"Sprott Asset Management LP is planning to make an unsolicited offer to acquire Central GoldTrust and Silver Bullion Trust valued at $800 million, a person with knowledge of the matter said.An offer at that level would reflect a 3.5 percent discount to the combined market value of the trusts at the close Wednesday of about $829 million. The proposal could come as early as Thursday, said the person, who asked not to be identified because the information is private.The trusts, which buy and hold substantially all of their assets in respective metals in bullion and certificates, have been under pressure from investor Polar Securities Inc., the Toronto-based hedge fund. Polar has been urging the trusts to change how unitholders can redeem their investment as a means of closing their trading gaps.Sprott aims to use its broader marketing platform and investor relations expertise to close the historic trading gap on both targets between their unit price and their net asset value, said the person familiar with the situation. Sprott projects it will add about $3.14 per unit in value to Central GoldTrust and 95 cents a unit to Silver Bullion by closing that gap, the person said.J.C. Stefan Spicer, president and chief executive of both Central GoldTrust and Silver Bullion, declined to comment. Glen Williams, a spokesman for Sprott, declined to comment."

23 April 2015

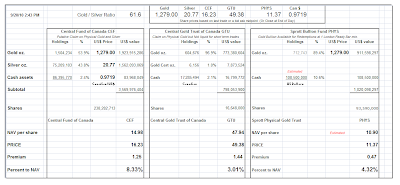

NAV of Certain Precious Metal Trusts and Funds - Sprott Bid For Canadian Metals Trusts

04 February 2014

NAV Premium of Certain Precious Metal Trust and Funds - 91,680 Ounces of Gold Out of Sprott

The premiums on PHYS and PSLV are back more to 'normal' levels now, although still hardly exuberant. PSLV is at a slight premium, and PHYS is almost flat.

The deeper discounts on CEF and GTU are still there, but a bit thinner that they have been.

Since the last time I put out this chart, another 91,680 ounces of gold bullion have been redeemed from the Sprott Physical Gold Trust.

I can imagine someone rationalizing this redemption as an arbitrage deal because PHYS is selling at a slight discount to its NAV. However, given the 'friction' of the transaction, and the necessity of storing this amount of gold, it seems like a fairly small amount to be tempting for a mere arbitrage against the NAV discount, given the volumes of gold that are being taken out.

Although it is possible that PHYS has priced its redemption process too cheaply. And there is no allowing for the desperation of a hedge fund that is willing to scrape for thin returns. This assumes they are not taking delivery to ship the gold to Asia for the premiums for physical paid there. If so, then it is not really arbitrage as I am using the term with regard to the discount to NAV, but the discount of paper to bullion. And that is a general trend that is hard to miss. But some do.

But one would think that playing the spread with paper and leverage, and betting that there would be a reversion to norms if the premiums fall to historically low discounts, would be a smoother and more scalable wager for any fund truly interested in paper profits. Here is a link to the distribution of PHYS premiums historically.

But this seems to be viewing a phenomenon in isolation that I think it is more correctly seen as part of a general trend, that one is foolish to ignore.

As I have shown here repeatedly, there is a general scouring of enormous proportions of the physical gold bullion from most if not all of the Western trusts and funds at these prices as set by the Comex, which unfortunately is still a price maker for the physical trade despite its own shrinking physical basis. That is the inconvenient reality that gold imposes on the financiers: they cannot print it into existence, except as an apparition of paper, without genuine substance.

And there are none so blind as those whose paychecks depend on their willing ignorance. It is unfortunate, but a fact of life.

So, let's see where this grand experiment goes. I have not been keeping an eye on the short interest in the PHYS, but I think the greater problem is the price of gold overall, which does not seem to be a market clearing price in terms of the actual commodity. And as a result, the physical bullion is flowing towards markets paying fairer prices, and finding ownership in stronger hands.

But why argue about it, especially with those whose mindset is clearly fixed in one direction? Let the tide go out, and we will see what allocated and unallocated funds are naked. And who, at the end of the day, is actually holding what gold, and with what encumbrances, cross claims, and counterparty risks.

So in summary, some might say that gold is flowing out of Sprott because of its discount to NAV, which I point out is miniscule, and much more adeptly gamed through the usual paper games.

Rather, gold is flowing from financialised markets to cash basis markets, from highly leveraged schemes to the vaults of stronger hands flush with paper of less confident value, and put even more simply, from West to East.

