"You might think that parking your money in a big bank like JP Morgan Chase would insulate you from fraud. It’s just the opposite. The big banks are the biggest perpetrators of financial fraud – fraud that affects millions of us, either directly or indirectly, on an ongoing basis. While they are wrist slaps when properly scaled, you can see the list of 'settlements' made between the government and the big banks here. These 'settlements,' the aftermath of Wall Street's near production of a second Great Depression, entailed not a single criminal indictment. The top two repositories of banksters, based on the number of settlements, are Bank of America and JP Morgan Chase.

The banks engage in fraud for two reasons. First, they profit from swindling the public. Second, they can get away with it via a simple technique. They buy off the regulators with promises of enormously lucrative jobs when they leave government service, and they buy off the politicians with huge direct and indirect campaign contributions."

Laurence Kotlikoff, When Banksters Buy Regulators and Prosecutors, Forbes, October 21, 2014

"Let us create a society in which it is easier for people to be good."

Peter Maurin

"The London Gold Pool was the pooling of gold reserves by a group of eight central banks in the United States and seven European countries that agreed on 1 November 1961 to cooperate in maintaining the Bretton Woods System of fixed-rate convertible currencies and defending a gold price of US$35 per troy ounce by interventions in the London gold market.

The central banks coordinated concerted methods of gold sales to balance spikes in the market price of gold as determined by the London morning gold fixing while buying gold on price weaknesses. The United States provided 50% of the required gold supply for sale. The price controls were successful for six years until the system became no longer workable. The pegged price of gold was too low and runs on gold, the British pound, and the US dollar occurred and France decided to withdraw from the pool. The London Gold Pool collapsed in March 1968.

The London Gold Pool controls were followed with an effort to suppress the gold price with a two-tier system of official exchange and open market transactions, but this gold window collapsed in 1971 with the Nixon Shock, and resulted in the onset of the gold bull market which saw the price of gold appreciate rapidly to US$850 in 1980."

Wikipedia, The London Gold Pool

“God meant things to be much easier than we have made them.”

Dorothy Day

Stocks managed to extend their gains.

Gold and silver lost a little more ground.

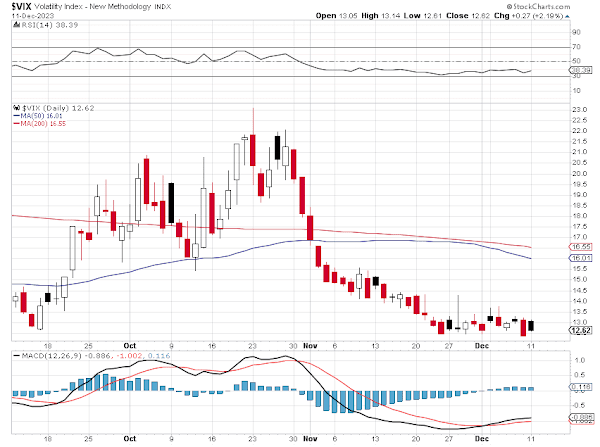

VIX is docile.

The Dollar was nominally unchanged.

This is a big week for events.

Tomorrow we will see the latest CPI data.

On Wednesday there will be an FOMC rate decision.

Expectations are for no action but maybe some notable words.

And on Friday we will have the big quad witch December stock option expiration.

Let's see what happens.

Oh yeah, and there are some brutal wars ongoing in the real world.

Banks 'r Us. Policy errors to infinity.

Our oligarchy is audacious.

Have a pleasant evening.