"The trust of the innocent is the liar's most useful tool."

Stephen King, Needful Things

"The bully type, the false 'tough,' has been the first to break down under the actual fire of battle. The quiet, the calm, the determined have made the best soldiers. Why? Obviously the bully is insecure in himself— he blusters to muster his own courage."

Pearl S. Buck, What America Means to Me

"Narcissists damage and hurt but they do so offhandedly and naturally, as an afterthough. They are aware of what they are doing to others - but they do not care.”

Sam Vaknin, Malignant Self-Love

"We have now sunk to a depth at which the restatement of the obvious is the first duty of intelligent men. It is not merely that at present the rule of naked force obtains almost everywhere. Probably that has always been the case. Where this age differs from those immediately preceding it is that a liberal intelligentsia is lacking. Bully-worship, under various disguises, has become a universal religion."

George Orwell

“Crowd-pleasers [demagogues] are generally brainless swine who can go out on a stage and whip their supporters into an orgiastic frenzy— then go back to the office and sell every one of the poor bastards down the tube for a nickel apiece.”

Hunter S. Thompson

The so-called paradox of freedom is the argument that freedom in the sense of absence of any constraining control must lead to very great restraint, since it makes the bully free to enslave the meek. The idea is, in a slightly different form, and with very different tendency, clearly expressed in Plato."

Karl Popper

"A confident, aggressive delivery style - often larded with jargon, clichés, and flowery phrases - makes up for the lack of substance and sincerity in their interactions with others ... they are masters of impression management; their insight into the psyche of others combined with a superficial - but convincing - verbal fluency allows them to change their personas skillfully as it suits the situation and their game plan.

The most debilitating characteristic of even the most well-behaved psychopath is the inability to form a workable team."

Paul Babiak and Robert Hare, Snakes in Suits

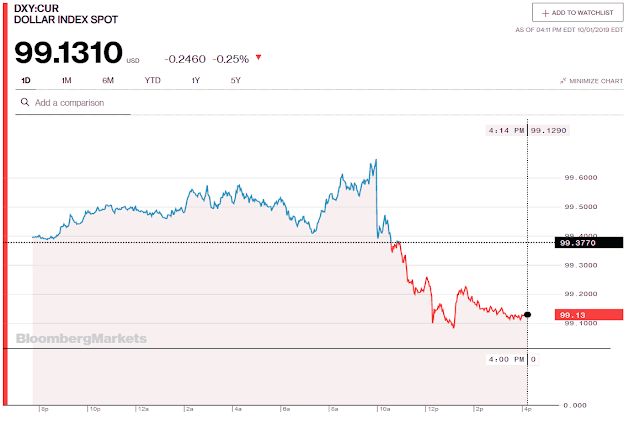

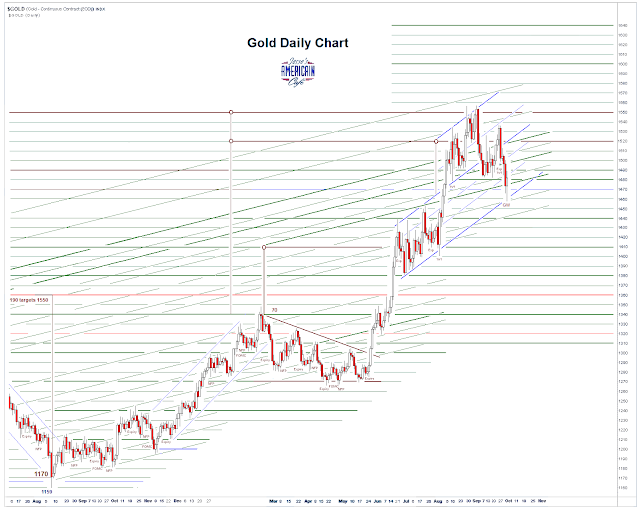

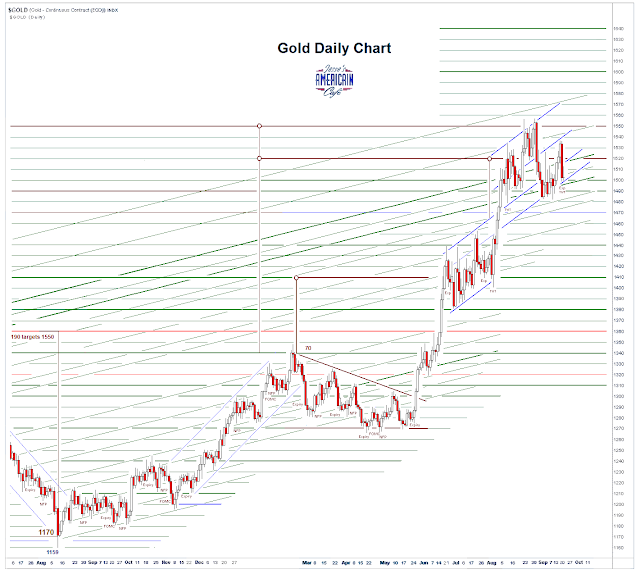

The end of quarter antics of Wall Street hit a brick wall this morning, when before the bell the ISM Manufacturing Index came in at 47.8%, which was quite a miss, and showed the early signs, not only of slowdown, but contraction. This also reinforced the Chicago PMI which came in with a shockingly low 47.1 on Monday.

And so stocks dumped and gold and silver rallied. The Dollar was marginally lower.

I would not count these jokers out just yet. We have some additional data coming out this week, especially the Non-Farm Payrolls and the ISM Services Index, which may serve to provide the wiseguys some additional courage in their market manipulation.

After all, 'manufacturing' is so much an old economy thing, and services are where we wish to be. A nation of servants ruled over by a few oligarchs and their enablers.

Have a pleasant evening.