"...Vancouver resident Nina Rhodes-Hughes — a 78-year-old American-born television actress and a local theatre enthusiast in the city's Bowen Island community — was serving as a volunteer fundraiser for Kennedy's campaign when he was fatally shot in a kitchen pantry at the Ambassador Hotel on June 5, 1968.

He died from his wounds about 24 hours later, on June 6. Five others injured in the attack survived.

Rhodes-Hughes, after a Saturday interview with CNN sparked a worldwide resurgence of interest in the assassination, told Postmedia News on Monday that she heard at least 12 shots that day — not eight as argued by the California prosecutors who convicted Sirhan as the lone gunman.

The gun Sirhan had when he was arrested held only eight bullets.

"I gave them a true account of what happened," Rhodes-Hughes said of the FBI investigators who interviewed her following the Kennedy killing. "I had no idea what they were going to say I said. You trust, you know? But what I said about a second shooter was completely ignored."

Following Sirhan's conviction, Rhodes-Hughes said she felt she was "not in a position of power or influence" to raise questions about a single-killer theory. Then, years after she'd moved to British Columbia in 1987 and become a Canadian citizen, she was contacted by University of Massachusetts professor and freedom-of-information advocate Philip Melanson, who was writing a book raising questions about the RFK assassination — including various threads of evidence pointing to more than eight gunshots and a possible second assassin.

She recalls Melanson showing her a transcript of her 1968 interview with FBI detectives.

There were more than a dozen errors in the document, she said, "and they credited me with saying there were eight shots — which I never said."

Her eyewitness account of Kennedy's murder "was completely misconstrued and misrepresented," she added, vividly recalling details of where people were standing and what happened on the night of the assassination.

"There was no way that the shots coming from my right at such rapid fire were done by Sirhan Sirhan," said Rhodes-Hughes, who spoke with Postmedia News Monday.

Rhodes-Hughes said in her CNN interview that she believes Sirhan — 24 at the time of the assassination and now 68 — "was absolutely there" as a participant in the killing and "I don't feel he should be exonerated."

But she added on Monday that "there is a great urgency" to identify the second shooter, "who I believe was the one that hit Senator Kennedy..."

Read the rest here.

30 April 2012

Eyewitness To RFK Assassination Says There Was a 'Definitely a Second Shooter'

Occupy the SEC on Wall Street Banks, JPM 'Hedging,' and the London Whale

JPM's 'hedging' is really prop trading.

I suspect strongly that this is the basis of their 'silver hedging' as well.

28 April 2012

Gold Bull's Long Term Trendline - The Indispensable Chart

Although they cannot resist its inevitable climb because of the changes in the global monetary system and the ongoing currency wars, the Western central banks wish the increase in the price of gold to remain 'orderly.'

And so it is.

Thanks to my friend Nick Laird at Sharelynx.com.

Nick has one of the most amazing collections of charts on the web.

Browsing his historical monetary and financial charts is a good way to spend a Sunday afternoon.

Category:

currency wars,

Gold Bull Market

Comex Silver Inventories - Bullion Banks To the Rescue

As I pointed out last week, inventories had fallen to historic lows ahead of the big delivery period. The bullion banks have anticipated this and have shown some strength ahead of the period.

Stiglitz - Politics Is At the Root of the Problem

Where Stiglitz refers to 'free markets' here, he means the 'efficient markets hypothesis.' That is, if markets are left entirely to their own devices they will manage themselves, honestly and efficiently.

Government and regulation are the problem, and they distort markets. Therefore if you 'free' markets from the influence of imperfect supervision, the natural efficiency of the market will prevail.

This model of the markets assumes that most market participants, people, are naturally good and almost perfectly rational, that information disperses equally among those participants, and that fraud becomes quickly known to all and is shunned, so that no participant will be encouraged to engage in it.

One of the things that will be reconsidered in the aftermath of this crisis, besides the perennial tendency of academic theories to act as handmaidens to thugs and gangsterism, is how to maintain a market based economy with effective regulation, so that when the unscrupulous come to tear down the protections erected by previous generations, to lure the foolish and gullible with their siren songs of progress and freedom, they might be seen for what they really are: the old familiar frauds come back to rob again.

I am a strong believer in a market based economy, where the rules encourage fairness and transparency, and decision making is broadly dispersed amongst a large number of well-informed participants. Monopolies, corruption and fraud are inimical to such a system.

An excess of planning and regulation, on the other hand, leads to a concentration of power in few hands, which is a form of monopoly or cartel which is the same abuse that occurs with too little transparency and regulation.

It takes hard work and an alert public to maintain the balance of justice, and it is hardly natural. For the affairs of all men do not naturally tend to virtue, alas, but from a minority of the lawless there is the tendency to selfish and short term thinking, and entropy from temptation, and the concentration of power in unworthy hands.

Such is the tendency of the world as it is, not naturally good, but imperfect and fallen. And this is not only the theme, but the force of history, the recorded actions of people, the continuing struggle between moderation and excess, between good and evil. Without it, history would be merely the progression of happiness and contentment, and that is not the condition of this world, but of the next.

Cross Posted from The European

"Politics Is at the Root of the Problem"

by Joseph Stiglitz

23.04.2012The European: Four years after the beginning of the financial crisis, are you encouraged by the ways in which economists have tried to make sense of it, and by the ways in which those insights have been taken up by policy makers?

Stiglitz: Let me break this down in a slightly different way. Academic economists played a big role in causing the crisis. Their models were overly simplified, distorted, and left out the most important aspects. Those faulty models then encouraged policy-makers to believe that the markets would solve all the problems. Before the crisis, if I had been a narrow-minded economist, I would have been very pleased to see that academics had a big impact on policy. But unfortunately that was bad for the world. After the crisis, you would have hoped that the academic profession had changed and that policy-making had changed with it and would become more skeptical and cautious. You would have expected that after all the wrong predictions of the past, politics would have demanded from academics a rethinking of their theories. I am broadly disappointed on all accounts.

The European: Economists have seen the flaws of their models but have not worked to discard or improve them?

Stiglitz: Within academia, those who believed in free markets before the crisis still do so today. A few people have shifted, and I want to give credit to them for saying: “We were wrong. We underestimated this or that aspect of our models.” But for the most part, the response was different. Believers in the free market have not revised their beliefs.

The European: So let’s take a longer view. Do you think that the crisis will have an effect on future generations of economists and policy-makers, for example by changing the way that economic basics are taught?

