"On November 12, 1999, President Clinton signed the Gramm-Leach-Bliley Act

(GLB) into law. This landmark legislation does much to unravel the influence of

the Glass-Steagall Act on the United States' financial system. Now banks and

other providers of financial services have far greater freedom to compete

against each other. No doubt, the legislation will prompt an altering of the

financial landscape in this country."John Krainer, Federal Reserve Bank of San Francisco Economic Review,

2000

12 August 2009

Remember, Remember, the Twelfth of November (1999)

11 August 2009

J P Morgan Chase Caught Speculating with Customer Money

Why the surprise? This is what the Wall Street banks do, even under a 'reform' administration. They use their customer money and public funds, for which they pay a pittance, to wildly speculate in markets, distorting prices and taking enormous risks, in order to pay themselves outrageous bonuses. They buy politicial influence to enable regulatory capture and support their financial schemes. And when their bets go wrong, the public absorbs the losses. This is the model of US gangster banking in the 21st century.

The Obama Administration cannot energize their health care reform because the public demands reform in the financial sector, and quite frankly Obama has lost the 'high ground' of the reformer by his inability to free his administration from the growing taint of scandal.

So it remains for the rest of the world to begin to rein in the outrageous behaviour of the US financial institutions that treat the world's bourses as their private casinos.

For a party that spent eight years on the sidelines, the American Democrats have proven themselves to be particularly inept at doing anything to promote their agenda once presented with a solid majority by the voting public.

The banks must be restrained, and the financial system reformed, before there can be any sustainable recovery.

Daily Mail

Blair bank targeted in £8.5bn FSA probe

By Ben Laurance

10th August 2009

The bank where Tony Blair is an adviser is the target of an unprecedented probe involving billions of pounds of customers' funds, the Daily Mail can disclose.

JP Morgan Chase, whose chief executive Jamie Dimon last year recruited the former prime minister as an adviser, is being investigated by the City's watchdog, the Financial Services Authority for allegedly failing to keep track of £8.5billion of clients' money.

The FSA has called in a top firm of accountants to examine the bank's London activities after evidence emerged that JP Morgan had mixed customers' funds with its own.

Banks are meant to maintain a strict segregation of their own money from that which is held on behalf of clients.

But JP Morgan managers in London discovered last month that client and bank money used for trading futures and options - a way of speculating on movements in currencies, share prices and commodities - had apparently been put into a single pool.

They raised the alarm and notified the FSA. The scale of case is unprecedented, say City insiders. The FSA has penalised small firms in the past for mixing funds owned by clients and the banks themselves.

But this is thought to be the first case involving such a large household name.

JP Morgan Chase faces the threat of an unlimited fine if the watchdog decides enforcement action is necessary.

News of the FSA investigation will come as a huge embarrassment for the bank, which is valued on Wall Street at £100billion.

It is thought that the JP Morgan Chase problem dates back to late 2002. This followed the takeover of JP Morgan by Chase Manhattan two years earlier.

Assets were not segregated to protect clients as FSA rules demand, insiders believe.

When the issue first came to light last month and the FSA was told, the authority called in specialists from leading accountancy firm KPMG to investigate.

The cost of the probe - known as a section 166 review - will be met by the bank.

Sources say that KPMG's team of investigators has been working at JP Morgan Chase's offices on London Wall in the City, combing through records and e-mails and interviewing staff.

Bank employees who were involved in handling client funds in 2002 as well as those still responsible have been questioned. The KPMG team has been asked to find out what checks, if any, were made to ensure that clients' money has been kept safe and segregated.

The accountants have also been asked to calculate if clients lost out because they were not paid any interest they might have been due.

Senior figures at the bank could be reprimanded or even barred from working in the City if the FSA concludes that they were slack in setting up systems for separating customers' funds.

The accountants have been asked to deliver their preliminary findings to the FSA by the end of this month. A final report is due by the end of September. These reports will not be made public - unless the FSA subsequently decides that the bank should be punished.

JP Morgan Chase has been regarded as one of the more robust of the banks to emerge from last year's meltdown in the global financial system. Among the six largest U.S. banks, it is the only one to have stayed consistently in the black since the recession began in 2007.

But it still took £15billion last year under the U.S. government's programme to prop up the financial system. The money has since been repaid.

Last month, the bank reported quarterly earnings of £1.64billion, which was a major factor in spurring the recovery in its shares and in Wall Street prices as a whole.

A report last week showed that last year, the firm paid bonuses of £600,000 ($1m) or more to 1,626 employees. Of those, more than 200 received at least £1.8m. The top four earners received a total of nearly £45million between them.

JP Morgan Chase said: 'We have no comment.'

The FSA said: 'We wouldn't comment on whether we are doing an investigation.'

KPMG also declined to comment.

27 July 2009

Martin Meyer on Credit Default Swaps

The current state of the Credit Default Swaps market represents a risk similar in quality to that of portfolio insurance just prior to the market crash of 1987.

What is alarming that in terms of quantity there is no comparison, as the risks now are probably an order of magnitude greater in that the risk in concentrated at the heart of the US banking system. In 1987 the US was still at least partially protected by Glass-Steagall.

On Credit Default Swaps: Comments at AIER

By Martin Mayer

June 25, 2009

Let me open with a large thought you can carry with you when you leave. Note how we are no longer being told that the chairman of the Federal Reserve is the second most powerful man in America. Why do you think that is true?

One of the truly awful moments of my time in this business was the early evening of December 9, 1982, an incident not in any of the histories but highly revelatory. What happened that evening was that Banco do Brasil failed at CHIPS (the Clearing House Interbank Payments System). Neither National City Bank nor Chemical, which represented Banco d Brasil in New York, was willing to pony up the $300-plus million the Brazilians couldn't find. So they kept the window open until midnight, while the Fed worked its necromancy on its member banks and the money was found.

Subsequent examination revealed that after the Mexican collapse the previous summer, Banco do Brasil had found it increasingly difficult to roll over its loans, and had steadily switched a higher and higher share of its borrowings out of the conventional lending and borrowing market and into the overnight infrastructure market. For more than six months, the Brazilians had increased the size of its overnight position, until somebody at National City noticed and said, No more.