This is what happens when once again we begin to see 'peak paper.' Yes it certainly has not failed yet, and yes, the official measures may show little devaluation from inflation and mask the enormous leverage and undisclosed counterparty risk that is still in the system, après Crash.

And to this I say, 'in time.'

Not everyone is investing with a two month time horizon, as is de rigueur in the City and on the Wall Street these days, and passing around their hot potatoes of dodgy paper from hand to hand as quickly as possible, before the next bell rings.

10 January 2014

NAV Premiums for Precious Metal Trusts and Funds - 83,890 Ounces Redeemed From Sprott Gold

Since the last time I had checked earlier this month there was a redemption of 10,072,357 shares for 83,890 ounces of gold bullion from the Sprott Physical Gold Trust. That is about 210 London Good Delivery bars.

I have heard some rumours about who has been asking around for delivery, but in checking I do not see anything official from the fund, so why speculate. But for a redemption of over $103 million, I doubt it is the eBay crowd shuffling up to the window, so it is probably one of the usual suspects, the inside outers, not the big morgue macher.

But then again, the Morgue has been in an acquisitive mood, and some say it is standing on a corner.

Redemptions at Sprott Gold had been very unusual, until recently it seems. Apparently that is changing, as the scraping of the bottom of the bullion barrel proceeds. No wonder the fiatscos are getting restless.

Yeah, there is no unusual demand for physical gold bullion in Asia. Nothing to see here, move along.

At least Sprott runs a fully allocated ship. If a 'run' on the unallocated pools of gold starts, this could really get interesting.

Deleveraging in a short squeeze. Could be some tough love, kitten.

There was no activity in the Sprott Silver Trust. But the cash levels in the PSLV Trust have gotten back down to the levels where another secondary offering of expansion might be in the offing sometime this year. That would be a big physical buy in another tight market. It could help to provide a 'come-to-Jesus' moment, as some have suggested.

But as we know all too well, anything goes in times of general deceit, with frickin' lasers, and the Banks breaking bad. So let's just see what happens.

From the Sprott website for PHYS.

Unitholders will have the ability, on a monthly basis to redeem their units for physical gold bullion for a redemption price equal to 100% of the NAV of the redeemed units, less redemption and delivery expenses, including:

•the handling of the notice of redemptionRedemption requests must be for amounts that are at least equivalent to the value of one London Good Delivery bar or an integral multiple thereof, plus applicable expenses. A ''London Good Delivery bar'' weighs between 350 and 430 troy ounces (generally, most bars weigh between 390 and 410 troy ounces).

•the delivery of the physical bullion for units that are being redeemed (estimated at $5 per troy ounce at the time of the prospectus, Feb. 2010 for delivery anywhere within continental US and Canada)

•and the applicable gold storage in-and-out fees (minimum $50 plus $5 per each additional bar, at the time of the prospectus).

10 April 2013

Insider Sales on the Sprott Physical Silver Trust

Someone emailed me about this, and I wanted to get the actual data so you can see it.

It appears that Eric Sprott has sold about 3 million shares of his Silver Trust so far this month. That is quite a bit of selling, but certainly not unheard of for someone who is a billionaire.

I have it second hand that the sales are related to a commitment that Eric Sprott has to a charitable obligation, and has nothing to do with his views on silver or the Trust. I obviously do not know with any certainty if this is the reason.

A similar search shows no such insider sales on the Sprott Physical Gold Trust.

I do have current positions in both of these funds, and some of their rivals.

I did not find anything about this on the Silver Trust homepage. I would think that some comment should be made given the size of the sales.

Insider Sales Data for PHS (PSLV in the US)

Note: Ed Steer reports that he called Eric Sprott and that the sales are being conducted for a charitable obligation, and that the sales are also related to his belief that miners will outperform bullion so he is shifting his assets accordingly.

One might obverse that a simple press release stating one's intentions for a very large sale or purchase is customary for the actions of a significant insider in a substantial public organization.

07 September 2012

Sprott Physical Gold Trust *PHYS* Prices At 14.84 - PHYS YTD Performance

This offering will raise between $341,000,000 and $392,000,000 for additional purchases of gold bullion, taking it off the world market. The final number depends on the actions of the underwriters with regard to their own allotment of 3,450,000 units at roughly 14.84.