Stiglitz: I think that change is really occurring with the young people. My young students overwhelmingly don’t understand how people could have believed in the old models. That is good. But on the other hand, many of them say that if you want to be an economist, you still have to deal with all the old guys who believe in their wrong theories, who teach those theories, and expect you to believe in them as well. So they choose not to go into those branches of economics. But where I have been even more disappointed is American policy-making. Ben Bernanke gives a speech and says something like, there was nothing wrong with economic theory, the problems were a few details in implementation. In fact, there was a lot wrong with economic theory and with the basic policy framework that was derived from theory. If your mindset is that nothing was wrong, you will not demand new models. That’s a big disappointment.

The European: There seemed to have been quite a bit of disagreement among Obama’s economic advisers about the right course of action. And in Europe, fundamental economic principles like the absolute focus on GDP growth have finally come under attack.

Stiglitz: Some American policy-makers have recognized the danger of “too big to fail,” but they are a minority. In Europe, things are a bit better on the rhetorical side. Influential economists like Derek Turner and Mervyn King have recognized that something is wrong. The Vickers Commission has thoughtfully re-examined economic policy. We have nothing like that in the United States. In Germany and France, the financial transactions tax and limits to executive compensation are on the table. Sarkozy says that capitalism hasn’t worked, Merkel says that we were saved by the European social model – and they are both conservative politicians! The bankers still don’t understand this, which explains why we still see the head of the European Central Bank, Mario Draghi, arguing that we have to give up the welfare system at a time when Merkel says the exact opposite: That the social model kept us going when the central banks failed to do their regulatory job and used politics to change the nature of our societies.

The European: How have your own convictions been affected by the crisis?

Stiglitz: I don’t think that there has been a fundamental change in my thinking. The crisis has reinforced certain things I said before and shown me how important they are. In 2003, I wrote about the risk of interdependence, where the collapse of one bank can bring about the collapse of other banks and increase the fragility of the banking system. I thought it was important, but the idea wasn’t picked up at the time. The same year we looked at agency problems in finance. Now we recognize just how important those issues are. I argued that the real issue in monetary economics is about credit, not money supply. Now everybody recognizes that the collapse of the credit system brought down the banks. (I don't agree, the collapse of the credit system was a symptom not a cause. It was the fraudulent paper, and the subsequent insolvency it promoted, that collapsed confidence which is the foundation of credit - Jesse) So the crisis really validated and reinforced several strands of theory that I had explored before. One topic that I now consider much more important than I did previously is the question of adjustment and the role of exchange rate systems like the Euro in preventing economic adjustment. A related issues is the linkage between structural adjustment and macroeconomic activity. The events of the crisis have really induced me to think more about them.

The European: The financial transaction tax seems to have died a political death in Europe. Now, economic policy in Europe seems largely dominated by the logic of austerity, and by forcing other European countries to become more like Germany.

Stiglitz: Austerity itself will almost surely be disastrous. It is leading to a double-dip recession that could be quite serious. It will probably make the Euro crisis worse. The short-term consequences are going to be very bad for Europe. But the broader issue is about the “German model.” There are many aspects to it – among them the social model – that allow Germany to weather a very big dip in GDP by offering high levels of social protection. The German model of vocational training is also very successful. But there are other characteristics that are not so good. Germany is an export economy, but that cannot be true for all countries. If some countries have export surpluses, they are forcing other countries to have export deficits. Germany has taken a policy that other countries cannot imitate and tried to apply it to Europe in a way that contributes to Europe’s problems. The fact that some aspects of the German model are good does not mean that all aspects can be applied across Europe.

The European: And it does not mean that economic growth satisfied the criteria of social fairness.

Stiglitz: Yes, so there is one other thing we have to take into account: What is happening to most citizens in a country? When you look at America, you have to concede that we have failed. Most Americans today are worse off than they were fifteen years ago. A full-time worker in the US is worse off today than he or she was 44 years ago. That is astounding – half a century of stagnation. The economic system is not delivering. It does not matter whether a few people at the top benefitted tremendously – when the majority of citizens are not better off, the economic system is not working. We also have to ask of the German system whether it has been delivering. I haven’t studied all the data, but my impression is no.

The European: What do you say to someone who argues thus: Demographic change and the end of the industrial age have made the welfare state financially unsustainable. We cannot expect to cut down on our debt without fundamentally reducing welfare costs in the long run.

Stiglitz: That is absurd. The question of social protection does not have to do with the structure of production. It has to do with social cohesion or solidarity. That is why I am also very critical of Draghi’s argument at the European Central Bank that social protection has to be undone. There are no grounds upon which to base that argument. The countries that are doing very well in Europe are the Scandinavian countries. Denmark is different from Sweden, Sweden is different from Norway – but they all have strong social protection and they are all growing. The argument that the response to the current crisis has to be a lessening of social protection is really an argument by the 1% to say: “We have to grab a bigger share of the pie.” But if the majority of people don’t benefit from the economic pie, the system is a failure. I don’t want to talk about GDP anymore, I want to talk about what is happening to most citizens.

The European: Has the political Left been able to articulate that criticism?

Stiglitz: Paul Krugman has been very strong on articulating criticism of the austerity arguments. The broader attack has been made, but I am not sure whether it has been fully heard. The critical question right now is how we grade economic systems. It hasn’t been fully articulated yet but I think we will win this one. Even the Right is beginning to agree that GDP is not a good measure of economic progress. The notion of the welfare of most citizens is almost a no-brainer. (Median is the message. - Jesse)

The European: It seems to me that much of the discussion is still about statistical measurements – if we’re not measuring GDP, we’re measuring something else, like happiness or income differences. But is there an element to these discussions that cannot be put in numerical terms – something about the values we implicitly bake into our economic system?

Stiglitz: In the long run, we ought to have those ethical discussions. But I am beginning from a much narrower base. We know that income doesn’t reflect many things we care about. But even with an imperfect indicator such as income, we should care about what happens to most citizens. It’s nice that Bill Gates is doing well. But if all the money went to Bill Gates, the system could not be graded as successful.

The European: If the political Left hasn’t been able to fully articulate that idea, has civil society been able to fill the gap?

Stiglitz: Yes, the Occupy movement has been very successful in bringing those ideas to the forefront of political discussion. I wrote an article for Vanity Fair in 2011 – “Of the 1%, by the 1%, for the 1%” – that really resonated with a lot of people because it spoke to our worries. Protests like the ones at Occupy Wall Street are only successful when they pick up on these shared concerns. There was one newspaper article that described the rough police tactics in Oakland. They interviewed many people, including police officers, who said: “I agree with the protesters.” If you ask about the message, the overwhelming response has been supportive, and the big concern has been that the Occupy movement hasn’t been effective enough in getting that message across.

