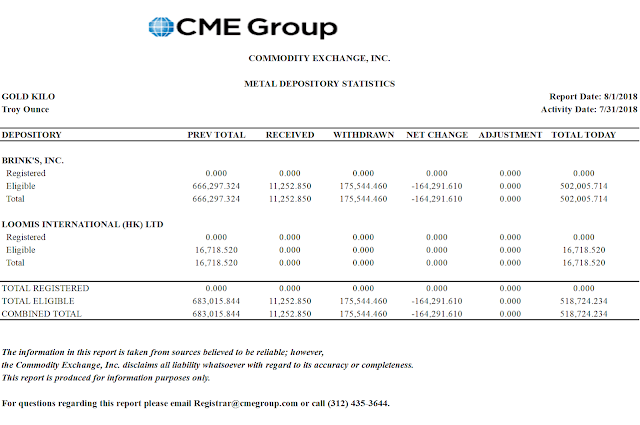

"I hold that the price of silver, gold and other metals is artificially derived at due to excessive speculation on the COMEX at the hands of managed money technical funds on one side and other traders, mostly commercials, on the other side, with JPMorgan playing a dominant role in the process.

As a result of JPMorgan’s outsized influence, the price of silver has remained artificially depressed in price, while the bank has used the depressed price to not only amass billions of dollars in paper trading profits, but it has also accumulated 750 million ounces of physical silver on the cheap, along with 20 million ounces of physical gold."

Ted Butler, A Simple Equation, 1 August 2018,

Ted Butler is the dean of those who comment on the trading structures of Comex silver.

As far as the Fed and the system's regulatory process goes, never in the history of financial endeavor have so many, done so much, for the benefit of so few.

Today the Fed did nothing about its benchmark rate today, and provided only minor tweaks to its statement. This was as expected.

There is a high probability that they will raise rates in September. They will do so unless the economy visibly falls off the rails.

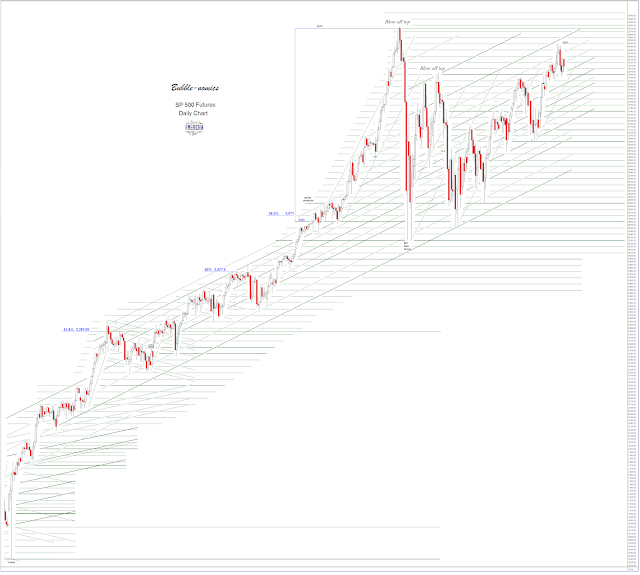

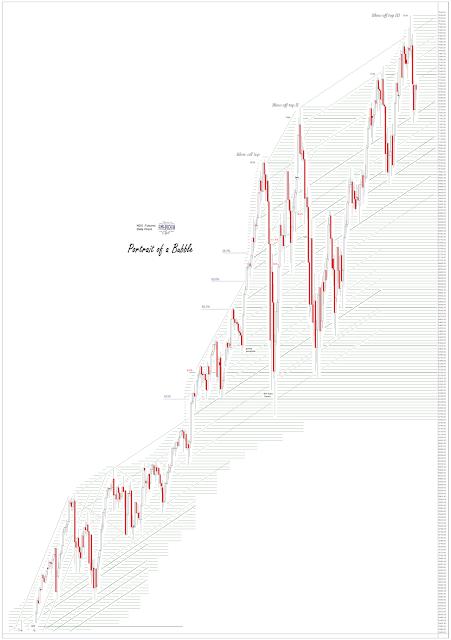

They wish to get the short term rate high enough to give themselves room for policy actions, eg. 'cuts', when this current bubble which they have created implodes, for the third time since the recent turn of the century. But they must move slowly, or they risk inverting the yield curve, which is an ominous sign for the equity markets.

Stocks were weak all day, with the SP 500 showing the greater weakness as compared to big cap tech in the NDX.

Gold and silver were off a bit. What a surprise.

The US Dollar was marginally higher.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.