"Twenty-five years ago, when most economists were extolling the virtues of financial deregulation and innovation, a maverick named Hyman P. Minsky maintained a more negative view of Wall Street; in fact, he noted that bankers, traders, and other financiers periodically played the role of arsonists, setting the entire economy ablaze. Wall Street encouraged businesses and individuals to take on too much risk, he believed, generating ruinous boom-and-bust cycles. The only way to break this pattern was for the government to step in and regulate the moneymen.

Many of Minsky’s colleagues regarded his 'financial-instability hypothesis,' which he first developed in the nineteen-sixties, as radical, if not crackpot. Today, with the subprime crisis seemingly on the verge of metamorphosing into a recession, references to it have become commonplace on financial web sites and in the reports of Wall Street analysts. Minsky’s hypothesis is well worth revisiting."

John Cassidy, The Minsky Moment, The New Yorker, 4 February 2008.

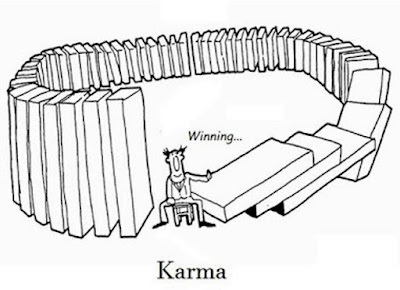

"The more people rationalize cheating, the more it becomes a culture of dishonesty. And that can become a vicious, downward cycle. Because suddenly, if everyone else is cheating, you feel a need to cheat, too."

Stephen Covey

"The prevalence of the corporation in America has led men of this generation to act, at times, as if the privilege of doing business in corporate form were inherent in the citizen; and has led them to accept the evils attendant upon the free and unrestricted use of the corporate mechanism as if these evils were the inescapable price of civilized life, and, hence to be borne with resignation.

Through size, corporations, once merely an efficient tool employed by individuals in the conduct of private business have become an institution— an institution which has brought such concentration of economic power that so-called private corporations are sometimes able to dominate the state.

Coincident with the growth of these giant corporations, there has occurred a marked concentration of individual wealth; and that the resulting disparity in incomes is a major cause of the existing depression [1933].

We must make our choice. We may have democracy, or we may have wealth concentrated in the hands of a few, but we can't have both."

Supreme Court Justice Louis D. Brandeis

“You can know the value of every item of merchandise, but if you don’t know the value of your own soul it is all a vanity.

This, this then is the essence of all wisdom— that you should know who you will be when your Day of Reckoning arrives.”

Rumi

Stocks dove and the precious metals overnight as the Chinese press cast gloom on the rosy predictions coming out of the White House with regard to the China-US trade talks.

And stocks recovered their losses and posted new gains as the White House issued some rosy forecasts about the meeting between Trumpolini and the Chinese Vice-Premier tomorrow.

And so the Dollar and the metals sold off, the metals having an assist from the big shorts on the Comex who sold gleefully into the market, driving the price lower.

For some time now Wall Street and the professional class have been thriving. And they believe they continue to do so, if they are able to maintain for themselves an inexhaustible supply of lies and easy money.

But all is not happiness among the financiers, despite the big drop in the VIX today, and the continuing faith that Desperate Donnie will do whatever it takes to prop the markets in order to uplift his flagging interests and prospects.

The Street and their assorted enablers and sycophants are becoming increasingly edgy, with fears that their easy money good times may be over, if Elizabeth Warren comes to change things.

And do not underestimate what they may do in order to sustain their exorbitant privileges.

Have a pleasant evening.