The Treasurer of Chemical was an exceedingly able young man who went on to a great career at AIG, oddly enough. I went to see him to help my understanding of what had happened. Finally, he said, "You have to understand. They were paying an extra eighth." A banker will turn himself absolutely inside out for what looks like a safe extra eighth of a point. The change over the quarter century is that now he will probably do it for five basis points. (And this is why banks must be regulated and their speculation firewalled from the public funds. Why? Because they are human. - Jesse)

Meanwhile, on a less cosmic scale, let us start with the thought that Wall Street gets in its worst trouble not by taking risks but by following false prophets who promise to make finance risk-free. The nomenclature and some of the equations change, but the truth is that there are only six scams, and each of these financial panics is rooted where the others were. (In defense of false prophets, Wall Street and others too often use them as a convenient excuse to do what they are already inclined to do in the first place. - Jesse)

What made the market break of 1987 so sharp and so deep was the widespread adoption of dynamic hedging, a mathematically proven plan to provide portfolio insurance by selling futures contracts on stock indexes if the stocks themselves fell hard. Dumbest idea ever accepted by any substantial part of mankind, said Howard Stein, who then ran the Dreyfus fund. How could anybody believe that everybody could sell at the same time?

It then took twenty years for the magnificently rewarded innovators of the new paradigm in banking to find an even dumber idea that everybody could safely and profitably hedge everybody else's risks through credit default swaps. (Quite so. The resemblance between portfolio insurance and the current state of Credit Default Swaps is apparent, but even worse, because they are so heavily written and held by the major money center banks, with their risk spread to the public compliments in part to Alan Greenspan and Phil Gramm - Jesse)

We make bad policy in this country because we do not inquire about how we got to where we are. There are every few second acts in American finance. Not one in a thousand of the people now commenting on the future or regulation of the CDS knows where the instrument comes from. The truth is that the CDS is one of many of what I shall call GSIs - "Government Supported Instruments" -- that would never have come into existence without dumb ideas from on high.

The Collateralized Debt Obligation or CDO, which came into existence in the late 1980s, is a single instrument expressing a garbage pail of loans and notes and bonds. It is all but impossible to value because it mixes together many disparate risks. Most people who think about it at all come to the conclusion that its not very useful for trading or for investing. In short, it is an excrescence that ought not to exist.

The CDO came about because Bill Seidman, when he was given control of the S&L workout in the late 1980s, wanted to sell whole banks rather than gather the tainted assets in FDIC control and auction them off in the usual FDIC procedure. Instead of taking, say, the real estate loans of six failed S&Ls and lumping them together as an offering on which real estate experts could paste a price, he wanted to take the entire portfolio of one or more failed thrifts and sell it off for what it would bring. (Marty is being a bit hard on Bill Seidman. There was nothing inherently fraudulent in the manner in which they packaged the sales related to the S&L crisis. It took Wall Street and the Rating Agencies to provide the real dose of fraud and larceny in the misrating and intentional mispricing of risk. - Jesse RIP Bill Seidman)

Note that this multiplied the amount of business Wall Street would get from the workout. The way you got people to bid on this sort of package was to give them the right to substitute other assets for assets in the package, or to guarantee the cash flow from the package.

The idea that a bank could be rid of its bad stuff through the device of a bad bank was then picked up by Mike Milken, and carried through with Mellon Bank in Pittsburgh, where the operation was funded through junk bonds. I wrote a piece for Barrons about how intelligent all this was. I spoke with some of the brilliant kids Milken assigned to this project.

The damage these CDS instruments do has not yet been exhausted. The publicized stress tests to which the federal bank examiners recently subjected the 19 largest banks was not really a serious enterprise, because all these banks rely on swaps to protect them against their losses on the toxic legacies they accumulated under the gaze of these same examiners -- and nobody knows whether or not these hedges will pay out if they are needed. (They will only pay out in full with government monies, which is the dirty little secret that the Treasury and Fed are desperate to hide from the public. And when they fail, they will bring down the top four or five banks in the United States. - Jesse)

Swaps, after all, are bilateral contracts, and if the loser under the contract can't pay, the fact that he has theoretically hedged his risk in a separate contract with a third party does not necessarily mean that the winner can collect. Hence the "systemic risk" when AIG or Lehman, signatories to tens of thousands of these contracts, blows up, leaving a paper litter of unimaginable dimensions.

Sixteen years ago, I testified before the House Banking Committee to urge that it should be public policy to discourage over-the-counter derivatives contracts and encourage the use of exchange-traded instruments instead. To assure that losers pay, exchange-traded contracts impose overnight deposits to meet margin requirements rather than collateral that may show up some day. The Treasury Department, after years of fighting on the other side, has now discovered the virtues of settling derivative contracts through clearing houses.

But what Treasury Secretary Timothy Geithner has proposed will not do the trick, because it leaves the actual trading of these instruments in the hands of inter-dealer brokers who do not publish the prices at which they arrange the deals (and may not offer the same prices to all bidders). And because it does not show the way to meeting the legitimate needs that spawned this illegitimate market, the Geithner proposals invite evasion of the rules. (Geither's solution was designed in large part by the banks themselves who do not wish the game to end just yet - Jesse)

The legitimate need is for a place where traders can short bonds.

Shares of stock scan be borrowed (fees for such borrowings are an important source of income for brokers) and delivered to buyers who don' know that what they have bought is borrowed stock. Much publicity has been given to traders who abuse these rules, sell what they have not borrowed and then fail to deliver and suffer no significant punishment for their failure. The SEC had been and remains asleep at the switch when it comes to this issue. And even when stock cannot be borrowed, there is an options market offering puts in a trading context where open interest is public knowledge. No such institutions exist in the bond market.

It was the difficulty of shorting bonds that produced the T-bond contract at the Chicago Board of Trade thirty years ago, permitting participants in the fixed-income markets to protect themselves against interest-rate fluctuations. Interest-rate futures are a legitimate instrument because there is a generic interest-rate risk, expressed in the market-determined yield curve.

It is easy to understand that traders once they have hedged interest-rate risks would seek to insure also against credit risks. But there is no such thing as a generic credit risk that can be traded. Like all instruments with a trigger option, they promote the illiquidity that drives markets out of the patterns the white swan people need.

Hat tip to Institutional Risk Analytics for the article

01 May 2009

The Cause of the Financial Crisis

The corruption of the political process, increasingly dependent on large campaign contributions, by the large corporate interests set the stage for the erosion of public regulation of markets and the rule of the law.

And of course, Alan Greenspan, without whom this disaster would almost certainly have not been possible.