The total raised would represent roughly 240,000 ounces of gold at $1740 per ounce.

Sprott Physical Gold Trust Prices Follow-on Offering of Trust Units In An Aggregate Amount of US$341,320,000

Sep 7, 2012

TORONTO, Sept. 7, 2012 /CNW/ - Sprott Physical Gold Trust (the "Trust") (NYSE: PHYS / TSX: PHY.U), a trust created to invest and hold substantially all of its assets in physical gold bullion and managed by Sprott Asset Management LP, announced today that it has priced its follow-on offering of 23,000,000 transferable, redeemable units of the Trust ("Units") at a price of US$14.84 per unit (the "Offering").

As part of the Offering, the Trust has granted the underwriters an over-allotment option to purchase up to 3,450,000 additional Units. The gross proceeds from the Offering will be US$341,320,000 (US$392,518,000 if the underwriters exercise in full the over-allotment option).

The Trust will use the net proceeds of the Offering to acquire physical gold bullion in accordance with the Trust's objective and subject to the Trust's investment and operating restrictions described in the prospectus related to the Offering. Under the trust agreement governing the Trust, the net proceeds of the Offering per unit must be not less than 100% of the most recently calculated net asset value per Unit of the Trust prior to, or upon determination of, pricing of the Offering...

Year-To-Date Comparison of the performance of gold and PHYS.

Year-To-Date Comparison of the performance of GTU and PHYS

18 July 2011

Net Asset Value of Certain Precious Metal Trusts and Funds - Sprott Follow On a Drag on PHYS

Gold and Silver are at heavy resistance, and on the verge of breaking out. More on this in the gold and silver commentary this evening.

The Sprott Physical Gold Trust continues to underperform a bit on premium because the market is still digesting its follow on offering at $14. The numbers have been updated to include the details on shares and ounces of gold release thus far.

Although priced at $14.00, the fund paid a commission to the underwriters amounting to about $10.6 million, or about .56 per new unit offered, roughly 4 percent. So the effective revenue to the fund is about $13.44. I assume this is the price that the underwriters, Morgan Stanley and RBC Capital Markets, will pay for any over allotments which they take.

"The Trust has granted the underwriters an option to purchase up to an additional 2,850,000 trust units at the public offering price, less underwriting commissions, within 30 days of the date of this prospectus supplement, to cover any over-allotments."

15 February 2011

30 September 2010

Net Asset Value of Certain Precious Metal Trusts and Funds and the Odd Performance of PHYS

I am finding this contraction in the premiums of the gold-only trusts GTU and PHYS to be extremely interesting. Both followed an expansion of the fund's units and large sales of overallocations to the underwriters, providing liquidity not only to expand the trust but also to game the shares.

This expansion facilitates an arbitrage on the premium in which one sells the trust and buys GLD for example. And the holding of units by the underwriters assures a ready supply of shares for shorting, if one assumes that the big punters even bother with the nicety of borrowing shares.

While the premiums remain uniform it does not matter since the NAV will track the bullion holdings, but it does create a sort of retrograde phenomenon in which the funds will briefly underperform bullion due to the contraction of their premium, especially in the case of PHYS, from the lofty 8% to the lowly 2%. It will be interesting to see if this holds, or if the range of premium reasserts on a new leg up in bullion, and the 'kick' of a possible short squeeze.

In the past a contraction of the premiums was often a signal of bearish sentiment, that the speculators were not willing to pay a premium because they felt that the move was nearing a top. One also has to wonder if this is the case once again.

Who can say? As Robbie Burns once observed:

But, Mousie, thou art no thy lane,

In proving foresight may be vain;

The best-laid schemes o' mice an 'men

Gang aft agley,

An' lea'e us nought but grief an' pain,

For promis'd joy!

Still thou art blest, compar'd wi' me

The present only toucheth thee:

But, Och! I backward cast my e'e.

On prospects drear!

An' forward, tho' I canna see,

I guess an' fear!

If you are trading for the shorter term, one needs to be aware of things like premiums and arbitrage. If you are buying and holding as an investor short term fluctuations become much less of an issue as other things increase in importance. You have to understand why you are buying something and what your own objectives are with it, and then be guided by them.

As in the case of the trusts, there are 'premiums' on stocks and options for example, that are not so readily determined because the exact valuations are not so simple and explicit.