The European: How do we move from talking about economic inequality to tangible change? As you said earlier, the theoretical recognition of economic problems has often not been translated into policy.

Stiglitz: If my forecast about the consequences of austerity is correct, you will see a new round of protest movements. We had a crisis in 2008. We are now in the fifth year of crisis, and we haven’t solved it. There’s not even a light at the end of the tunnel. When we come to that conclusion, the discourse will change.

The European: The situation needs to be really bad before it will get better?

Stiglitz: Yes, I fear.

The European: You recently wrote about the “irreversible decay” of the American Midwest. Is this crisis a sign that the US has begun an irreversible economic decline, even while we still regard the country as a potent political player?

Stiglitz: We are facing a very difficult transition from manufacturing to a service economy. We have failed to manage that transition smoothly. If we don’t correct that mistake, we will pay a very high price. Already, the average American is suffering from the failed transition. My concern is that we have set in motion an adverse economics and an adverse politics. A lot of American inequality is caused by rent-seeking: Monopolies, military spending, procurement, extractive industries, drugs. We have some economic sectors that are very good, but we also have a lot of parasites. The hopeful view is that the economy can grow if we rid ourselves of the parasites and focus on the productive sectors. But in any disease there is always the risk that the parasites will devour the healthy body parts. The jury is still out on that.

The European: Have we at least understood the disease well enough to prescribe the correct therapy? Especially with regard to policy-making and the Euro crisis, there seems to be a lot of shooting into the dark.

Stiglitz: I think the problem is not a lack of understanding by dispassionate social scientists. We know the basic dilemma, and we know the effect of campaign contributions on policy-makers. So we are facing a vicious circle: Because money matters in politics, that leads to outcomes in which money matters in society, which increases the role of money in politics. You have more gerrymandering and more disillusionment with parliamentary politics.

The European: Has politics become too focused on outcomes, and is it not sensitive enough to the processes that lead to those outcomes? The bedrock of democracy seems to hinge on the avenues for participation, not on the effectiveness of particular policies.

Stiglitz: Let me put it this way: Some people criticize by saying that we have become too focused on inequality and are not concerned enough about opportunity. But in the United States, we are also the country with the biggest inequality of opportunity. Most Americans understand that fraud political processes play in fraud outcomes. But we don’t know how to break into that system. Our Supreme Court was appointed by moneyed interests and – not surprisingly – concluded that moneyed interests had unrestricted influence on politics. In the short run, we are exacerbating the influence of money, with negative consequences for the economy and for society.

The European: Where is change rooted? In parliament? In academia? In the streets?

Stiglitz: You look in the streets and a little bit in academia as well. When I say that the major thrust of the economics profession has disappointed me, I need to qualify that statement. There have been groups that push new economic thinking and challenge the old models.

The European: You have written that the challenge is to respond to bad ideas not with rejection but with better ideas. Where is the longest and strongest lever to bring new economic thinking into the realm of policy?

Stiglitz: The diagnosis is that politics is at the root of the problem: That is where the rules of the game are made, that is where we decide on policies that favor the rich and that have allowed the financial sector to amass vast economic and political power. The first step has to be political reform: Change campaign finance laws. Make it easier for people to vote – in Australia, they even have compulsory voting. Address the problem of gerrymandering. Gerrymandering makes it so that your vote doesn’t count. If it does not count, you are leaving it to moneyed interests to push their own agenda. Change the filibuster, which turned from a barely used congressional tactic into a regular feature of politics. It disempowers Americans. Even if you have a majority vote, you cannot win.

The European: We’re looking at six months of presidential campaigning. The role of money has been embraced by both parties. Campaign finance reform seems rather unlikely.

Stiglitz: Even the Republicans have become more aware of the power of money by seeing how it influenced and distorted the primaries. The outcomes are not what the Republican party establishment had hoped for. The disaster is becoming clear – but that will not lead to immediate remedies. Those who become elected depend on that money. It will require a strong third party or civil society to do something about this.

Category:

financial reform

27 April 2012

Excerpt From 'Debt Generation' - We Are All Kettled Now

We Are All Kettled Now

30 Mar 09

For anyone who has never been ‘kettled’ it is when the police at a protest suddenly close ranks and refuse to let anyone leave. You suddenly find you are held against your wishes. The police will not explain why, and they won’t allow any exceptions. You suddenly have no control over what is happening, and no discussion is permitted. A decision made by someone you have never seen now exerts complete and total control over your life.

We are all in that position now.

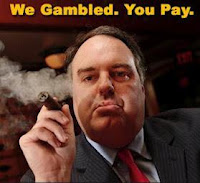

So vast is the debt our government has burdened us with that this one fact will now determine most of the politics of the next decade. Other hopes and desires – the wish for better schools, a better health service, better care for the elderly - will wither in the shadow of the debt repayments. If we are forced to pay back from taxes all the vast sums that have been sucked out of public spending and given to the banks, the country will not recover for a generation.

The economic ‘plans’, forced on us without debate, are all based on the banks returning large parts of the money they have taken from us. This means, whether we like it or not, we all have to hope that the banks make profits as quickly as possible. We have all been ‘kettled’ into having to hope and work for the largest possible growth in world trade and finance. We have to hope that the rich get richer, and quickly. The lords of finance and their servants in politics decided this for us.

There never was any discussion or debate of possible alternatives when the financial crisis began. It was declared, and universally agreed (always a bad sign) that the problem was liquidity, not solvency. That meant the only answer ever proposed was to provide liquidity at all costs. Liquidity being our money to cover the massive losses they had incurred. This, we were told, wasn’t really a cost at all, but ‘an investment’. An investment which would pay back all the loaned, borrowed and printed money long before the debts came due through reinflated levels of growth and asset value.

That was, and is, their only plan. And so absolute is the certainty in the minds of all concerned that none of them can even conceive of looking beyond the closed circle of that logic. No counter-argument is allowed or taken seriously. No warning signs are read as such.

Their so-called ‘free market’ has seized control and locked us in to a course of action in which democratic choice has been foreclosed. The growing realisation that this is what is happening will bring about increased anger. The smug reaction to anger is to label it ‘mindless’. The mindless anger of the ignorant who don't understand the necessary steps being taken by those who know better. That is the boiled down assumption of all our leaders, all the economic experts and most economic journalists.