Dr. Greenspan, at the Federal Reserve, with a bully pulpit and a printing press.

Texas Observer

Causes of the Crisis

James K. Galbraith

May 01, 2009

...This is a panel on the crisis. Mr. Moderator, you ask what is the root cause? My reply is in three parts.

First, an idea.

The idea that capitalism, for all its considerable virtues, is inherently self-stabilizing, that government and private business are adversaries rather than partners...; the idea that regulation, in financial matters especially, can be dispensed with. We tried it, and we see the result.

Second, a person.

I’d also cite the Commodity Futures Modernization Act, slipped into an 11,000-page appropriations bill in December 2000 as Congress was adjourning following Bush v. Gore. This measure deregulated energy futures trading, enabling Enron and legitimating credit-default swaps, and creating a massive vector for the transmission of financial risk throughout the global system. ...

Third, a policy.

This was the abandonment of state responsibility for financial regulation... This abandonment was not subtle: The first head of the Office of Thrift Supervision in the George W. Bush administration came to a press conference on one occasion with a stack of copies of the Federal Register and a chainsaw. A chainsaw. The message was clear. And it led to the explosion of liars’ loans, neutron loans (which destroy people but leave buildings intact), and toxic waste. That these were terms of art in finance tells you what you need to know. ...

The consequence ... is a collapse of trust, a collapse of asset values, and a collapse of the financial system. That is what has happened, and what we have to deal with now. Can “stimulus” get us out?

Can “stimulus” get us out?

As a matter of economics, public spending substitutes for private spending. ... But it is not self-sustaining in the absence of a viable private credit system. The idea that we will be on the road to full recovery and returning to high employment in a year or so therefore seems to me to be an illusion.

And for this reason, the emphasis on short-term, “shovel-ready” projects in the expansion package, while understandable, was a mistake. As in the New Deal, we need both the Works Progress Administration ... to provide employment, and the Public Works Administration ... to rebuild the country. ...

The risk we run, in public policy, is not inflation. It is lack of persistence, a premature reversal of direction, and of course the fear of large numbers. If deficits in the trillions and public debt in the tens of trillions scare you, this is not a line of work you should be in.

The ultimate goals of policy are not measured by deficits or debt. They are measured by the performance of the economy itself. Here Leader Armey and I agree. He spoke with approval, in his remarks, of the goals of 3 percent unemployment and 4 percent inflation embodied in the Humphrey-Hawkins Full Employment and Balanced Growth Act of 1978. Which, as a 24-year-old member of the staff of the House Banking Committee in 1976, I drafted.

08 April 2009

Bank Credit Growth Drops Precipitously

The Growth Rate of Total Credit at all US Commercial Banks is dropping precipitously as can be seen from the chart below.

This is a negative indicator for most banks involved in the actual business of banking, even as the spreads between Fed money and money on loan widen.

Advantage goes to those banks who are gaming the markets, also known as trading profits, which is probably the opposite outcome which Tim and Ben would desire, if they were thinking about it.

Should banks be trading in the markets at all for their own accounts? We think not.

Glass-Steagall should be reintroduced as quickly as possible to get the banks back in the business of banking. It is a profound disappointment that the Obama Administration with the Democratic leadership have done little or nothing to reverse the speculative trends in the money center banks.

That they have been the recipients of huge campaign contributions from these same banks make the situation all the worse, for how can one stand on principle when the outcome is at odds with your stated objectives, and you are taking money from those who favor that outcome?

If you wish to get the banks lending again, stop giving them hot money and a free ticket to the speculative gaming tables where the rules, or a lack thereof, are in their favor.

31 March 2009

Derivatives: the Heart of Financial Darkness

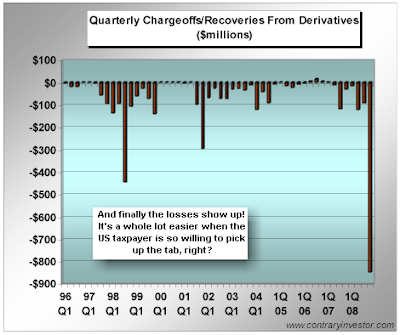

The heart of our financial crisis is reckless speculation with "too big to fail" funds by a relatively small group of US based money center banks.

There is sufficient circumstantial evidence from their concerted lobbying efforts to undo and resist regulation to show planning and forethought in what is an almost amazingly straightforward case of fiduciary and financial fraud. Many a blind eye was turned to the decline of the nation as it occurred, as the media and politicians and financial regulators were caught up in a seductive web of corruption.

The perpetrators are still in place, relatively unrestrained, and certainly not facing anything that might be called 'justice.'

Before there is any recovery, the banks must be once again restrained and balance restored to the economy and the financial system. The efforts of the Obama Administration are hopelessly ineffective, conflicted, and supportive of continuing losses.

The Prime Suspects

The Killing Field

The Wagers on Failure

The Wages of Speculation

07 March 2009

Weekend Reading: How Wall Street and Washington Are Betraying America

The original title for this essay was "How Wall Street and Washington Betrayed America." As you can see from the above, this blog has a slightly different perspective.

We would like to be able to say that this was an unfortunate problem that has occurred, and that we are dealing with its aftermath. The repair of the economy is just a matter of time and money.

It is not, and we are not.

The problem continues. This was not an exogenous event like an accident. It is a pernicious condition, a chronic wasting disease. The carriers of the infection are still at work.

The system is distorted, sick, incapable of self-cure. Feeding intravenous liquidity to obtain the appearance of health will not work, only allow the disease to progress. Strong medicine is required.

We will have no recovery until we have reform.

We will have no reform until the banks are restrained, and balance is restored.

The looting of the public Treasury will continue while the Congress and the Executive take their direction from Wall Street.

Paying for Policy in Washington

Wall Street's Best Investment

By ROBERT WEISSMAN

"The entire financial sector (finance, insurance, real estate) drowned political candidates in campaign contributions, spending more than $1.7 billion in federal elections from 1998-2008. Primarily reflecting the balance of power over the decade, about 55 percent went to Republicans and 45 percent to Democrats. Democrats took just more than half of the financial sector's 2008 election cycle contributions.

