Gold and silver managed to hold their own today with gold showing a bit more lift perhaps.

There will be an option expiration on the Comex this Thursday the 26th for the April contract. As you may recall, April will be an 'active' contract for gold unlike March.

I have not looked at the composition of the options holdings lately, or the commitments of traders as well. There are others that do this much better, and I would rather look at their thoughts on this. Ted Butler does a very good job of keeping tabs on silver.

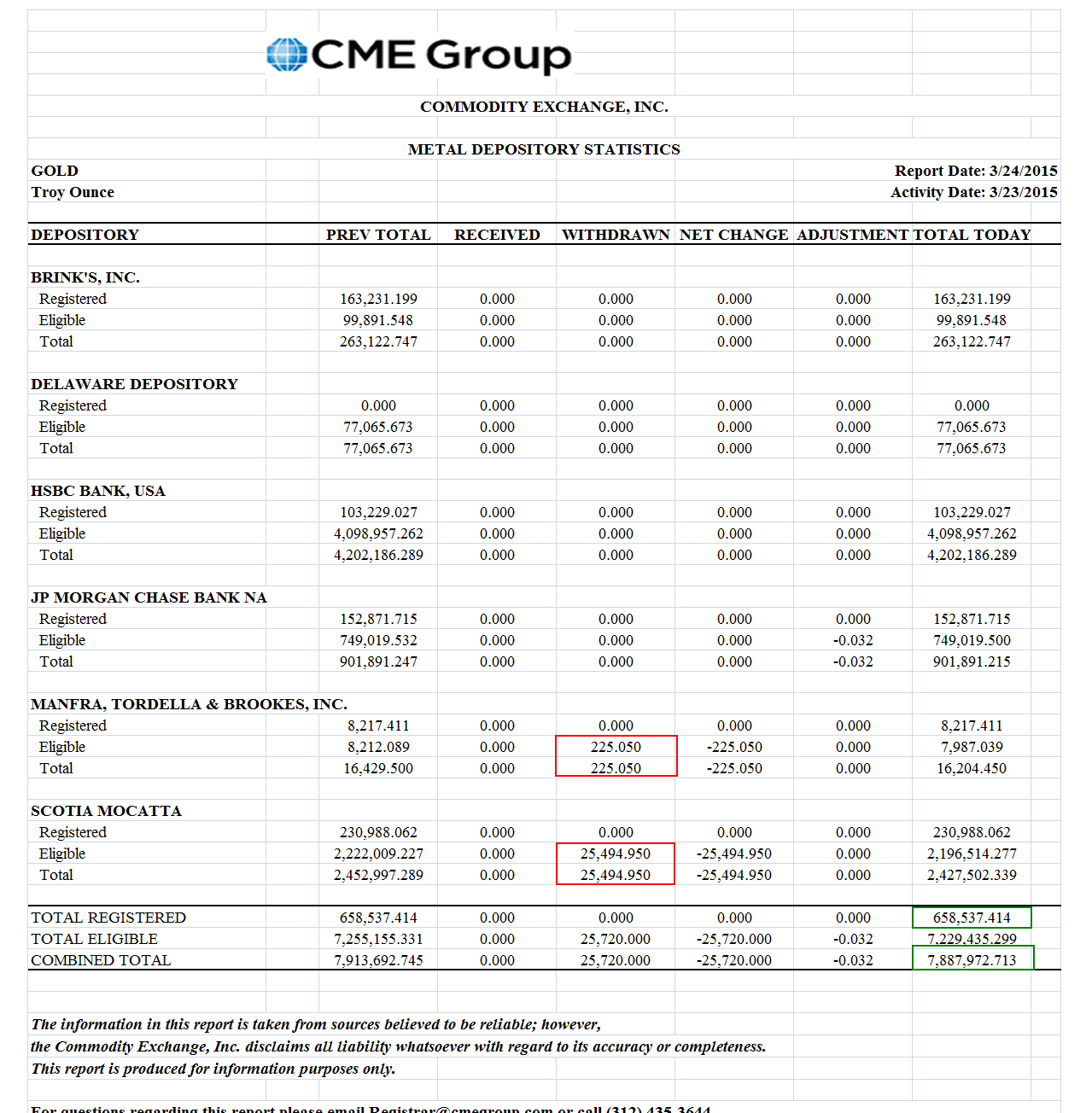

But at the end of the day, I have come to the conclusion that the Comex is a bucket shop now, basically a betting parlor without a fundamental linkage to the underlying commodities that form the basis of its bets.

I see it giving way to the great changes in world currencies. As I forecast several years ago, there is a strong movement to include the Chinese yuan in the composition of the SDR. Now, this would not mean all that much, unless the SDR was intended to take on more significance than it has today.

And of course there is talk that with the yuan there will be some element of gold included in the SDR as well.

We are not close yet to a resolution. The currency war is just getting hotter, as the forces of the New American Century still seek to impose their own order of things on the world, and counterforces with their own agendas oppose them.

And so here we are, between the cracks, trying to seek safety, and stay out of the way of the opposing forces of the will to power, and elephantine greed.

Have a pleasant evening.