"Why is surprise the permanent condition of the U.S. political and economic elite? In 2007-8, when the global financial system imploded, the cry that no one could have seen this coming was heard everywhere, despite the existence of numerous analyses showing that a crisis was unavoidable.

Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. In fact, they tend to be too calm and exhibit minimal variability as silent risks accumulate beneath the surface.

Although the stated intention of political leaders and economic policymakers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite. These artificially constrained systems become prone to 'Black Swans' — that is, they become extremely vulnerable to large-scale events that lie far from the statistical norm and were largely unpredictable to a given set of observers.

Such environments eventually experience massive blowups, catching everyone off-guard and undoing years of stability or, in some cases, ending up far worse than they were in their initial volatile state. Indeed, the longer it takes for the blowup to occur, the worse the resulting harm in both economic and political systems."

Nassim Taleb, The Black Swan of Cairo, Foreign Affairs, May 2011

Stocks rallied today, on surprisingly light volume

The VIX rose sharply.

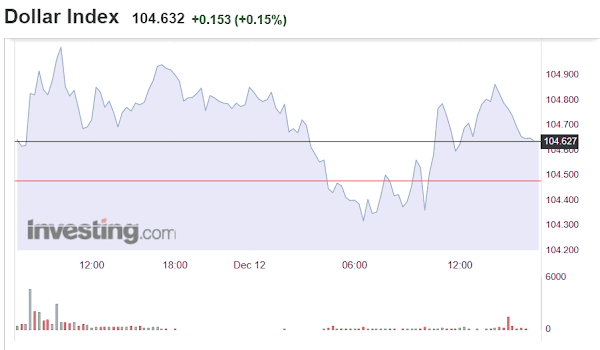

The Dollar chopped sideways.

Gold and silver declined.

This is an interesting week.

Tomorrow we get the CPI reading.

Wednesday there will be an FOMC rate decision.

And Friday there will be the last index option expiration of the year.

Wash-rinse-repeat.

The stars of financial shenaniganza are in alignment.

Have a pleasant evening.