The industry spent even more -- topping $3.4 billion -- on officially registered lobbyists during the same period. This total certainly underestimates by a considerable amount what the industry spent to influence policymaking. U.S. reporting rules require that lobby firms and individual lobbyists disclose how much they have been paid for lobbying activity, but lobbying activity is defined to include direct contacts with key government officials, or work in preparation for meeting with key government officials. Public relations efforts and various kinds of indirect lobbying are not covered by the reporting rules.

During the decade-long period:

* Commercial banks spent more than $154 million on campaign contributions, while investing $383 million in officially registered lobbying;

* Accounting firms spent $81 million on campaign contributions and $122 million on lobbying;

* Insurance companies donated more than $220 million and spent more than $1.1 billion on lobbying; and

* Securities firms invested more than $512 million in campaign contributions, and an additional nearly $600 million in lobbying. Hedge funds, a subcategory of the securities industry, spent $34 million on campaign contributions (about half in the 2008 election cycle); and $20 million on lobbying. Private equity firms, also a subcategory of the securities industry, contributed $58 million to federal candidates and spent $43 million on lobbying.

Individual firms spent tens of millions of dollars each. During the decade-long period:

* Goldman Sachs spent more than $46 million on political influence buying;

* Merrill Lynch threw more than $68 million at politicians;

* Citigroup spent more than $108 million;

* Bank of America devoted more than $39 million;

* JPMorgan Chase invested more than $65 million; and

* Accounting giants Deloitte & Touche, Ernst & Young, KPMG and Pricewaterhouse spent, respectively, $32 million, $37 million, $27 million and $55 million.

The number of people working to advance the financial sector's political objectives is startling. In 2007, the financial sector employed a staggering 2,996 separate lobbyists to influence federal policy making, more than five for each Member of Congress. This figure only counts officially registered lobbyists. That means it does not count those who offered "strategic advice" or helped mount policy-related PR campaigns for financial sector companies. The figure counts those lobbying at the federal level; it does not take into account lobbyists at state houses across the country. To be clear, the 2,996 figure represents the number of separate individuals employed by the financial sector as lobbyists in 2007. We did not double count individuals who lobby for more than one company the total number of financial sector lobby hires in 2007 was a whopping 6,738.

A great many of those lobbyists entered and exited through the revolving door connecting the lobbying world with government. Surveying only 20 leading firms in the financial sector (none from the insurance industry or real estate), we found that 142 industry lobbyists during the period 19982008 had formerly worked as "covered officials" in the government. "Covered officials" are top officials in the executive branch (most political appointees, from members of the cabinet to directors of bureaus embedded in agencies), Members of Congress, and congressional staff.

Nothing evidences the revolving door -- or Wall Street's direct influence over policymaking -- more than the stream of Goldman Sachs expatriates who left the Wall Street goliath, spun through the revolving door, and emerged to hold top regulatory positions. Topping the list, of course, are former Treasury Secretaries Robert Rubin and Henry Paulson, both of whom had served as chair of Goldman Sachs before entering government. Goldman continues to be well represented in government, with among others, Gary Gensler, President Obama's pick to chair the Commodity Futures Trading Commission, and Mark Patterson, a former Goldman lobbyist now serving as chief of staff to Treasury Secretary Timothy Geithner.

All of this awesome influence buying has enabled Wall Street to establish the framework for debates in Washington, and to obtain very specific deregulatory actions, with devastating consequences."

Click below to find the full report with Executive Summary.

Sold Out: How Wall Street and Washington Betrayed America

Is the Bailout of AIG by the Fed a Bailout or a Payoff to the Major Banks?

In a Senate Banking Committee hearing in Washington on Thursday, Fed Vice Chairman Donald Kohn declined to identify AIG's trading partners. He said doing so would make people wary of doing business with AIG.

The Fed has far overstepped their bounds and are disbursing tax money in secret without the oversight of Congress.

Wall Street Journal

Top U.S., European Banks Got $50 Billion in AIG Aid

By SERENA NG and CARRICK MOLLENKAMP

MARCH 7, 2009

The beneficiaries of the government's bailout of American International Group Inc. include at least two dozen U.S. and foreign financial institutions that have been paid roughly $50 billion since the Federal Reserve first extended aid to the insurance giant.

Among those institutions are Goldman Sachs Group Inc. and Germany's Deutsche Bank AG, each of which received roughly $6 billion in payments between mid-September and December 2008, according to a confidential document and people familiar with the matter.

Other banks that received large payouts from AIG late last year include Merrill Lynch, now part of Bank of America Corp., and French bank Société Générale SA.

More than a dozen firms with smaller exposures to AIG also received payouts, including Morgan Stanley, Royal Bank of Scotland Group PLC and HSBC Holdings PLC, according to the confidential document.

The names of all of AIG's derivative counterparties and the money they have received from taxpayers still isn't known, but The Wall Street Journal has identified some of them and is publishing others here for the first time.

Lawmakers Want Names

The AIG bailout has become a political hot potato as the risk of losses to U.S. taxpayers rises. This past week, legislators demanded that the Federal Reserve disclose names of financial firms that have received money from AIG, which Fed officials have described as too systemically important in the financial system to be allowed to fail.

In a Senate Banking Committee hearing in Washington on Thursday, Fed Vice Chairman Donald Kohn declined to identify AIG's trading partners. He said doing so would make people wary of doing business with AIG. (ROFLMAO - Wary of doing business with AIG? - Jesse)

But Mr. Kohn told lawmakers he would take their requests to his colleagues. The Fed, through a new committee led by Mr. Kohn to discuss transparency concerns, is now weighing whether to disclose more details about the AIG transactions.

The Fed rescued AIG in September with an $85 billion credit line when investment losses and collateral demands from banks threatened to send the firm into bankruptcy court. A bankruptcy filing would have caused losses and problems for financial institutions and policyholders globally that were relying on AIG to insure them against losses.

Since September, the government has had to extend more aid to AIG as its woes have deepened; the rescue package now has swelled to more than $173 billion.

The government's rescue of AIG helped prevent its counterparties from incurring immediate losses on mortgage-backed securities and other assets they had insured through AIG. The bailout provided AIG with cash to pay the banks collateral on the money-losing trades; it also bought out underlying mortgage-linked securities, many of which are currently worth less than half their original value.

Banks and other financial companies were trading partners of AIG's financial-products unit, which operated more like a Wall Street trading firm than a conservative insurer. This AIG unit sold credit-default swaps, which acted like insurance on complex securities backed by mortgages. When the securities plunged in value last year, AIG was forced to post billions of dollars in collateral to counterparties to back up its promises to insure them against losses.