The truth is quite different. People like me are angry because exactly the same people who, in 2008, assumed they knew how to run the global economy still assume they, and only they, know what must be done now. And their prescription is as simple as it is arrogant: put it back they way it was.

We are told that the debts accrued by those in charge must be paid by us rather than honoured by them. No debate.

We are told we must get lending back to the old levels. No debate.

We are told we must get the consumer consuming again rather than saving. No debate.

We are told that we must agree and complete the Doha round of global free trade liberalization. No debate.

To be robbed is one thing: to be condescended to by the people who robbed you is another altogether.

That is why many people like me are angry. We are angry because the financial elite are shoving their ideology down our throats. We are angry because we might have wanted to have a say. We are angry because we had different ideas that were never even considered.

Here we are at the point in history when many of us are looking at the imminent threats of climate change and oil scarcity, clearly seeing the dangers of unbridled growth, and yet at this point democratic choice has been kettled. No debate.

And that is why this crisis is no longer just about lack of confidence in the markets: it is now about the legitimacy of our governments. The entire political class has been captured by the same ideology. They all, to one extent or another, believe ‘the market’ is going to save us. No other solutions have even been allowed into the debate.

We shouldn’t waste our time arguing over which party is most to blame. All the parties and the economists and the City boys all agreed, and they still do. In their minds the banks had to be bailed out and their losses made ours. We were taken to war without discussion and on false pretences; the same has happened with this financial crisis. So enough of who is to blame: they all were and are.

They all believe in a system that says we must create demand and then feed it with debt. This necessarily involves increasing demand by the creation of yet more debt. It always crashes and always will. That is how their system works. If we allow it to be the solution, it will create another crash and another. Each time the rich will reap profits on the way up and rape the public purse on the way down. It's win, win for them and lose, lose for us.

Plus ça change!

Plus ça change!

Debt Generation - By David Malone

Gold Daily and Silver Weekly Charts

Eric Sprott warns that there are 'global shocks coming' in this interview at King World News. I think he is right.

I put a heavy hedge back on what is now a straight up long bullion position, sans miners.

SP 500 and NDX Futures Daily Charts

26 April 2012

Gold Daily and Silver Weekly Charts - Gold to $10,000 oz. - Walkin' On the Sun

In general I do not like to post flat out projections for anything at much higher than the current market price, but directionally I think we might be facing a market dislocation in the metals to the upside for some fairly well identified fundamental and technical reasons.

I do not think that a domestic US gold standard is inevitable at all. I think it is still rather unlikely.

But I do believe that gold and possibly silver will have an important role to play in international trade.

But first things first. Gold must break up and take out the small and then the larger symmetrical triangles and retest the previous high.

There was some thinly disguised nonsense about gold on financial television today that is often a good sign of an impending rise in price.

SP 500 and NDX Futures Daily Charts - Smells Like Teen Spirit

VIX has dropped below the 50 DMA.

Stocks may be poised to break out, but GDP tomorrow may be important for any further upward progress.

25 April 2012

US Department Of Labor Is NOT Banning 'Farm Chores' For Children

Several people sent me this news about the US Department of Labor banning farm chores, so I thought I would take a look at it.

Google news showed that the citations were all from social conservative sites, and most if not all were quoting a single site that printed this news this morning. No major news media was carrying the story.

Here is what I found out about it. You can read the entire story here.

I like the way this author ended his piece. 'Trust, but verify.' We are in a period of growing hysteria.

Demagogues will attempt to sway people and move them to action, often to counter legitimate complaints and efforts at reform, and to undermine legitimate protests.

This sort of urban mythology and demonization can become very dangerous, especially when it starts looking for scapegoats among minorities. The haters are coming, at least according to history, and you do not want any part of it.

Look for the facts and make up your own mind.

"...The conservative social web has been freaking out this morning over a story from the Daily Caller who reported:

Rural kids, parents angry about Labor Dept. rule banning farm choresTwitchy even highlighted some of the knee-jerk reactionaries (I’m laughing with some of you) who took to Twitter to create the #ObamaFarmChores hashtag to mock the supposed impending doom of farm chores for boys and girls across America. Not that the kids would mind. Amiright?!

A proposal from the Obama administration to prevent children from doing farm chores has drawn plenty of criticism from rural-district members of Congress. But now it’s attracting barbs from farm kids themselves.

The Department of Labor is poised to put the finishing touches on a rule that would apply child-labor laws to children working on family farms, prohibiting them from performing a list of jobs on their own families’ land.

Read more: http://dailycaller.com/2012/04/25/rural-kids-parents-angry-about-labor-dept-rule-banning-farm-chores/

This Internet urban (or rural, in this case) myth is much ado about nothing. In the very US Labor Department proposal that the Daily Caller cited, the language is clear about this. From the 2nd paragraph of the US Labor Department proposal (my emphasis in bold):

The department is proposing updates based on the enforcement experiences of its Wage and Hour Division, recommendations made by the National Institute for Occupational Safety and Health, and a commitment to bring parity between the rules for young workers employed in agricultural jobs and the more stringent rules that apply to those employed in nonagricultural workplaces. The proposed regulations would not apply to children working on farms owned by their parents.Also, getting everyone in a tizzy is the rumor that 4-H would be eliminated under this proposal. Not true. From the US Labor Department site:

There are some portions of this US Labor proposal that do need some attention, but not the one being widely misreported. The lesson here: trust, but verify."Five Facts about the Proposed Child Labor in Agriculture Rule

Fact # 1: The proposed Child Labor in Agriculture rule will not prohibit all people under the age of 18 from working on a farm.

The proposed rule would not change any of the Fair Labor Standards Act’s minimum age standards for agricultural employment. Under the FLSA, the legal age to be employed on a farm without restrictions is 16. The FLSA also allows children between the ages of 12 and 15 years, under certain conditions, to be employed outside of school hours to perform nonhazardous jobs on farms. Children under the age of 12 may be employed with parental permission on very small farms to perform nonhazardous jobs outside of school hours.

Young people can be employed to perform many jobs on the farm – and this would be true even if the proposed rule were adopted as written. The proposed rule would, however, prohibit the employment of workers under the age of 18 in nonagricultural occupations in the farm-product raw materials wholesale trade industries. Prohibited establishments would include country grain elevators, grain elevators, grain bins, silos, feed lots, feed yards, stockyard, livestock exchanges, and livestock auctions not on a farm or used solely by a single farmer. What these locations have in common is that many workers, including children, have suffered occupational deaths or serious injuries working in these facilities over the last few years.

