Gold December futures fell to 1535 and Silver to 26.15 in the overnight session as a determined night bombing raid took them down in the least liquid period of the 24 hour trading day, with the low being reached around 2 AM New York time.

Silver Dec futures are now at 30.78 in New York, virtually unchanged from their open at 30.85, or up over $4.50 from the low.

Gold is at 1623 now, or up $88 from its overnight low.

The December SP 500 Futures had bottomed at 1116 around the same early morning hours, and are now at 1158 or about 42 point from the overnight lows.

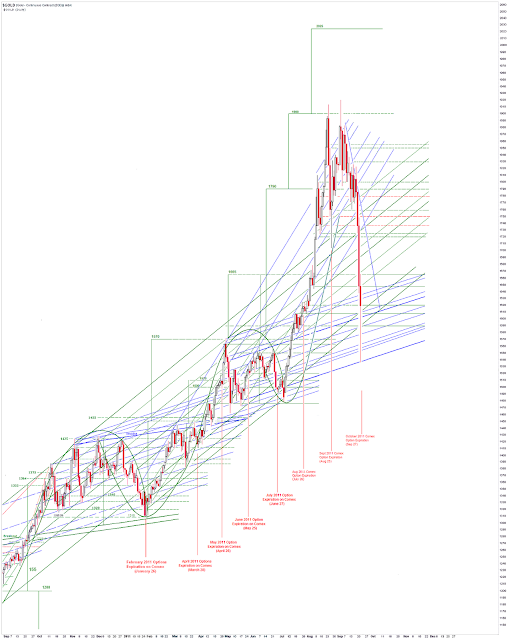

Gold has NOT yet broken the short term downtrend, marked with a sharply declining blue line on the chart.

Tomorrow is option expiration on the Comex as we might have expected. I would hope that long term investors would take advantage of these price drops by locking in physical bullion purchases when they can.

However, it is hard to do this with the leverage and margin requirements on Comex especially on the overnight globex trading session. How can an average trader hope to maintain a position? And that is the basis of their schemes.

"It is not immediately clear at this juncture who was selling or why - but in placing such a huge order into the market when the least number of market participants were active tells you that they were out for dramatic effect.

Anyone looking to offload significant amounts of metal at the best possible price would have done so when both London and New York were both open - this would have ensured they would have hit the market when it was most liquid and ensured they got the best price for their sale.

Clearly finessing gold into the market was not their motive - they wanted a statement."

Ross Norman, Sharps Fixley

The interplay between the LBMA 'physical market' and the New York 'futures markets' is fairly obvious. The leverage on the LBMA physical market for gold and silver, as opposed to the London Metals Exchange which trades base metals, is reputed to be around 100 - 1. So any 'run' on the metals will stress the system.

According to their website the LBMA market markers are some of the largest Too Big to Fail banks including UBS, Société Générale, Merrill Lynch (BoA), Credit Suisse, Barclays, Goldman Sachs, JPM, HSBC, The Bank of Nova Scotia ScotiaMocatta, Deutsche Bank.