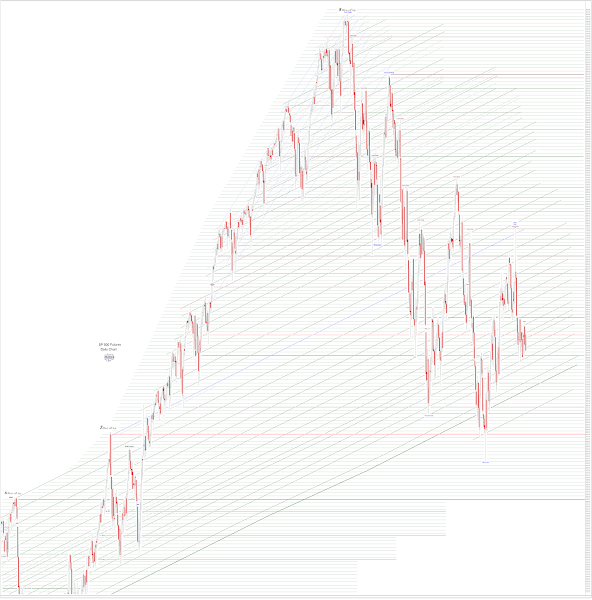

"In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance."

Hyman Minsky, The Financial Instability Hypothesis

"The period of financial distress is a gradual decline after the peak of a speculative bubble that precedes the final and massive panic and crash, driven by the insiders having exited but the sucker outsiders hanging on hoping for a revival, but finally giving up in the final collapse."

Charles Kindelberger, Manias, Panics, and Crashes: A History of Financial Crises

"Twenty-five years ago, when most economists were extolling the virtues of financial deregulation and innovation, a maverick named Hyman P. Minsky maintained a more negative view of Wall Street; in fact, he noted that bankers, traders, and other financiers periodically played the role of arsonists, setting the entire economy ablaze. Wall Street encouraged businesses and individuals to take on too much risk, he believed, generating ruinous boom-and-bust cycles. The only way to break this pattern was for the government to step in and regulate the moneymen.

Today, with the subprime crisis seemingly on the verge of metamorphosing into a recession, references to it have become commonplace on financial web sites and in the reports of Wall Street analysts. Minsky’s hypothesis is well worth revisiting."

John Cassidy, The Minsky Moment, The New Yorker, 4 February 2008

"FDR came right at Wall Street and the Banks with serious reform that saved capitalism from itself, and worked for a generation to hold back its darker impulses. This is a lesson that we have apparently forgotten.

If the Fed attempts their old fix [cheap money, financial asset inflation] once again, they may do what I thought was almost inconceivable, and go a step beyond mere stagflation which is bad enough, and cause an actual break in confidence, and the bond of their word, the currency. The people of the world will not be fooled forever.

As Hyman Minsky once said, and the moderns seem to have forgotten, 'Anyone can create money; the problem is in getting it accepted.' He should have added, except by force [force is bad monetary policy by other means]. Reform goes hand in hand with recovery."

Jesse, Moral Hazard of the Fed's Current Policy: Fraudulent Paper, 24 January 2013

When a similar boom and bust, fomented in each case by Fed monetary policy, happens three times in 21 years, you may wish to consider that it is not an accident, or a coincidence, or addle-brained fat finger error, but something a little more purposeful, and at its heart more than mere careless incompetency.

The recent insider trading scandals in the Fed's highest ranks, and the ensuing cover-up and deflection, make our confidence a bit more strained.

Non-Farm Payrolls tomorrow.

Have a pleasant evening.