Fact # 2: The proposed rule would not eliminate the parental exemption for owners/operators of a family farm.

The parental exemption for the owner or operator of a farm is statutory and cannot be eliminated through the regulatory process. A child of any age may perform any job, even hazardous work, at any age at any time on a farm owned by his or her parent. A child of any age whose parent operates a farm may also perform any task, even hazardous jobs, on that farm but only outside of school hours. So for children working on farms that are registered as LLCs, but operated solely by their parents, the parental exemption would still apply.

Fact # 3: This proposed regulation will not eliminate 4-H and FFA programs.

The Department of Labor fully supports the important contributions both 4-H and the FFA make toward developing our children. The proposed rule would in no way prohibit a child from raising or caring for an animal in a non-employment situation — even if the animal were housed on a working farm — as long as he or she is not hired or “employed” to work with the animal. In such a situation, the child is not acting as an “employee” and is not governed by the child labor regulations. And there is nothing in the proposed rule that would prevent a child from being employed to work with animals other than in those specific situations identified in the proposal as particularly hazardous.

Fact # 4: Under the proposed rule, children will still be able to help neighbors in need of help.

In order for the child labor provisions of the FLSA to apply, there must first be an employer/employee relationship. The lone act of helping a neighbor round up loose cattle who have broken out of their fencing, for example, generally would not establish an employer/employee relationship.

Fact # 5: Children will still be able to take animals to the county fair or to market.

A child who raises and cares for his or her animal — for example, as part of a 4-H project — is not being employed by anyone, and thus is outside the coverage of the FLSA. Even if the child needs to rent space from a farm, the animal is not part of the farm’s business and with regard to the care of the animal no employer/employee relationship exists, so the child labor provisions would not apply. Likewise, there would be no problem with taking the animal to the county fair or to market, since the child is doing this on his/her own behalf – not on behalf of an employer. The proposed prohibitions would apply only if the child was an employee of the exchange or auction.

Gold Daily and Silver Weekly Charts - Jack of All Trades, And We'll Be All Right

The capping on gold and silver is hard to miss.

There was a fairly stiff gut check tossed at gold around the time the FOMC decision came out, but it bounced back quickly.

Paper and physical are in a bit of a struggle here, and so we see price winding tighter and tigher on the chart.

Intraday commentary on the financial system here. Tavakoli 'tells it like it is.'

Someone asked, why bother, why be concerned? Why be so concerned about reform?

"Even in a time of elephantine vanity and greed, one never has to look far to see the campfires of gentle people.

Lacking any other purpose in life, it would be good enough to live for their sake."

Garrison Keillor

That's why. Whatever you do for the least of these, you do for Me.

SP 500 and NDX Futures Daily Charts - Apple Dumplings

APPL came in with very good results last night, and so the markets rallied led by tech.

No breakouts, so we are still waiting to see which way this goes.

Today was a good day to go for a walk.

Tavakoli: Another Financial Crisis Looming, And You're On Your Own

Janet Tavakoli takes the gloves off and tells it like it is in the cover story in the May 2012 issue of Research Magazine.

You'll have to read it here, because I doubt you would hear this in any of the mainstream media.

I hate to apply the overused term 'expert,' but Janet is a highly credentialed expert in financial derivatives with years of practical experience. That does not mean that everything she says is necessarily right, but it certainly has credibility.

Someone asked me why would someone who is in the financial industry, and has benefited from their expertise in derivatives, speak out like this?

Have we really sunk that low that we cannot believe that some people could ever wish to speak the truth as they see it from moral principles, even against their short term material advantages? No wonder we are so easily taken in by lies, because that is what we want to hear. We are a lost generation.

This straight talk is a good spice to add to the somewhat bland presentation on the financial crisis last night from PBS Frontline.

It's all about fraud and the subsequent cover up and ongoing bailouts. Its the credibility trap, and it continues to undermine the recovery and the real economy today.

The cover story is that these are just well meaning and extremely bright people who did their best, but a few people got carried away, and well, you know, things just happen.

Just like MF Global, right?

Finding the Culprits

Derivatives expert Janet Tavakoli takes a hard look at what — and who — caused the financial crisis.

By Jane Wollman Rusoff

April 25, 2012

...Now Tavakoli sees another huge financial crisis looming.

The University of Chicago MBA has traded, structured and sold derivatives at firms including Merrill Lynch, PaineWebber and Westdeutsche Landesbank; and she had earlier stints at Bear Stearns and Goldman Sachs. Research recently talked with her about red flags and preventive solutions.

You write that, in the past three years nothing has been fixed but that we must hold Wall Street responsible for the fraud that resulted in the financial crisis. What should be done?

We need to have investigations. But with the pushback and all the lobbying, what they’ve been counting on is that the statute of limitations for some of these frauds is expiring. So if you don’t file complaints, you may not be able to.

Members of Congress are enabling the lack of punishment and covering up great misdeeds in our financial system — and they’re doing it with no fear of consequences — i.e., being voted out of office, in which case they could find themselves the subject of investigation.

What do you mean: “covering up”?

Many people are covering up for cronies who have a lot of money sloshing around. We threw money into the financial system with no accountability and thus made the problem worse. Our system has been completely infiltrated and bought off. Things aren’t changing because Big Money doesn’t want it to change.

What other indications are there of a cover-up?

The MF Global dog-and-pony show. The attitude toward bundlers like Jon Corzine [the firm’s ex-CEO], who is a big bundler for the Obama campaign, is that the guy can do no wrong. This was before he even testified. People who are raising big money for campaigns get off with no real investigation.

In the Sarbanes-Oxley age, for MF Global to say they were unaware of what they were doing beggars belief. And yet there has been no indictment.

Is President Obama part of the cover-up?

Yes, in that he’s enabled it. He’s left people in place who crashed the global financial system in the first place: [Treasury Secretary] Tim Geithner and [Federal Reserve chair] Ben Bernanke. Obama had told us: “You can’t keep doing things the same way and expect different results.” So he’s been quite a hypocrite.

Who else is in the cover-up?

Mary Schapiro was appointed [by President Obama] to head the SEC. She was formerly head of FINRA, the antichrist of investor advocacy! Yet she was chosen SEC [chair] because the regulators are captive by and serve the people they’re supposed to be regulating. They do not serve investors.

In a way, Obama has been the anti-regulator because he didn’t put people in the regulatory agencies, the Fed or the Treasury who would investigate and fix things that are wrong in our global financial system.

If he’s re-elected, then presumably, things will continue in this same way?

Yes.

What if a Republican is elected President?