More Problems

Now, other problems are popping up for AIG. The insurer generated a sizable business helping European banks lower the amount of regulatory capital required to cushion against losses on pools of assets such as mortgages and corporate debt. It did this by writing swaps that effectively insured those assets.

Values of some of those assets are declining, too, forcing AIG to also post collateral against those positions. And if the portfolios incur losses, AIG will have to compensate the banks.

AIG had seen this business as a relatively safe bet for the company and its investors. The structures were designed to allow European banks to shuck aside high capital costs. A change in capital rules has meant that the AIG protection no longer meets regulatory requirements.

The concern has been that if AIG defaulted, banks that made use of the insurer's business to reduce their regulatory capital, most of which were headquartered in Europe, would have been forced to bring $300 billion of assets back onto their balance sheets, according to a Merrill report.

06 March 2009

The Banking Crisis: Obama's Iraq Part 1

Its a step in the right direction, but its hardly reform.

Everything about the Obama Administration to date has been 'limp,' toothless, almost apologetic.

Obama is on the road to failure, getting an "A" for rhetoric but "F's" for vision, commitment, team-building, and action.

Bloomberg

Volcker Urges Dividing Investment, Commercial Banks

By Matthew Benjamin and Christine Harper

March 6 (Bloomberg) -- Commercial banks should be separated from investment banks in order to avoid another crisis like the U.S. is experiencing, according to former Federal Reserve Chairman Paul Volcker.

“Maybe we ought to have a kind of two-tier financial system,” Volcker, who heads President Barack Obama’s Economic Recovery Advisory Board, said today at a conference at New York University’s Stern School of Business. (Uh, didn't we have one up until a few months ago when Goldman Sachs and Morgan Stanley put on the Fed feedbag? - Jesse)

Commercial banks would provide customers with depository services and access to credit and would be highly regulated, while securities firms would have the freedom to take on more risk and practice trading, “relatively free of regulation,” Volcker said. (OMG - Jesse)

Volcker’s remarks indicated his preference for reinstating some of the divisions between commercial and investment banks that were removed by Congress’s repeal in 1999 of the Great Depression-era Glass-Steagall Act.

Volcker’s proposals, included in a January report he wrote with the Group of 30, would allow commercial banks to continue to do underwriting and provide merger advice, activities traditionally associated with investment banking, he said.

Still, Goldman Sachs Group Inc. and Morgan Stanley, which converted to banks in September, would have to exit some businesses if they were to remain as commercial banks, he said.

‘Separation’

“What used to be the traditional investment banks, Morgan Stanley, Goldman Sachs so forth, which used to do some underwriting and mergers and acquisitions, are dominated by other activities we would exclude -- very heavy proprietary trading, hedge funds,” he said. “So there’s some separation to be made.”

Jeanmarie McFadden, a spokeswoman for Morgan Stanley, declined to comment. A Goldman spokesman couldn’t be immediately reached.

Volcker also said international regulations on financial firms are probably an inevitable consequence of the industry’s current problems.

“In this world, I don’t see how we can avoid international consistency” on securities regulations going forward, he said. “The U.S. is no longer in a position to dictate that the world does it according to the way we’ve done it.”

Volcker’s comments come as President Barack Obama seeks legislative proposals within weeks for a regulatory overhaul of finance, especially companies deemed vital to the stability of the financial system.

Glass-Steagall

The new regulatory framework may stop short of reinstating Glass-Steagall, analysts say, though banks may separate their business lines in order to avoid strong regulatory scrutiny.

Volcker, who ran the Fed from 1979 to 1987, said the financial industry’s problems stem from larger issues. “I don’t think this is just a technical problem, it’s a societal problem,” he said. He cited bankers on Wall Street receiving multimillion-dollar bonuses for engineering failed mergers.

“There’s something wrong with the system,” Volcker said. “What are the incentives, what’s going on here?”

03 March 2009

JP Morgan Made $5 Billion in Profit on $88 Trillion in Unregulated Derivatives Speculation

There is no justification for a commercial bank, with regulated depositors' funds insured by the government, should be speculating on a level this great.

There is no justification for a commercial bank, with regulated depositors' funds insured by the government, should be speculating on a level this great.

One also has to wonder who actually 'lost' in those derivatives bets that JP Morgan made, who the counterparties were. How many losses were taken by AIG, Bear Stearns, and Lehman?

Who is really being bailed out here? Aren't we paying for JP Morgan's "winnings?"

If they speculate and lose, who pays for that? We do.

What is a bank doing gambling in unregulated over-the-counter derivatives involving commodities and financial instruments worth $89 Trillion?

Getting paid by the public whether they win or lose it appears.

When a single player with deep pockets and government guarantees is placing bets in markets on a scale that dwarfs the Gross Domestic Product of United States that is the very definition of moral hazard.

Until the Obama Administration takes strong steps to bring back Glass-Steagall, and put hard limits on the banks there will be no reform and no recovery.

We are 48 days into this Administration. We have see little or no systemic reform. Just a continuation of crony capitalism under Bernanke, Summers and Geithner.

Bloomberg

JPMorgan earns $5 billion derivatives profit

By Ratul Ray Chaudhuri in Bangalore

Tue Mar 3, 2009 2:56am EST

March 3 (Reuters) - JPMorgan Chase & Co generated $5 billion in profit during the worst year in Wall Street history by trading over-the-counter fixed-income derivatives, Bloomberg said, citing two people with knowledge of the results.

The bank, which reported $5.6 billion of total profit in 2008, has not disclosed earnings for its interest-rate swap, municipal bond and foreign exchange derivatives group, the agency said. The unit was among the most profitable at the New York-based company, it added.

The JPMorgan trading desk may have benefited as the collapse of Lehman Brothers Holdings Inc and JPMorgan's takeover of Bear Stearns Cos left companies and hedge funds with fewer trading partners in the private derivatives markets, the agency said.

Among commercial lenders, JP Morgan dominates OTC derivatives trading, the agency said, citing data compiled by the Office of the Comptroller of the Currency.

The bank held $87.7 trillion worth of outstanding OTC contracts as of Sept. 30, more than the next two banks, Bank of America Corp and Citigroup Inc, combined, the agency reported.

JPMorgan could not be immediately reached by Reuters for comment.