This is why trading for the shorter term is a highly specialized craft and is not suitable for any but a few who have the time and knowledge to attempt it. I have been at it for many years, and still learn new things almost every day, all too often the hard way.

You may wish to keep this in mind if and when Mr. Sprott introduces his Physical Silver Trust.

Here is what the NAVs looked like in early September 2010. One 'benefit' of the added liquidity is that the spreads on the Buy - Ask for these trusts has narrowed significantly.

20 September 2010

Net Asset Value of Certain Precious Metal Trusts and Funds: Sprott Adds Bullion

Here we see the initial impact of the Sprott share sale and the increase in their gold holdings. They still have excess cash listed as of Friday's report and will be adding gold until the US dollar assets are substantially invested in bullion.

Figures from September 13 for comparison

14 July 2010

The Sprott Physical Silver Trust

Since silver is 'the people's gold' I would expect this trust to be very popular.

Since silver is 'the people's gold' I would expect this trust to be very popular.

This fund has the monthly delivery option as does PHYS for gold.

Presumably the delivery will be in standard silver bars of 1000 troy ounces with a minimum fineness of .999. This is approximately 68.5 pounds avoirdupois. The bar would be worth about $18,280 at today's prices. Presumably there will be some fees involved in delivery. This size is popular with institutions.

This fund could put some stress on the silver bullion market which is already a bit tight by any measure. We assume the prospectus will indicate a negative position on leasing of the fund's silver, and the requirement not to engage in fractional reserve silver bullion.

Of course there need to be explicit auditing standards down to the bullion level to avoid some of the counter party risk appearing in some of the ETFs which deal in subcontracting with passive audits. ETFs are fine for a trade, but if one is buying bullion for insurance against currency risks, then the auditing and allocation issues become rather substantial.

Financial Posth/t Rodd, aka 'Silverholic'

Sprott Has a New Physical Silver Trust

Barry Critchley

Wednesday, Jul. 14, 2010

It has worked for gold plus a number of other metals including molybdenum and uranium -- though it didn't work for copper -- and the hope now for the promoters is that it will work for silver. We are talking about the Sprott Physical Silver Trust, which wants to raise capital via the sale of US $10 units.As the name suggests, the issuer will use the proceeds to invest in physical silver bullion. "The Trust seeks to provide a secure, convenient and exchange-traded investment alternative for investors interested in holding physical silver bullion without the inconvenience that is typical of a direct investment in physical silver bullion," states the prospectus.

The document offers a number of reasons to invest in physical bullion: It's convenient, all the proceeds will be invested in physical silver; the silver will be stored at the mint and the trust will be able to secure lower transaction costs than investors doing it themselves. But the fund is geared to those who like their income in the form of capital gain; the trust does not intend to pay any dividends.

But one wrinkle is that once a month, unit holders will be able to redeem all or some of their units and receive physical silver. It's not immediately clear why a unit holder would want to do that, other than to provide unit holders with comfort that they can get their hands on the metal...

One reason for the popularity of funds that invest in physical metals is the favourable tax afforded U.S. institutions. The prospectus talks about the capital gains advantages for such buyers: The tax rate is 15% (though it will rise to 20% by year end) on such investments compared with the normal 28% tax rate.

09 June 2010

Net Asset Value of Certain Precious Metals Trusts and Funds

Interestingly, the Sprott premium has been driven down to near parity with that of GTU, which has no meaningful redemption policy for its gold.

I suspect this is the result of the ham-handed way in which Sprott managed its recent sale of additional units, and the munificence with which it delivered shares to the underwriters at prices well below the market. If I had done it that way, I would have been ashamed.

TORONTO, June 1 /CNW/ - Sprott Physical Gold Trust (the "Trust") (NYSE: PHYS / TSX: PHY.U), a trust created to invest and hold substantially all of its assets in physical gold bullion and managed by Sprott Asset Management LP, today announced that it has completed its follow-on offering of 24,840,000 Units at US$11.25 per Unit for gross proceeds of US$279,450,000 (the "Offering"). This includes the exercise in full by the underwriters of their over-allotment option.I do expect the PHYS premium to get back closer to long term trend after the excess shares are sold into the market and the profits of the underwriters are booked. The redemption feature is attractive, but the method in which Eric Sprott treated his shareholders may dampen future enthusiasm for his products.

