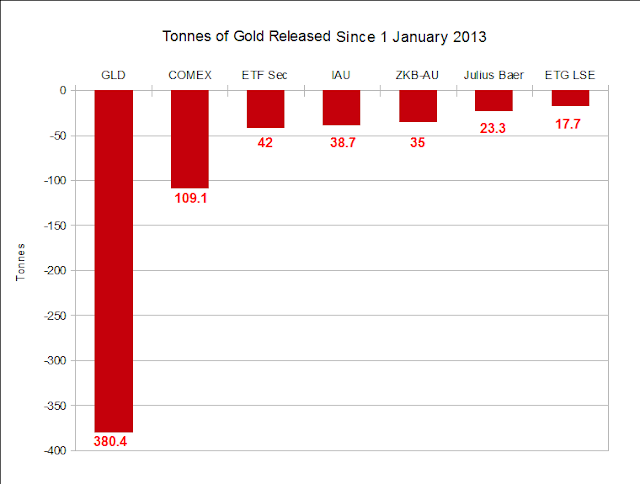

Considering the theory that the purpose of this market operation was designed to take the price of gold lower since the first of the year, and to free up bullion to relieve certain stresses in delivery, I was wondering if we could quantify the results of it in any way.

With the help of Nick at Sharelynx.com, the keeper of records and master of charts, I was able to calculate the approximate number of tonnes of inventory that were released into the market, or some private storage area perhaps, from the top funds and exchanges in the western world. The time period is from the beginning of this year through 26 June.

If this is correct, and the hypothesis is correct, then it is 'mission accomplished.'

There should be no excuses for not delivering Germany's gold. And plenty of other bullion has been made available to solve those other pesky failures to deliver that seemed to be cropping up.

So one may presume that the bullion is in the mail to its rightful owners, in care of the Herr Weidmann at the Deutsche Bundesbank. The NY Fed sends its special regards. Ich liebe dich.

Unless of course it has been rehypothecated to those barbarian buyers in Asia and the Mideast, yet again.

C'est la guerre des monnaies. Quelle dommage!

I have also included Nick's personal wave count for gold and silver, although I am not an adherent to the waves theory per se. And his long term confidence range for the gold bull market.

The stars seem to be aligning, with perhaps a few more antics and end of quarter shenanigans. But boys will be boys, and they can't keep their hands off their toys. So who can say what will happen next. How about another round of bailouts?