24 February 2009

Coup d'Etat by Crisis

"Necessity is the plea for every infringement of human freedom. It is the argument of tyrants; it is the creed of slaves." William Pitt (1759-1806)

Quite the dire, almost inflammatory piece from Time Magazine. It certainly paints Bank of America, Citigroup, General Motors, and AIG in a bad, almost villainous light.

It is time to for a real change. It is time to stop allowing the country to be held hostage by a relatively small number of financiers who have gamed the system and corrupted the regulatory and legislative process. It is time to stop allowing those deeply involved with the problem to manage the investigation and the solutions.

Put the money center banks into a managed restructuring, and stop calling it nationalization, which wrongfully suggests the British socialism of the post World War II era. We did not have to use that sort of language or raise these emotional issues when the Savings and Loan scandal was cleared.

Let's get this open sore cleaned, bound and stitched.

But one thing we might wish to keep in mind is that it may not be AIG, BAC, and C that are pulling the strings, that are at the center of this. They look more like patsies than prime motivators.

Transparency would be interesting in this case with regards to the CDS market and the derivatives markets.

Who has the most to gain and lose if Citi, Bank of America, and AIG are put into managed restructuring? Who has the most and biggest bets on their failure?

Let's have transparency of positions now. And we cannot afford to take anyone's word on this.

The real sticking point is not the shareholders or managers of these companies, although they may be making the most noise at this point.

We will be surprised, if transparency is actually provided, and new and independent regulators armed with the full array of investigative tools, dig into this mess to see where the strings lead, if we do not find many of them in the hands of the other major Wall Street banks, media giants, and corporate conglomerates, among others.

We will keep an open mind, but do not expect any light or serious new information to come from these Congressional Committees with their circus, show trial atmosphere.

Time to bring back Glass-Steagall and to enforce the Sherman Anti-Trust laws. Time to compel the three or four banks to unwind their trillions in opaque derivatives. Time to audit the Federal Reserve, and clarify their role in our system to them, and nail a copy of the Constitution to their front door.

We do not need or want fewer, bigger, more powerful banks as a drag on the real economy, taking a tax on each transaction whether it be through credit cards or fees or loans or subsidies.

Time for a real change. Time to remind Congress where the power and legitimacy of their offices resides. Time for the lobbyists, corrupt regulators, corporate princes and the enablers and motivators of this grand theft to find a place in an unemployment line or a witness stand.

We must demand action from the Congress and the Administration who we recently put in place through the elections to clean this mess up and then change the system that delivered it.

Contact the White House

Contact Your Senator

We do not want fewer, bigger banks exacting a fee on every commericial transaction in this country.

1. Bring back Glass-Steagall.

2. Clean up the derivatives mess, starting with J.P. Morgan.

3. Enforce the various anti-trust laws, enacting new ones where necessary, and break up the media and banking conglomerates.

4. Enact aggregate position limits in all commodity markets and transparency with immediate disclosure of all position over 5% in any market.

5. Effective restrictions and enforcement of naked short selling, price manipulation, reinstatement of the 'uptick rule,' the prohibition of regulated banks from engaging in any speculative markets either for themselves or as agents, and usury laws and regulation of all interstate financial transactions at the national level.

And for the sake of the country, establish a vision, a model, of what the system should look like in accord with the Constitution. And then strike out for it, as painful as that may be, and stop this management by crisis, and weaving a shroud for our freedom out of a web of endless fixes, concessions and necessities.

"If there must be trouble, let it be in my day, that my child may have peace." Thomas Paine

Time

AIG's Plan to Bleed the Government Dry

By Douglas A. McIntyre

Tuesday, Feb. 24, 2009

Management at AIG has calculated exactly how much money the Treasury and Fed will have access to after all of the TARP, financial stimulus, and mortgage bailout projects have been funded. The insurance company then plans to ask for whatever is left to fund its deficits so that it can stay in business, effectively making the federal government insolvent.

According to CNBC, AIG is about to post another huge loss. "Sources close to the company said the loss will be near $60 billion due to writedowns on a variety of assets including commercial real estate." The financial channel also reports that the need for capital may be so great that AIG might have to enter Chapter 11, something the government has spent over $130 billion trying to prevent.

Just like Detroit, Bank of America (BAC), and Citigroup (C), AIG is playing a game of chicken with Washington that the government does not feel it can afford to lose. Imagine what it would be like if all of these businesses failed at the same time.

It is actually worth imagining. The government has so many balls in the air between the financial systems and deteriorating parts of the industrial sector that it may not have either the capital or intellectual capacity to go around. The Treasury has just appointed a prominent investment banker to help oversee the mess in Detroit, but it would take an army of financiers to first comprehend and then advise on what should happen to GM (GM) and Chrysler. The period for comprehension is already in the past. The trouble in the auto industry has to be addressed in the next few weeks or its capacity to operate will go up in flames.

The government made noises about taking a larger position in Citigroup (C). Based on the market's reaction, not may analysts and investors believe that the action will solve much. The poison of bad investments is in the blood of the financial system. Quarantining Citigroup will not solve that problem. The Treasury and Fed will have to take a holistic approach which involves healing the entire financial system. It is not clear that can even be done. How it would be done is an even more complicated matter.

The Little Dutch Boy is running out of fingers. The water that threatens to swamp the international financial system is getting closer to breaching the walls and pouring in. A month ago that seemed inconceivable. Now the odds that the government will have to allow large operations like AIG go into bankruptcy are fairly high. The trouble with that is not what will happen to AIG. As the market found out with the Lehman Brothers bankruptcy, many of the firms that are doing business with a very large financial institution when it becomes insolvent can have transactions worth billions of dollars wither voided or devalued.

In the intricate global financial system, there is no such things as one big player going down in a vacuum.

23 February 2009

US Considers a 40% Ownership of Citigroup, Diluting the Common Shares

Citigroup is the prime candidate for receivership.

Citigroup is the prime candidate for receivership.

The only reason to continue this charade, other than to inspire us with confidence in the opaque duplicity of this Administration, is to preserve the shareholders who would almost certainly be wiped out, and the bondholders who would get a high and tight haircut, in the kind of restructuring that Citigroup requires as an insolvent institution.

Larry Summers and Tim Geithner are promoting this crony capitalist approach to preserve the wealth of a few at the expense of the many.

