"Sprott Asset Management LP is planning to make an unsolicited offer to acquire Central GoldTrust and Silver Bullion Trust valued at $800 million, a person with knowledge of the matter said.An offer at that level would reflect a 3.5 percent discount to the combined market value of the trusts at the close Wednesday of about $829 million. The proposal could come as early as Thursday, said the person, who asked not to be identified because the information is private.The trusts, which buy and hold substantially all of their assets in respective metals in bullion and certificates, have been under pressure from investor Polar Securities Inc., the Toronto-based hedge fund. Polar has been urging the trusts to change how unitholders can redeem their investment as a means of closing their trading gaps.Sprott aims to use its broader marketing platform and investor relations expertise to close the historic trading gap on both targets between their unit price and their net asset value, said the person familiar with the situation. Sprott projects it will add about $3.14 per unit in value to Central GoldTrust and 95 cents a unit to Silver Bullion by closing that gap, the person said.J.C. Stefan Spicer, president and chief executive of both Central GoldTrust and Silver Bullion, declined to comment. Glen Williams, a spokesman for Sprott, declined to comment."

23 April 2015

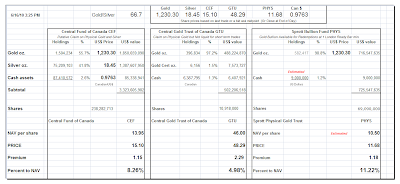

NAV of Certain Precious Metal Trusts and Funds - Sprott Bid For Canadian Metals Trusts

23 June 2010

NAV of Certain Precious Metal Trusts: GTU Closes Secondary Offer: Gold to Shine for Rest of 2010

The Central Gold Trust (GTU) shelf offering closed today.

CENTRAL GOLDTRUST CLOSES U.S. $ 280,197,000 UNIT ISSUE

TORONTO, Ontario (June 23, 2010) – Central GoldTrust of Ancaster, Ontario is pleased to announce that it has completed the sale of 5,730,000 Units of Central GoldTrust at a price of U.S. $48.90 per Unit to a syndicate of underwriters (the “Underwriters”) led by CIBC, raising total gross proceeds of U.S. $280,197,000. The Units offered were primarily sold to investors in Canada and in the United States under the Multijurisdictional Disclosure System.

The issue price of U.S. $48.90 per Unit was non-dilutive and accretive for the existing Unitholders of Central GoldTrust. Substantially all of the net proceeds of the offering have been invested in gold bullion, in keeping with the asset allocation provisions outlined in Central GoldTrust’s Declaration of Trust and the related policies established by its Board of Trustees. The additional capital raised by the offering is expected to assist in reducing the annual expense ratio in favour of all Unitholders of Central GoldTrust.

The new total of issued and outstanding Units of Central GoldTrust is 16,648,000. The investment holdings of Central GoldTrust are now represented by approximately 604,676 fine ounces of gold bullion, 6,156 ounces in gold certificates and approximately U.S. $16,980,360 in cash and short term notes.

I thought it was interesting that in response to a UBS poll, central banks and their ilk chose gold as the best performing asset for the rest of 2010, albeit with a minority of the respondents.

“Gold will be the best-performing asset for the rest of the year as investors seek to protect wealth from sovereign debt risks and economic turbulence...'So long as fears about global debt sustainability and sovereign risk remain heightened, gold will continue to rise,' London-based UBS analyst Edel Tully said today in a separate report. 'Against this backdrop, it is little wonder that nearly a quarter of respondents expect gold will be the most important reserve currency in 25 years’ time.'”Nothing is certain in the land where wealth and great fortunes rise and fall by fiat, and control frauds are a major facet of a national economy.

Gold to Be Best-Performing Asset for the Rest of the Year, UBS Poll Finds

The FOMC will be announcing its decision at 2:15 EDT today. Benji and his Banksters are quietly strangling the US productive economy while taking very good care of the Fed's owners, the big banks, in a series of remarkable policy errors and some very innovative financial engineering. All the traders I know are watching that marathon match at Wimbledon, or the World Cup. No one seems to care what Ben has to say.

It was correct of Mr. Obama to sack General McChrystal for gross insubordination,, or quite simply, talking trash while drinking heavily to a Rolling Stone reporter.

