This calculated slamdown was a little enthusiastic even by current market standards, or lack thereof.

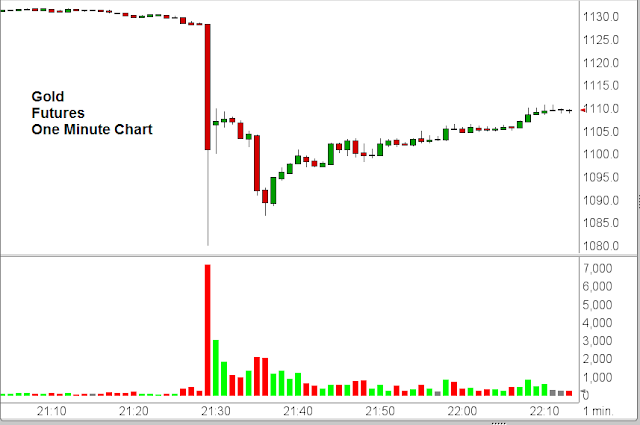

About seven thousand gold futures contracts, representing 21.8 tonnes of paper gold, were dumped at market in less than one minute driving the price down to $1,080.

Several thousand contracts were bought back in the following two minutes.

No legitimate profit-oriented sellers would operate in this manner, since they are selling against themselves. You do not dump large volume without limit into a quiet market unless you are trying to disrupt the price.

A similiar operation happened in silver.

Who would suspect a thing? Certainly not the regulators, or even some market 'reformers.' Not when something is so obvious.

Oh, well done.

I think this is another conveniently timed, clumsy attempt to clear out more of the August open interest and give a nice shot to the gut for any foolish enough to still buy options on the Comex. The next precious metals option expiry is on the 28th July.