Wall Street Journal

U.S. Eyes Large Stake in Citi

By David Enrich and Monica Langley

February 23, 2009

Taxpayers Could Own Up to 40% of Bank's Common Stock, Diluting Value of Shares

Citigroup Inc. is in talks with federal officials that could result in the U.S. government substantially expanding its ownership of the struggling bank, according to people familiar with the situation.

While the discussions could fall apart, the government could wind up holding as much as 40% of Citigroup's common stock. Bank executives hope the stake will be closer to 25%, these people said.

Any such move would give federal officials far greater influence over one of the world's largest financial institutions. Citigroup has proposed the plan to its regulators. The Obama administration hasn't indicated if it supports the plan, according to people with knowledge of the talks.

When federal officials began pumping capital into U.S. banks last October, few experts would have predicted that the government would soon be wrestling with the possibility of taking voting control of large financial institutions. The potential move at Citigroup would give the government its biggest ownership of a financial-services company since the September bailout of insurer American International Group Inc., which left taxpayers with an 80% stake. The talks reflect a growing fear that Citigroup and other big U.S. banks could be overwhelmed by losses amid the recession and housing crisis. Last week, Citigroup's share price fell below $2 to an 18-year low. Bank executives increasingly believe that the government needs to take a larger ownership stake in the institution to stop the slide.

The talks reflect a growing fear that Citigroup and other big U.S. banks could be overwhelmed by losses amid the recession and housing crisis. Last week, Citigroup's share price fell below $2 to an 18-year low. Bank executives increasingly believe that the government needs to take a larger ownership stake in the institution to stop the slide.

Under the scenario being considered, a substantial chunk of the $45 billion in preferred shares held by the government would convert into common stock, people familiar with the matter said. The government obtained those shares, equivalent to a 7.8% stake, in return for pumping capital into Citigroup.

The move wouldn't cost taxpayers additional money, but other Citigroup shareholders would see their stock diluted. A larger ownership stake by the government could fuel speculation that other troubled banks will line up for similar agreements.

Bank of America Corp. said Sunday that it isn't discussing a larger ownership stake for the government. "There are no talks right now over that issue," said Bank of America spokesman Robert Stickler. "We see no reason to do that. We believe the goal of public policy should be to attract private capital into the bank, not to discourage it...."

20 February 2009

Major Banks Will Be Nationalized Eventually: Wall Street's Dirty Little Secret

Why doesn't the Street wish you to realize this? First and foremost, the days of big bonuses and big earnings are over. Banks will increasingly become, once again, institutions to support savings and lending, with insured depositors accounts as a major source of capital.

The leveraged days and market speculation for the big money center banks is over.

We no longer need big salaries to retain traders in the banks because they won't be doing much trading for their own accounts anymore. That will be left to the brokerages.

They won't be writing insurance, they won't be taking huge short positions in commodities, and they won't be to big to fail, at least not to this degree with single institutions threatening national solvency.

We need to strike a model of what wish to have as a national financial system, and begging to invest towards that, and not try to reflate a bubble that ought never to have existed in the first place.

Nationalization does not mean the banks will be run by the government. It means that they will be taken into receivership, broken up, and made once more into banks. Those which are not nationalized must be constrained by a new "Glass-Steagall" law limiting their ability to imperil the national economy for their own personal gambling interests.

That is the point that is being lost in this opaque analysis and muddled discussion. The Big Money Center Banks will be nationalized one way or the other. The only real variable is how much money they can take out of the system before it happens.

Bloomberg

Dodd Says Short-Term Bank Takeovers May Be Necessary

By Alison Vekshin

Feb. 20 (Bloomberg) -- Senate Banking Committee Chairman Christopher Dodd said banks may have to be nationalized for “a short time” to help lenders including Citigroup Inc. and Bank of America Corp. survive the worst economic slump in 75 years.

“I don’t welcome that at all, but I could see how it’s possible it may happen,” Dodd said on Bloomberg Television’s “Political Capital with Al Hunt” to be broadcast later today. “I’m concerned that we may end up having to do that, at least for a short time.”

Citigroup and Bank of America, which received $90 billion in U.S. aid in the past four months, fell as much as 36 percent today on concern they may be nationalized. Citigroup, based in New York, fell as low as $1.61. Bank of America, based in Charlotte, North Carolina, tumbled as low as $2.53.

President Barack Obama’s administration is resisting the idea of nationalizing banks, said Dodd, a Connecticut Democrat. “They prefer not to go that way for all of the reasons that we’re familiar with in terms of the symbolic notion of nationalization of major lending institutions,” he said.

The Obama administration strongly believes a “privately held banking system is the correct way to go,” White House spokesman Robert Gibbs told reporters at a briefing today. “That’s been our belief for quite some time, and we continue to have that,” Gibbs said.

‘Leeway’ on Compensation

Treasury Secretary Timothy Geithner has “an awful lot of leeway” in interpreting the restrictions on executive compensation included in the economic stimulus bill and opposed by the banking industry, Dodd said today.

Treasury officials are still examining how to implement the new compensation restrictions and have not yet determined whether they will apply to participants in the administration’s rescue plan or only to banks and companies that get cash injections from the Troubled Asset Relief Program.

Compensation consultants including Alan Johnson, founder of Johnson Associates Inc. in New York, said the rules may be “catastrophic” to Wall Street’s talent base. The caps made top- producing employees “nervous,” and those who can find other jobs will probably leave, said James Reda, who heads a compensation firm in New York.

“I’m sort of stunned in a way that some people are reacting the way they are about all of this,” Dodd said. “At a time like this, everyone needs to pull in the same direction.”

Dodd also said he doesn’t want U.S. automakers to go through a prepackaged bankruptcy or a “forced merger.” General Motors Corp., Ford Motor Co. or Chrysler LLC risk liquidation with such actions, Dodd said on the broadcast.

01 December 2007

Professor Marvel Never Guesses. He Knows!

We obviously don't know, but suspect this revelation was connected with a subprime contagion affecting the derivatives markets. If derivatives are Weapons of Mass Destruction, then the Credit Default Swaps market is the H Bomb. Credit Default Swaps, if they start unwinding, can develop a chain reaction that will take out a fair chunk of the real economy, in addition to two or three big name corporations.