This just serves to remind one that no trust or fund is a long term substitute for owning the real thing.

15 April 2010

05 April 2010

Net Asset Value of Certain Precious Metal Funds and Trusts

The Sprott Physical Gold Trust continues to add bullion, and is now almost on a par with the Central Gold Trust, which is several years old.

02 March 2010

Is the Sprott Physical Gold Trust in the Market Trying to Buy 10 Tonnes of Gold?

Something is powering the spot price of gold higher the past few days. Are the Chinese or some other entity claiming the 191.3 tonnes of IMF gold again?

Perhaps relatedly, Sprott Asset Management is involved with a new physical gold bullion trust now trading in the States with the ticker symbol "PHYS."

The IPO for the fund was last Friday 26 February, with a reported 40 million shares outstanding at 10$Cndn. There is no hard news yet on how much of the IPO was held by underwriters. In fact, most of the news on it is a bit dated.

Here is their website for the Sprott Physical Gold Trust, and the link to their NAV financials. Here is a link to the prospectus. This is a link to the stocks' *indicative value* which appears to be its NAV which they use in their premium calculation from their website.

As you can see, there is still some key information missing. The cash assets less expenses of the trust are not yet listed. I have not seen a detailed release on the results of the IPO yet. And more importantly, the trust lists only 13,686 ounces of gold owned, with a market value of approximately US$15 million.

According to the prospectus, the fund will store its gold in Canada, is established in Ontario and is under that jurisdiction, but will be calculating its NAV in US$. It appears to be a trust where price tracks their NAV, and not an ETF which tracks the price of some external instrument like an stock index or spot commodity prices.

The implication is that they will not be selling and buying bullion in relation to market fluctuations as actively as an ETF pegged to spot for example. So the examination of premiums and discounts to NAV will be an issue.

If the trust has sold all its units listed as outstanding, they are in a cash position of approximately $390 million. Are the underwriters still holding any of this inventory? Their prospectus commits them to holding 97% of their assets in gold bars. No certificates or derivatives. And they are only listing $15 million in current gold assets.

Nine out of ten Americans might notice that the Sprott trust needs to buy about 10 tonnes of gold, the size of most small central bank purchases, if they have not negotiated and secured delivery already. According to the Prospectus, the trust does not traffic in paper certificates and derivatives, but in good bullion only.

I am more familiar with trusts and funds taking an incremental approach in their bullion purchases, and the negotiation for delivery before the units are sold. I am not sure what the case is here. It obviously is worth watching. Spot gold has risen quite a bit since last Friday. There is not enough data to suggest a correlation. However, if the entire IPO was placed, and the current gold holdings on the web site are accurate, they need to acquire almost 10 tonnes of quality physical bullion in a market reported to be tight in deliverable quality supply.

And the purchase is large enough so that we ougbt to be able to see an inventory drawdown somewhere. I have heard the buying will be done in London, and not at the Comex. The last purchases of this size were supplied by the IMF directly.

Above and beyond the short term interest in potential physical gold buying pressure, the Trust has some promising innovations in terms of holdings and transparency as compared to some other similar funds.

What I found personally appealing, subject to additional detail, is the ability for individual unit holders to redeem their shares for delivery in as little as one bar of London bullion, at the NAV but subject to delivery fees. This will obviously have its appeal for those who wish to add bullion for retirement accounts, with an eye to taking physical delivery at some point without incurring storage fees which can be significant over time.

I will leave the detailed analysis of this trust to more capable people who specialize in analyzing ETFs and Trusts. I have to admit that the IPO completely escaped my attention, although I did know it was coming some months ago. I had read enough then to know that it met some of my personal needs, based on my holdings and age. I find it more suitable than GLD for example, which seems to be a speculative trading vehicle. I prefer the Trusts like CEF and GTU for some things, and the redemption policy of PHYS seemed to be advantageous even compared to them. But more details are required.

As always perform your own due diligence and if needed discuss your investments with a qualified investment advisor.

Disclosure: I bought some units yesterday despite not feeling comfortable yet about being able to calculate the NAV for myself, and not having some of the details regarding redemptions and the status of their holdings and the IPO. It was some months ago that I read the prospectus. The NAV was indicated yesterday at 9.49 by the company on their site from Friday, which was less than 2 percent premium at yesterday's market price, which is advantageous and more than reasonable for my purposes.