Who else is not in the pocket of Big Money interests! (Ron Paul - Jesse)

So, no matter who’s President, these crimes — if you want to call them crimes — will be perpetuated?

Yes. And we do want to call them crimes! They are crimes.

What should Obama do now to help Americans?

He has a lot of resources at his disposal, one main one being moral suasion — he’s got the pulpit. When there was a crisis, Reagan, Carter, Bush went on television and explained what needed to be done. We haven’t seen that kind of leadership from President Obama. If anything, the American people have been told things to make them think [conditions] aren’t really as bad as they are: inflation isn’t as bad as you think because an iPad is cheaper now — nonsense like that.

So the public is being poorly informed?

Yes. Therefore, financial advisors need to be doing fundamental analysis of investments and not [only] be reading the Wall Street Journal or, God forbid, watching CNBC. (Don't look for any appearances on CNBC or Bloomberg TV, Janet - Jesse)

In other words, FAs should do their own research and figure things out for themselves.

Yes. Sadly, you’re on your own. That’s part of how we got into this mess: We lost the art of rolling up our sleeves and looking for opportunities.

On Internet TV, you stated that we’re “absolutely vulnerable to a repeat [crisis] because the fraud went unpunished and we printed money like crazy to bail us out of the last one.” That’s scary.

But the fact is we’ve bailed people out and had no consequences for them. So it emboldened them to turn around and behave in the same way. Look at banks like JP Morgan: Shortly after the crisis, they thumbed their nose at the idea of trying to separate speculation from the rest of the bank. So if you don’t have restraints on behavior, you’ll see it repeated. And now we’ve made it worse. It’s like handing a drunk driver who got into a crash the keys to a bigger, faster car together with a bottle of vodka.

In every area of finance where we bailed people out, you see the same wrongdoers volunteering to help fix the situation. That’s pretty funny: They weren’t trustworthy before, and they’re not trustworthy now.

But what about the investigations that already have been held?

They’re all for show, and people end up with a slap on the wrist for minor issues. Investigators should be looking instead at the interconnected fraud that infected the mortgage lending market. And there is still a lot today, especially fraud on borrowers. If you go to the root of the problem and choke off the money supply, you stop the fraud in its tracks.

But the banks say they lost money.

The fact that a bank lost money isn’t an indication that they were a victim as opposed to being a perpetrator. A classic problem with control fraud is that the parasites destroy the host — in this case, the host being the bank and the parasites being the bank employees. If you were the victim of a control fraud by the people who worked in your own bank but meanwhile, you were collecting huge bonuses, you overlooked the control fraud within your own institution.

Why haven’t the apparently guilty been punished?

We haven’t seen the felony indictments that these people richly deserve because our regulators and investigators are captive — and Congress, more than ever, has been lobbied, courted and bought off by Wall Street. More than any time in the past, you’ve seen these big-money interests protected by Congress.

Is there an alternative to bailouts, such as those of the financial crisis?

Yes. Troubled financial entities should be restructured, old shareholders should be wiped out and we should return Glass-Steagall.

What should have been done in the case of, say, AIG?

Bankruptcy declared, and then [the government] says: “We’ll back-stop your contracts for now, but we’re going to investigate all those fraudulent credit derivative contracts and ‘claw’ money ‘back’ from your counterparties — like Goldman Sachs and Credit Suisse — if need be.” So there’s a controlled demolition. You’re not just handing money out with no consequences....

Read the rest here.

24 April 2012

MF Global: The Untold Story of the Biggest Collapse Since Lehman - Reckless Disregard

The question is not what the politicians and monied interests in Washington and New York will do to restore confidence in the financial system.

Rather, it is what they are willing to do, how far they will go, to save themselves and their cronies after the next financial collapse and disclosure of pervasive fraud and theft occurs.

From what we have seen at MF Global, the answer is that not much, if anything, is off the table.

Alternet

MF Global: The Untold Story of the Biggest Wall Street Collapse Since Lehman

By Pam Martens

April 20, 2012

There are plenty of lessons to be learned from MF Global, all of which we can count on Congress to ignore at the behest of Wall Street money until the next financial crisis.

Only on Wall Street can you bankrupt a company; misplace $1.6 billion of customers’ money; lose 75 percent of shareholders’ money in two weeks; speed dial a high priced criminal attorney and get a court to authorize the payment of your multi-million dollar legal tab from the failed company’s insurance policies; have regulators waive your requirements to take licensing exams required to work in the securities and commodities industry; have your Board of Directors waive your loyalty to the firm; run a bucket shop out of the UK; and still have the word “Honorable” affixed to your name in a Congressional investigations hearing.

This is not a flashback to the rotting financial carcasses of 2008. This putrid saga has been playing out in five Congressional hearings since December with the next episode scheduled for Tuesday, April 24, before the Senate Banking Committee under the auspicious title: “The Collapse of MF Global: Lessons Learned and Policy Implications.” (The title might more appropriately be, “MF Global: Lessons Never Learned and Policy Implications of a Wild West Financial System Just One TradeAway from the Next Taxpayer Bailout.”)

There are plenty of lessons to be learned from MF Global and heart-pounding policy implications; all of which we can count on Congress to ignore at the behest of the Wall Street money and lobby machine until the next epic financial crisis – an eventuality that is growing more likely each day as Congress refuses to restore the Glass-Steagall Act, the depression era legislation that bars Wall Street securities firms from owning banks holding insured deposits...

Read the rest here.

"Fellas it's been good to know ya."

Category:

MF Global

PBS Frontline: Money, Power, and Wall Street

As promised, this has just become available. You can watch the first two hours here:

PBS Frontline: Money, Power, and Wall Street

Episode One: Derivatives Spark a Credit Boom and the Mispricing of Risk

The Attempted Whitewash - "We never saw it coming."

Understates the extent of the fraud and Greenspan and others involvement in promoting a bubble.

Watch Money, Power and Wall Street: Part One on PBS. See more from FRONTLINE.

MF Global Customer Money Unvaporized: 'Substantial Portion Went to JP Morgan'

"The final $680 million or so was transferred to other financial institutions with which MF Global did business, including a substantial portion that went to JPMorgan. Giddens said his team has "a solid basis for seeking the recovery of some of the funds that were transferred to JPMorgan," and is engaged in ongoing talks on the issue."

As they say in the trade, Q. E. D. (quod erat demonstrandum)

CNN Money

$1.6 billion in missing MF Global funds traced

By James O'Toole

April 24, 2012: 6:49 PM ET

NEW YORK (CNNMoney) -- Investigators probing the collapse of bankrupt brokerage MF Global said Tuesday that they have located the $1.6 billion in customer money that had gone missing from the firm.