Now if only Obama would give Timmy and Larry the boot for gross incompetence at the least, and replace them with the likes of Elizabeth Warren and Robert Reich, the US economy might gain some traction.

Let's see what happens.

16 June 2010

Net Asset Value of Certain Precious Metals Funds and Trusts

The Central Gold Trust was pressured today in response to its new unit offering from the existing shelf prospectus. The price declined 3.67% from yesterday's close with gold down $7.10. The total placement will be $285 million.

The premium is now low enough to make one an interested buyer, all things being equal, if there is an optimistic outlook for gold.

I have not quite calculated the 'greenshoe' on this offering as I am otherwise occupied today, but it might involve shortselling ahead of the offer as is customary and explained here.

Press Release

CENTRAL GOLD TRUST

For Immediate Release to Canada News Wire and U.S. Disclosure Circuit

TORONTO, Ontario (June 16, 2010) - Central GoldTrust of Ancaster, Ontario announced today that it has entered into an underwriting agreement with CIBC World Markets Inc., as lead underwriter, and Credit Suisse Securities (Canada), Inc. (the “Underwriters”), under which the Underwriters have agreed to buy and sell to the public in Canada (except Québec) and in the United States under the multijurisdictional disclosure system, 5,730,000 Units of Central GoldTrust.

The Underwriters have been granted the right to increase the size of the offering (the “Right”) by up to an additional 1,000,000 Units, exercisable in whole or in part, at any point prior to 4:00 p.m. (EST) on June 16, 2010. The offering will be made under an initial prospectus supplement to Central GoldTrust’s US$800,000,000 base shelf prospectus dated June 8, 2009.

The purchase price of U.S. $48.90 per Unit is expected to result in gross proceeds of approximately U.S.$ 280 million, prior to the exercise of the Right.

Substantially all the net proceeds of the offering have been committed to purchase gold bullion for settlement at closing, in keeping with the asset allocation provisions outlined in Central GoldTrust’s Declaration of Trust and the related policies established by its Board of Trustees. Any additional capital raised by the offering is expected to assist in reducing the annual expense ratio in favour of all Unitholders of Central GoldTrust.

Closing is expected to occur on or about June 23, 2010.

15 June 2010

Central Gold Trust Opens Its Entire $800 Million Base Shelf Prospectus in a Non-Dilutive Offering

Stefan Spicer is opening up his Central Gold Trust (GTU) for expansion in a very classy way, making it non-dilutive of NAV so as to not penalize the existing unit holders.

Well done indeed. An excellent response to surging market demand. The Spicers once again show the way to respond to their customers.

It will be interesting to see how quickly this offering sells. Since the Central Gold Trust holds its bullion in a strict allocation it represents a potentially large physical offtake in a tight bullion market as the move to hard assets continues.

And as an aside, it is so nice to be able to trade Canadian securities on the American exchanges. Anyone who trades the Canadian junior miners on the 'pink sheets' is all too familiar with the spread games and bid dodging the market makers are playing these days.

For Immediate Release toCanada News Wire and U.S. Disclosure Circuit

TSX SYMBOLS: GTU.UN (Cdn. $) and GTU.U (U.S. $)

NYSE AMEX EQUITIES SYMBOL: GTU (U.S. $)

CENTRAL GOLDTRUST ANNOUNCES PROPOSED OFFERING

TORONTO, Ontario (June 15, 2010) - Central GoldTrust of Ancaster, Ontario announced today that it plans to offer Units of Central GoldTrust to the public in Canada (except Québec) and in the United States under its existing U.S.$800,000,000 base shelf prospectus dated June 8, 2009 and filed with the securities commissions in each of the provinces and territories of Canada, except Québec, and under the multijurisdictional disclosuresystem in the United States pursuant to a proposed underwritten offering by CIBC.

Central GoldTrust will only proceed with the offering if it is non-dilutive to the net asset value of the Units owned by the existing Unitholders of Central GoldTrust.

The entire original amount of U.S.$800,000,000 provided for in the base shelf prospectus is available for this offering.

Substantially all of the net proceeds of the offering will be used for gold bullion purchases, in keeping with the asset allocation provisions outlined in Central GoldTrust’s Declaration of Trust and the related policies established by its Board of Trustees. Any additional capital raised by the offering is expected to assist in reducing the annual expense ratio in favour of all Unit holders of Central GoldTrust...Read this entire news release here.