We obviously don't know, but suspect this revelation was connected with a subprime contagion affecting the derivatives markets. If derivatives are Weapons of Mass Destruction, then the Credit Default Swaps market is the H Bomb. Credit Default Swaps, if they start unwinding, can develop a chain reaction that will take out a fair chunk of the real economy, in addition to two or three big name corporations.Subprime had the Fed a little concerned; CDS has them staring into the abyss and shitting their pants. Aren't you glad we have men so familiar with the mistakes the Fed made in 1929 to 1932 with regard to Fed Policy? We wish they had at least audited the courses covering the Fed's mistakes form 1921 to 1929. Sure, they are the experts; we're just concerned that they may be preparing to fight the last war.

28 November 2007

Citizen Kohn

US equity markets just had the largest two day rally in the last four years. The trigger for this rally, besides the happy coincidence of a surfeit of hot money, lots of short sellers, and end of month motivation was an interesting speech by the Federal Reserve vice-chairman Don Kohn to the Council on Foreign Relations this morning.

US equity markets just had the largest two day rally in the last four years. The trigger for this rally, besides the happy coincidence of a surfeit of hot money, lots of short sellers, and end of month motivation was an interesting speech by the Federal Reserve vice-chairman Don Kohn to the Council on Foreign Relations this morning.

As you may recall, Mr. Kohn is the second most powerful member of the board, and only he and the chairman, Mr. Bernanke, are allowed to make speeches that may signal changes in Fed policy. What you may not know is that he is also the consummate Fed long term insider:

Dr. Kohn is a veteran of the Federal Reserve System. Before becoming a member of the Board, he served on its staff as Adviser to the Board for Monetary Policy (2001-02), Secretary of the Federal Open Market Committee (1987-2002), Director of the Division of Monetary Affairs (1987-2001), and Deputy Staff Director for Monetary and Financial Policy (1983-87). He also held several positions in the Board's Division of Research and Statistics: Associate Director (1981-83), Chief of Capital Markets (1978-81), and Economist (1975-78). Dr. Kohn began his career as a Financial Economist at the Federal Reserve Bank of Kansas City (1970-75).There is a consensus among informed observers that Vice Chair Kohn signaled, contrary to the pronouncements of several lesser Fed lights in recent days, a fresh persuasion of the Fed to cut the Fed Funds rate this December 11, because of a deterioration in the capital markets and the real economy.

Is that all there is? A likely 25 basis point cut in the target Fed funds rate in December triggers one of the most powerful rallies in US equities this decade? Is a simple 25 basis point cut good for all that?

Well, we don't think as naively and simply as all that. Its the end of month, there was about a solid two days of float on short side at daily volumes, and the Fed and Treasury have been spooning out liquidity like K Street lobbyists handing out donations during election season.

Still, this is an exceptionally powerful rally. There has been no real 'good news' excepting a tsunami of excess dollars may be coming back at us from overseas, as witnessed by Abu Dhabi doing something more useful with their dollar reserves than letting them depreciate.

No. Its got to be more than that. So we did the unlikely thing among most investors and financial pundits these days, and in addition to sound bytes and commentary from the Babel-Babes of Bubblevision, we looked for a copy of the text of Mr. Kohn's speech, and actually read it.

Here to us seems to be a somewhat overlooked portion of his speech, in terms of what commentary we have seen so far. From the text of his speech:

Moral Hazard

Central banks seek to promote financial stability while avoiding the creation of moral hazard. People should bear the consequences of their decisions about lending, borrowing, and managing their portfolios, both when those decisions turn out to be wise and when they turn out to be ill advised. At the same time, however, in my view, when the decisions do go poorly, innocent bystanders should not have to bear the cost.

In general, I think those dual objectives--promoting financial stability and avoiding the creation of moral hazard--are best reconciled by central banks' focusing on the macroeconomic objectives of price stability and maximum employment. Asset prices will eventually find levels consistent with the economy producing at its potential, consumer prices remaining stable, and interest rates reflecting productivity and thrift.

Such a strategy would not forestall the correction of asset prices that are out of line with fundamentals or prevent investors from sustaining significant losses. Losses were evident early in this decade in the case of many high-tech stocks, and they are in store for houses purchased at unsustainable prices and for mortgages made on the assumption that house prices would rise indefinitely.

To be sure, lowering interest rates to keep the economy on an even keel when adverse financial market developments occur will reduce the penalty incurred by some people who exercised poor judgment. But these people are still bearing the costs of their decisions and we should not hold the economy hostage to teach a small segment of the population a lesson."

THAT was the heart of the signal, the change in policy that Mr. Kohn was embracing on behalf of the Fed. Moral hazard is not an issue when bailing out the banks of Wall Street, for the simple reason that innocent bystanders might be harmed in the process. A noble sentiment indeed. The banks, however repugnant, depraved, and venal they might become, are just too big to fail.

"But these people are still bearing the costs of their decisions..."What costs? We won't go into a lengthy diatribe on the huge numbers of insiders who are most assuredly NOT being hurt one little bit in this wild West sideshow of a financial market, light on regulation and long on collusion. In fact we are absolutely appalled at what Wall Street has become. And we are sure that, given a little input from some of the innocent public on the chat boards we frequent, suitable punishments for that small segment of the population which harms us can easily be devised without holding the entire economy hostage.

What Mr. Kohn seems to be proposing is that, once again, as Mr. Greenspan before him so often concluded, the risk and penalties to be sustained by malinvestment and corruption are best handled by spreading them out from the few to the many, from the insiders to the public, from those who produce nothing to the broader public, which struggles to just keep going forward as best they can, in one of the great transfers of wealth in modern history.

Won't work you say? Well, of course it won't work!

The punch line, and what so few realize, is that the bankers are not trying to fix anything. The fixes were put in place after the Crash of 1929 and the Great Depression. Fixes, such as the Glass-Steagall Act. They are just trying to prolong the games as it is, which the Wall Street banking community paid good money to get, spending hundreds of millions of dollars in lobbying money to create over the period of almost twenty years.

Frontline: The Wall Street Fix - The Long Demise of Glass-Steagall

A relatively small percentage of the population can twist and corrupt the financial system, destroying the lives of hundreds of thousands of their fellow citizens, because its profitable, and because they simply do not care about the damage they do to others. The dirty little secret is that capitalism, like any other form of social structure, requires policing, regulation, laws, and enforcement to prevent the predations of sociopaths and con men, no matter what weapons they may choose to employ.

Text of Vice-chairman Kohn's Address to the Council on Foreign Relations Nov. 28, 2007