But just how much of those funds can be returned to the firm's clients, and who will be held responsible for their misappropriation, remains to be seen.

James Giddens, the trustee overseeing the liquidation of MF Global Inc, told the Senate Banking Committee on Tuesday that his team's analysis of how the money went missing "is substantially concluded."

"We can trace where the cash and securities in the firm went, and that we've done," Giddens said.

MF Global failed last year after its disclosure of billions of dollars worth of bets on risky European debt sparked a panic among investors. About $105 billion in cash left the firm in its last week, Giddens said, as clients withdrew their funds and trading partners called for increased margin payments, leaving the firm scrambling to make good on its obligations.

It has since emerged that MF Global tapped customer funds for its own use during this crisis and failed to replace them, in violation of industry rules.

Roughly $700 million of the missing money is now locked up with MF Global's subsidiary in the United Kingdom, where Giddens and his team are engaged in litigation to have it returned to U.S. customers. Giddens said he is "reasonably confident" that these funds will be recovered, though he added that it will be a lengthy process with no guarantee of success.

Another $220 million was transferred inadvertently from the accounts of securities customers to those of commodities customers. That money is now in limbo amid a dispute over which customers it belongs to, said Kent Jarrell, a spokesman for Giddens.

The final $680 million or so was transferred to other financial institutions with which MF Global did business, including a substantial portion that went to JPMorgan.

Giddens said his team has "a solid basis for seeking the recovery of some of the funds that were transferred to JPMorgan," and is engaged in ongoing talks on the issue. JPMorgan did not immediately return a request for comment....

Read the rest here.

"But please, to our friends in the Big Media, could we stop saying that we don't know the location of the missing $1.6 billion of client funds from MF Global? The money is safe and sound at JPM and other counterparties. As with Goldman Sachs et al and American International Group, the banks have been bailed out at the cost of somebody else. And the various agencies of the federal government are complicit in the fraud...

The effort by former New Jersey governor and MF Global CEO Jon Corzine to save his firm by stealing customer funds seems to warrant further discussion, yet instead we have silence...

So why is it that the Large Media have such trouble reporting this story? The fact seems to be that the political powers that be in Washington are protecting JPM CEO Jamie Dimon from a possible career ending kind of stumble with respect to MF Global."

Chris Whalen, Institutional Risk Analyst, February 2012

Category:

MF Global

Missouri's Sound Money Bill

"I don't think this has any practical implications,” says David Rapach, associate professor of economics at St. Louis University. “This could be a combination of nostalgia toward both states' rights and the gold standard, but we moved away from those types of models for good reasons.”

Perhaps the good professor has never heard of Gresham's Law, or seen The Hunger Games. But it does fit my model that most economists' understanding of current economic events has a lag of about ten years. That is why so many of them missed the build up to the financial collapse.

I would not underestimate the ingenuity of the public and their preference for stable value, and their building resentment at being bullied and abused by pampered elites in a distant city. The Sound Money Bill may be a local protest, but so was The Boston Tea Party.

Missouri's Sound Money Bill Is Really a Protest

By David Nicklaus

April 24, 2012

When the dreaded hyperinflation arrives, the Missouri House wants Missourians to be ready.

Last week, the legislative body passed the Missouri Sound Money Act of 2012, which declares U.S. gold and silver coins to be legal tender in the state.

That sounds a bit odd, especially since the federal government already recognizes its bullion coins as legal tender. It's just that nobody's going to pull out a $50 gold piece to pay for snacks at QuikTrip, because the ounce of gold in the coin is really worth $1,600.

Backers of the Sound Money Act envision a system in which you could deposit gold and silver coins in a vault and get a debit card tied to their metal value. If the Federal Reserve debases the value of the dollar – a favorite prediction among the gold-bug set – gold and silver would rise in value, and prescient Missourians could brag about their enhanced purchasing power.

Utah passed a legal-tender law last year, and South Carolina's legislature is considering one this year.

Rich Danker, economics director of conservative lobbying group American Principles in Action, said a couple of institutions in Utah are working to create the gold debit-card system. Until that's in place, sound-money advocates have to spend out of bank accounts denominated in dollars, just like the rest of us.

Missouri's legal-tender bill would benefit precious metals investors by eliminating state capital gains taxes on U.S.-minted coins. A fiscal note says the state treasury could lose more than $370,000 a year.

That's a small price to pay, backers argue, for monetary freedom....

Read the rest here: Missouri's Sound Money Bill Is Really a Protest - St. Louis Today

Category:

monetary theory

Michael Hudson and Max Keiser - Beggars Without Borders - Is the EU the New AIG?

The more I examine the financial, political, and economic structure of the European Union, the less sustainable and sensible it appears.

Having a common currency without allowing for transfer payments to make up for the lack of a flexible currency exchange is almost incredible considering the diversity of the region.

And when one adds the fact that each country is expected to issue its own bonds, in euros, with its own interest rates, and it becomes more like some doomed mutant, a kluge created by a committee, than a viable entity with a well thought out, robust structure.

Is the EU the new AIG? What were they thinking? The financiers are going to devour the best parts and then pick its bones.

Europe as it is currently constituted cannot last. It may go on for some years as an artificial construct, but it has a relatively short half life. It requires major surgery.

Gold Daily and Silver Weekly Charts - Winding Winding...

There is little doubt that gold and silver are being 'capped' here.

The question is which way they will break out and up, or down, as the winding tension in the market becomes unsustainable.

SP 500 and NDX Futures Daily Charts - All Eyes On AAPL

All eyes are on AAPL which reports earnings and revenues at 4:30 PM.

Tomorrow afternoon is the FOMC rate decision, and on Friday the advance GDP number from Q1.

US Leads Developed Nations In Percent of People In 'Low Wage Work'

This could be a good question on a quiz.

With regard to Victorian England I have seen estimates that show that almost 20 percent of workers were 'in service,' that is, were employed as domestic servants.

I see where they are already bringing back debtor prisons in the States.

And Australia and New Zealand are falling behind it appears. Some stubborn fascination with equality no doubt, insufficient elitism.

Research shows the US is a low wage country

By Mark Thoma

April 23, 2012

(MoneyWatch) - Recent research from John Schmitt of the Center for Economic Policy Research shows that the US leads developed countries in the share of workers earning low wages. The research also shows that increased wage polarization over the last several decades is one of the reasons for the large share of low wage-work in the US. The bars in this graph represent the share of workers in low wage work, where low wage work is defined as employees earning less than 2/3 of the median wage (approximately $10 per hour or $20,000 per year). In this category, the US leads among developed nations...

