"Corruption is a tree, whose branches are

of an immeasurable length: they spread

Everywhere; and the dew that drops from thence

Hath infected some chairs and stools of authority."

Beaumont and Fletcher, The Honest Man's Fortune

The silver market is rallying strongly today, after the recent dip in price below $18 with respect to the options expiration and delivery dates for the May contract earlier this week. When futures options are filled, one is not paid in cash, but instead they receive active futures contracts at the strike price.

The market game is to either get the front month price below the key strike prices before the expiry to make the options worthless, or to take the price down below the strikes the day after to run the stops of the contract holders. The market makers can see the relative levels of holdings in market in near real time, privileged information not permitted to the average investor.

Three or four banks are short more silver on the COMEX than can easily be attributed to legitimate forward sales or hedging for all the miners in the entire world, for years of production. Granted, it is hard to determine what the truth is because they are allowed to hide their actual positions and collateral, so as to be able to make their leverage and risk difficult to determine. It's the obsessive secrecy for improbable positions and returns that is the tell in most market manipulation and schemes such as Madoff's ponzi investments.

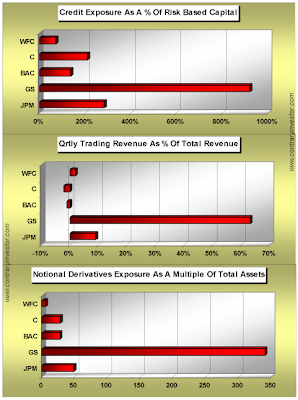

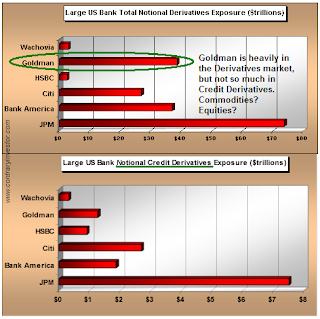

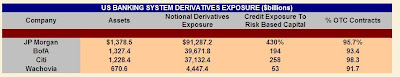

Goldman Sachs was able to obtain the exemptions of a hedger in the markets through contrivance, for the purpose of their proprietary speculation. But if Goldman is the vampire squid, then J. P. Morgan is the kraken of the derivatives markets, having less leverage than the squid as a percentage of assets, but significantly more reach and nominal size, positions which seem almost impossible to manage competently against value at risk in the event of a very modest market dislocation. And of course the risk which a miscalculation presents could shake a continent of counterparties. These oversized positions appear to be integral to the misprision of legitimate price discovery that is at the heart of derivatives frauds in other markets.

The 4Q '09 report from the Office of the Comptroller of the Currency reports that "The notional value of derivatives held by U.S. commercial banks increased $8.5 trillion in the fourth quarter, or 4.2%, to $212.8 trillion." J.P. Morgan alone has a total derivatives exposure that is larger than world GDP. Granted, by far most of these derivatives are based on interest rates, which are largely under the nominal control of Wall Street's creature, the Fed, at least for now.

Here is a description of the derivatives market by Carl Levin that seems appropriate to the current situation, but also to other market dislocations such as that of LTCM which foundered through the misapplication of risk management assumptions to enormously outsized positions.

"Ordinarily, the financial risk in a market, and hence the risk to the economy at large, is limited because the assets traded are finite. There are only so many houses, mortgages, shares of stock, bushels of corn, [bars of silver], or barrels of oil in which to invest.

But a synthetic instrument has no real assets. It is simply a bet on the performance of the assets it references. That means the number of synthetic instruments is limitless, and so is the risk they present to the economy...

Increasingly, synthetics became bets made by people who had no interest in the referenced assets. Synthetics became the chips in a giant casino, one that created no economic growth even when it thrived, and then helped throttle the economy when the casino collapsed."

These bets can be used to overwhelm the clearing price of physical bullion. Further, these bets distort markets, and those markets have an impact on the real commodity supplies and the economy, in the form of artificial oil and energy shortages for example as in the case of Enron. And given enough time these distortions can, through misallocation of resources, capital and labor, create real systemic shortages in key commodities that can take years to remedy, in addition to the short term damage and pain they inflict on countries whose economies rely on commodity exports.

These bets can be used to overwhelm the clearing price of physical bullion. Further, these bets distort markets, and those markets have an impact on the real commodity supplies and the economy, in the form of artificial oil and energy shortages for example as in the case of Enron. And given enough time these distortions can, through misallocation of resources, capital and labor, create real systemic shortages in key commodities that can take years to remedy, in addition to the short term damage and pain they inflict on countries whose economies rely on commodity exports.Perhaps Senator Levin can reuse this quote when he questions CFTC Chairman Gary Gensler, another Goldman alumnus in government, and Sandy Weil's protege Jamie Dimon, when the Congress holds hearings on the defaults in the commodity markets and the requested bailouts of the banks who were holding enormously leveraged derivatives positions.

Unless, that is, the bailouts are conducted in secret, as Mr. Gordon Brown may have done for the bullion banks when he sold England's gold for a pittance. It is hard to know the facts of that sale because it has been hidden away by the Official Secrets Act. That type of bailout would be hard to do with silver, since the US has long since depleted its official holdings, and has trouble keeping its own mint in supply. But such a bailout might be done with the gold in Fort Knox and West Point, or the oil in the Strategic Reserve. And cash settlement is always an option, since the Fed does own a printing press.

I know this sounds a bit much at times, and there are plenty who will tell you to ignore it and move along. Tinfoil hat and all that. And it is natural to grow tired of it, to wish it would just go away. I know that I do.

But these things have happened, and continue to happen, and if you do not understand even now how the government and the banks are acting together in the the shadows for the benefit of the monied interests, you have not been following the news. Or perhaps you have, since the mainstream media largely ignores it, and investigates little or nothing, preferring the less expensive route of chairing phony debates between vested insiders, shameless promoters and paid position whores known as 'strategists.' The financial medai seems to have led the way on this, turning their 'news coverage' into an extended infomercial.

It is a dirty, shameful lapse in stewardship, and an overall failure in the upholding of oaths and responsibilities in public figures and officials. I have not seen anything like it since the Watergate trials which seemed to drag on interminably, and the scandalous behaviour and abuses that were exposed in the Nixon Administration. And it has only just begun to come out, but slowly. Because this time the US lacks a truly independent press that respects and investigates the evidence provided by whistle blowers, and is willing to question the sham explanations of the powerful insiders in the government and the financial sector.

And no one in power is recording anything for posterity, at least not voluntarily.