"If you follow issues like Too-Big-To-Fail or Wall Street corruption long enough, you realize that the reason things don't get done about them by our government has very little to do with ideology or even politics, in the way most of us understand politics.

Instead, it's a bizarre, almost tribal mentality that rules our capital city – a kind of groupthink that makes extreme myopia and a willingness to ignore the tribe's ostensible connection to the people who elected them a condition for social advancement within."

Matt Taibbi, Neil Barofsky's Adventure in Groupthink

Personally I think this is the corrosive influence of the credibility trap, the amorality of careerism, and of course, an ambivalence towards white collar corruption as the inherent entitlement of privilege. There seems to have been a shift in perspective amongst the new ruling class from noblesse oblige to droit du seigneur. This is what Robert Johnson calls 'the audacious oligarchy.'

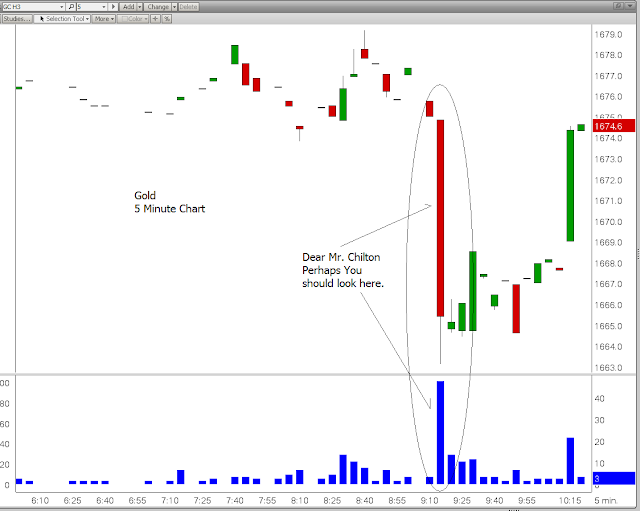

While it is recovering much of this sudden, five minute loss even now, with spot back to 1680 already, the hit on the gold market in the New York trade this morning was fairly blatant.

Perhaps it was just some innocent who had the desire to drop a boatload of contracts into a quiet market, and knock the price down while maximizing their selling loss. Or another 'fat finger' mishap, which seem to happen quite a bit around option expiration for example.

Or perhaps it was some wiseguy trader who looked at the market, having some advantageous insight into the order books, and decided to 'run the stops.'

Thank God the US has the CFTC, whose job it is to look at this sort of thing and to tell us whether it was legitimate, or not.

And we should hear back about this, perhaps as early as January, 2017. And maybe even sooner on this one: 24 Tonnes of Paper Gold Dumped at Market

But it is nice to see that the CFTC is doing something. They are asking the court to overturn the $30 million fine on the Amaranth trader who was caught manipulating the natural gas market, because another regulator did their job for them.

And how is that MF Global investigation going by the way?