Research Shows that US is a 'low wage' country - Mark Thoma

23 April 2012

Gold Daily and Silver Weekly Charts - Two Day Fed Meeting Weighs on Metals

The money-printers will announce their latest decision on Wednesday around 2:15 PM, after their two FOMC meeting.

Gold and silver typically sell off into such meetings so today was no real surpise. The correlation with the equity markets allowed our short stock hedges to function well.

I put out the latest Net Asset Value premiums this afternoon, and PHYS produced a fairly surprising .94% premium to NAV. That, ladies and gentlemen, is not a euphoric number.

SP 500 and NDX Futures Daily Charts

700 million shares had traded on the NYSE at the bell, and that is light, and symptomatic of the lack of broad participation in this market. Shares are getting tossed around like hot potatoes among speculators and trading programs, with little conviction.

The two big pivot points of expected news will be on Wednesday when the Fed reports its FOMC decision and economic outlook, and on Friday when the advance number for US GDP Q1 comes out.

Europe continues to overhang the risk trade.

Net Asset Value Premium of Certain Precious Metal Trusts and Funds

The premium on PHYS is about as low as I can recall seeing.

It is so low that I checked for news of a secondary offering but found none.

Category:

NAV of precious metal funds

Weekly US Economic Calendar

The Fed has a two day meeting and will report their decision and outlook on Wednesday.

The US will report the Advanced GDP number for Q1 on Friday.

Category:

Government Statistics

Banking On Fear: Why the Policy of Stuffing the Banks With Money Does Not Help the Real Economy

"The big banks are buying up what they call fixed income instruments (bonds and other debt backed paper) and at the same time offering CDS insurance on the same. Just like they bought and sold protection on mortgages..."This is a fairly good description of why the policies of Bush and Obama have failed to effect an economic recovery.

The policy of 'saving the banks' first and foremost, and of stuffing them with cheap money in the hopes that they will stimulate the real economy with loans, is a cruel hoax.

Cheap money is hot money and it seeks high beta returns. It does not seek investment with returns over long periods of time. And in an environment of lax regulation and little deterrence for abusive financial practices, one sets up a scenario ripe for fraud and another, more chilling, financial collapse.

And the problem is not in the US alone. Europe and the UK are following similar practices, of serving the financial elites first, and the people very little or not at all.

There will be no sustainable recovery until the banking system is reformed, and balance is restored to the economy. Growth, not austerity, is the way out of the wilderness. But that growth is only achievable if the corruption that brought down the system in the first place is corrected and the real economy restored to some sort of natural order and sensible priority.

The hot money seeks out speculative returns, and when it cannot find them, it creates them. And that is the well spring of fraud, and of many of the corrosive economic problems facing our world today.

The problem is complicated because most of the western political leaders are complicit, by action or acquiescence, in the financial corruption that holds their nations by the throat, and allows the very few to prosper enormously at the expense of the people in general. The leadership is caught in a credibility trap. They are unable and unwilling to reform the system, and promote a renewal and change might bring them down with it as well as the corruption that feeds them with money and power.

"...The problem (one of them at least) is that while our leaders are banking on growth to save us, the banks are not. They are banking instead, on fear. Our leaders keep thinking if they ‘save’ the banks then the banks will help save us by investing in growth. They fail to understand that ‘invest’ is really not something high up on the global bank’s ‘to do’ list. I spoke at length recently to bankers in The City who deal in investing in raising money for Small and Medium businesses. They were unequivocal – it is getting harder not easier to raise money for such investment. The big banks and big funds are looking for short term speculative returns not slow investment returns.

When you have large and growing losses from bad debts you cannot and will not recoup and recover on the basis of wise but slow investment returns. The worse your previous debt mountain is, the greater the pressure to pursue exactly the sort of high-risk speculation that got you in trouble in the first place. If it is a choice between investing in Spanish factories or buying Spanish debt or selling CDS on that debt, the ‘smart’ bonus seeking money goes for the latter every time.

The brokerage Carmel whose study I have quoted is a good example. On page 9 of their study they say,

We began buying Spain CDS in Q4 2011…[with a coupon of] 3.5% of notional per annum –effectively an option premium on the default of Spain.300%! Investing in small and medium businesses or a potential 300% speculating on Spanish default. You choose.

Should the Spanish crisis flare up in 2012 as we expect, we can generate a 300% return on the annual premium.

Banks are banking on fear and the volatility fear causes. They are not banking on or helping to support growth. They will do the politically necessary minimum and no more. The big banks are buying up what they call fixed income instruments (bonds and other debt backed paper) and at the same time offering CDS insurance on the same. Just like they bought and sold protection on mortgages..."

Read the rest of this blog from 'Golem XIV' in the UK here.

Also see his essay "We Are All In This Together."

This may also be a good time to read or re-read this essay of mine, Currency Wars: The Anglo-American Century. What is happening in the western world is no accident, anymore that the rise of tyrants and the destruction of freedom are accidental.

The Case Against Lehman Brothers - The Credibility Trap

This documents the investigation into Repo 105 and the fraudulent transfers between New York and London, and when the accounting firm of Ernst & Young knew of them. The SEC and the Federal Reserve were there at the company, with access to the records, when all this happened.

And of course, there have been no indictments. And the reason may be that the SEC and the Fed, in their desire to maintain confidence in the system, knew about it and failed to disclose it. Or they could claim incompetence and a failure to do their jobs in protecting the public from financial fraud.

This is the credibility trap. When you are complicit in a fraud, in any number of ways, you cannot take effective, credible action against it, and deter other frauds from occurring. And you cannot afford to even discuss the issues credibly, because your are too compromised in your own actions, or inaction.

Category:

credibility trap,

financial corruption,

financial reform

21 April 2012

Currency Wars: Rickards On Gold, QE, and the Economy

Jim Rickards is interviewed by FutureMoneyTrends.com.

Part 1 is focused on Gold manipulation and why gold plays such an important role in the world, even if conventional wisdom doesn't believe so, gold is not only being watched by central bankers, as Mr. Rickards put, "the gold price is being managed."

Part 2 expands into the economy and probability of more quantitative easing (QE). According to Mr. Rickards, QE will come in the next few months because it can't be done this fall since it will look political, and if the FED tries to wait until December, it will be too late.

Subscribe to:

Posts (Atom)