Gold continued to advance higher and silver joined in, edging up to the cusp of the 15 handle.

They are a little short term overbought, and we are going to be enjoying another chapter in the ongoing fictional story of the US Economic Recovery tomorrow.

I refuse to draw the tentative 'cup and handle' formation on the charts for fear of jinxing it. I know, but hey its hard for any trader to be perfectly rational ALL the time, especially in the teeth of a three year bear market that seems to defy all the facts and fundamentals.

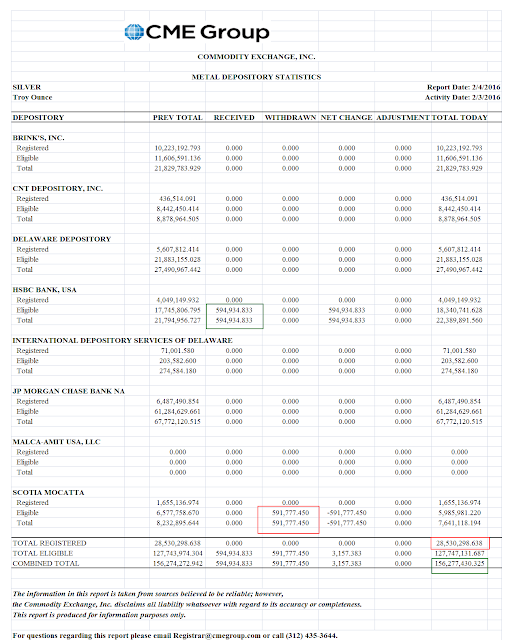

There was little to no delivery activity for the PM's at The Bucket Shop yesterday. The movement of bullion being shoved around the plate at least in the case of silver is noted in the reports below.

Let's see if gold can push up to that 'blue line' overhead on the chart and stick a close sometime this active month of February.

Everything about these markets and our glorious recovery reminds me of a predetermined decision about the future course of events, and monumental efforts to bring about their appearance by The Fed, the financial establishment's Adjustment Bureau.

And who then, after our little noted financial coup d'etat, is now the real Man in the High Castle?

Much Ado About Not So Much

Speaking of the Fed, I heard from a friend about a video from Mike Maloney that highlights a big drop in the Federal Reserve Banks aggregate Balance Sheet of about $20 Billion in December of last year.

There was some questioning and speculation about this being due to some behind the scenes banking crisis.

Although I don't read them as much anymore, a quick look at the Fed's H.4.1 release from December revealed this statement below by way of explanation.

Net-net the change was a bookkeeping maneuver in response to the 'Fixing America's Surface Transporation Act' (FAST) which was enacted on 4 December 2015. They were required to transfer certain amounts in excess of $10B to the Treasury, where they would eventually end up anyway after expenses. The Fed is a cost-based entitlement to the Banks.

Our first impulse when encountering an interesting diversion from the familiar ought to be to examine the available evidence and ask a lot of questions, especially with regard to facts.

But that does not mean that irregularities and unexplained things do not occur. Sometimes they do. And they are dismissive by the same type of 'normality bias' and ludicrous arguments by the apologists for the serial felons who have been rigging almost every market there is for the last ten years or so.

And there are plenty of odd things going around these days, swirling in the fog of 'currency war.'

Have a pleasant evening.

FEDERAL RESERVE statistical release

For Release at

4:30 P.M. EST

December 31, 2015

Publication Note

The Board's H.4.1 statistical release, "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks," has been modified to reflect the policies under which Federal Reserve Banks make payments of their residual net earnings to the U.S. Treasury.

The Fixing America's Surface Transportation Act (FAST), which was enacted on December 4, 2015, requires that aggregate Federal Reserve Bank surplus not exceed $10 billion. Therefore, any amount of aggregate Reserve Bank surplus that exceeds this limit will be remitted to the U.S. Treasury.

The line "Interest on Federal Reserve Notes due to U.S. Treasury" on table 6 has been replaced with "Earnings remittances due to the U.S. Treasury" and footnotes to tables 1, 5, and 6 have been similarly modified.

The amounts of the line items "Other liabilities and capital" on table 1, and "Surplus" on tables 5 and 6 reflect the payment of approximately $19.3 billion to Treasury on December 28, 2015, which was necessary to reduce aggregate Reserve Bank surplus to the $10 billion limitation in the FAST Act.