"The Fed can expand its Balance Sheet to kingdom come, but they cannot produce a single ounce of actual gold bullion in the process.

And that is why gold is such an emotional topic, so feared and derided in turn by those whose power is based on position and paper, because gold resists the forces of fiat money and the human will by its mere stubborn existence."

Jesse

I had the opportunity last night to discuss things with a few old friends, from around the world in fact, and thanks to some helpful folks I was able to get a better idea of the mechanics of delivery at the Comex.

There was intraday commentary about the delivery process for gold at the Comex here.

I have to admit that this gold situation has me interested. There are some odd things happening, and I suppose digging into things one might not ordinarily care about is what must to done to understand them better.

There is nothing of science in this, no particular body of knowledge, but just some secular process and jargon, and some exchange rules that one has to learn in order to understand what is going on better. Since I would never even consider taking delivery from the Comex for anything, it a level of detail that I don't expect to come in handy anytime in the future.

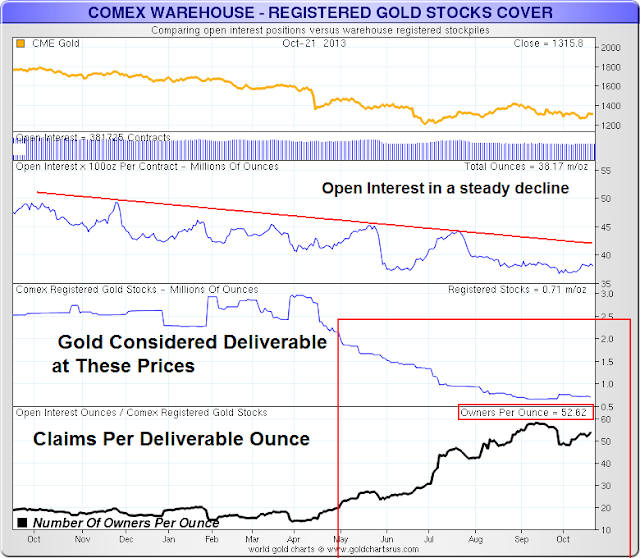

But I can see now that the Comex is more of a paper exchange than I had previously suspected, and is dominated by a relatively small number of players. I would like to think that this is a change from what I was more familiar with in the 1990's and early 2000's, but at that point I was trading in energy and commodities where delivery did not even come up in passing.

What I would really like to find out is the distribution of inventory outside the Comex, especially what encumbrances exist on central bank gold, and especially the harder figures on inventory at the LBMA.

But like the physical market, it seems like a lot of the inventory information is heading east. I don't know how much data will be released from the new Asian exchanges, but that is clearly where the action is moving.

I will be interested to see what kind of December we will end up having, given the 'December gold manipulation' pattern we saw the last couple of years. You can click on the label at the end of this for more info.

JPM is taking quite a bit of gold delivery and at this rate *could* end up with most of the registered gold at the Comex. What they are up to in this I cannot say. Someone suggested they could use it to hammer price during January and February as they did early this year. I don't think they have enough runway to really pull that one off, but I won't underestimate their aggressiveness in swinging the trade their way. One only has to look at the massive declines in inventories in the first half of this year to get an idea of what was thrown at the market. And JPM was a big seller.

Jim Sinclair and Ted Butler think that these smackdowns are used for the Banks to fill their own inventories and cover and even get long, and there is some merit in that as well. I cannot say since I am not sure I have enough data to know. You really have to see a traders whole book and not just their trades in one market to get the bigger picture.

Have a pleasant evening.