"Predicting the failure of a complex system is not easy. One can examine it as a whole, and determine that it will fail, and often calculate what must change in order to allow the system to function more reliably. But it is often beyond our power to calculate exactly how it will fail, and consequently when it will fail.

This does not invalidate the observation that the system will ultimately fail. It merely underscores the unpredictability of timing a failure with the degrees of freedom inherent in a calculation with a large number of exogenous variables.

There are four major types of tipping points:

o Demand: a break in the level of consumption in the US caused by the

unwillingness or ability of households to incur further debt to support

consumption beyond real wage growth

o Supply: a major disruption in the supply of an essential commodity like

energy, food, or raw materials, or even the realization that a major

commodity is in shorter supply than expected, such as silver or oil.

o Monetary: an inability of foreign central banks to continue to

monetize the US trade deficit and budget deficit through the recycling of

their trade surplus into US debt securities.

o Systemic failure: the failure of a major counter party that threatens the

US financial system, particularly in the hugely leveraged derivatives market.

Jesse, Long Term Forecast: The Humpty Dumpty Economy, 2005

You may have noticed a fairly wide range in the US stock markets today.

Much of that was related to the trillion dollars or so in stock option expiration.

God may not play dice with the universe, but the Wall Street financiers are more than willing to play dice with the stability of the real economy and the lives of the American public.

So we had another miraculous snapback rally in the late hours of trading, taking the major indices off some fairly impressive new lows.

I don't think the powers-that-be wanted people going into the weekend and worrying about their investments.

The enablers wanted to post the headline: Stocks Rally Back, Avert Bear Market.

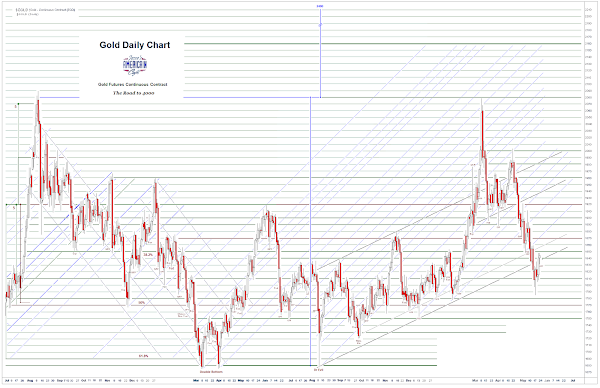

Gold held up well, and silver managed to hang on by its fingernails.

The Dollar rose to take back the 103 handle.

VIX was largely unchanged after a wild swing.

I am struggling a little bit with a choice with the CrashTrak model.

I still think we are testing that 'second low' as the rally we saw off that initial bottom was pretty much a one day wonder.

But if it was not, if it was in fact a 'failed rally' before a decline, well, we will see how that works out in the next week or so.

This will provide the wiseguys with yet another chance to hand off the consequences of yet another bubble to mom and pop.

The bottom line is that the risks are pronounced, even if a brief euphoria of optimism and greed return.

We need to break the second high to invalidate the model.

The higher ground still seems like a good place to be.

Have a pleasant weekend.