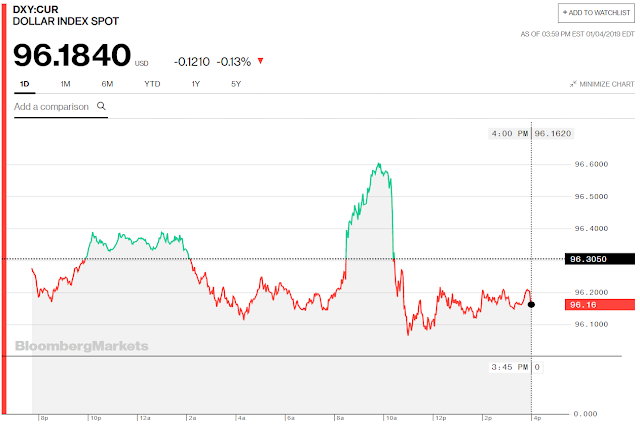

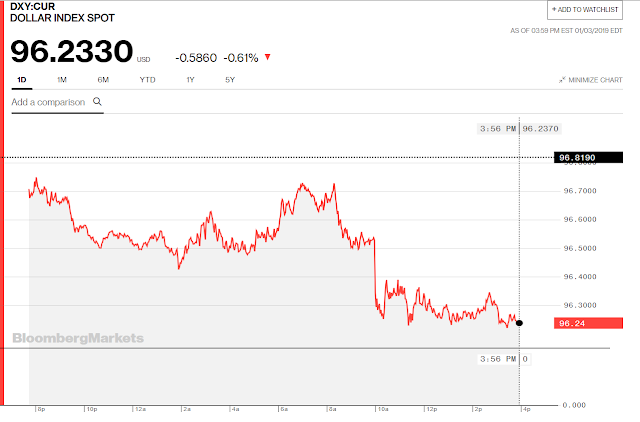

The US Dollar slid a bit lower, and gold managed to regain some of the ground that it lost in the big risk on extravaganza last week. Silver was flat.

Gold is holding on to what looks like a breakout from trend. Let us see if this continues.

The bubbles in housing and financial assets seem to be a bit fragile. Everywhere we are seeing the mood in the housing market growing cooler.

The number of unsustainable things are beginning to weigh on those titans of finance at the Central Banks. As the fraud effect weakens, the amount of force required to maintain the illusion of a fiat economy must increase.

We will be getting less US economic data this week because of the continuing closure of certain portions of the government. The impasse is largely driven by egos, and the polarization of the extremes in perspective between the two established political crime families.

And so we have a New Year, with much of the same.

Need little, want less, and love more. For the Lord has created you, and redeemed you, because He desired you to be— with a perfect knowledge of who you are as He made you. So abide in His love, and in the light, and do not allow the hate and the darkness of the world to claim you, and take you away.

That, in the end, is the only real tragedy.

Have a pleasant evening.