Showing posts with label Shanghai Gold Exchange. Show all posts

Showing posts with label Shanghai Gold Exchange. Show all posts

01 May 2015

24 April 2015

50 Tonnes of Gold Withdrawn from Shanghai Gold Exchange in Latest Week

There were about 50 tonnes of gold bullion taken out of the Shanghai Gold Exchange in the latest week.

That is roughly 1,606,000 ounces in one week.

I include the gold inventories at the Comex warehouses below for the purposes of comparison. The 'registered' category is what is available for sale at current prices.

These charts below are from the data wrangler Nick Laird at sharelynx.com.

Category:

Shanghai Gold Exchange

18 April 2015

34.53 Tonnes of Gold Withdrawn from the Shanghai Gold Exchange In Latest Week

The Comex is a rounding error compared to the global physical market for precious metals.

Shanghai saw 34 tonnes of gold withdrawn last week.

There are less than 18 tonnes of registered (for sale at these prices) gold in all the Comex warehouses, and very little of it sees even a changing of hands, much less withdrawn.

This is why I call it a bucket shop. It has stopped being a major price setting mechanism for actual buyers and sellers of the physical metals, devolving into a speculative pricing platform.

This mispricing of risk and investment will have the usual consequences.

Gold and silver are natural currencies. And it is their physical nature that makes them resistant to long term manipulation.

Category:

Shanghai Gold Exchange

19 February 2015

China Offtakes 59.12 Tonnes of Gold For Week Ending 13th February

China withdrew 59.12 tonnes of gold bullion from the Shanghai Gold Exchange for the week ending 13 February.

This makes 374 tonnes year to date.

China has withdrawn a total of 8,288 tonnes of gold from the SGE.

Category:

Shanghai Gold Exchange

30 January 2015

China Takes Down Another 71 Tonnes of Gold Bullion From Shanghai

Major macro trend changes in long term buying habits by the world's major Banks don't matter.

Daily prices are perfect indicators of all information. No markets are ever rigged.

Central Banks don't know any more about their own long term strategies than a beer vendor at a ball game, and have about the same amount of buying power to back them up.

People hang on every word from Janet Yellen's lips, but whatever China does is meaningless.

Nothing to see here, move along.

Category:

central bank gold,

Shanghai Gold Exchange

23 January 2015

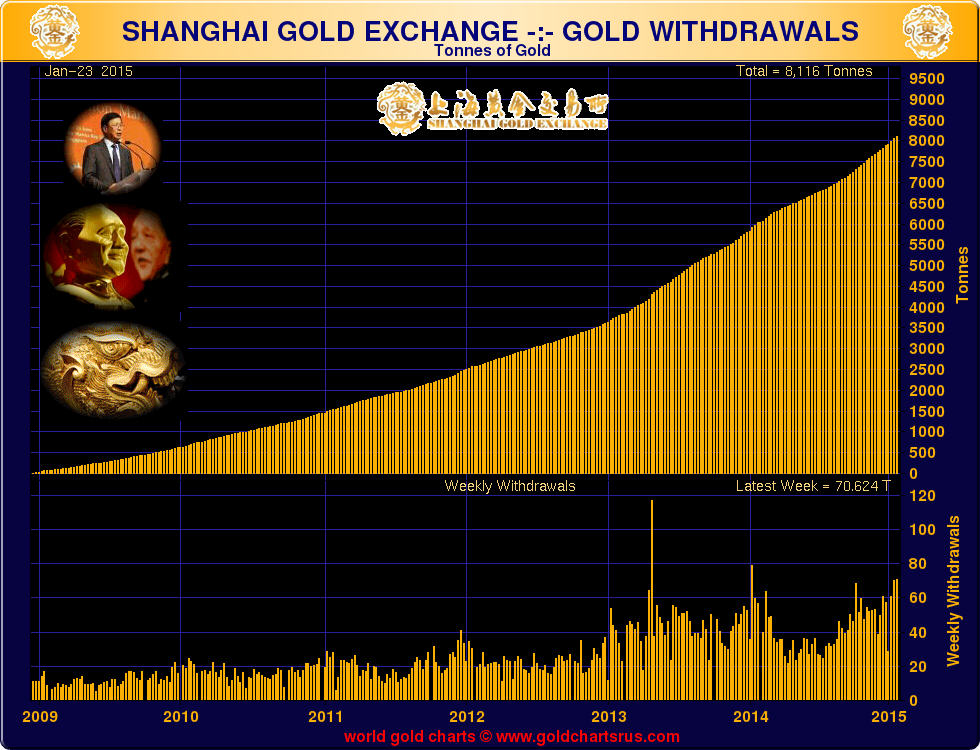

China Withdraws 70 Tonnes Gold From Shanghai Week Ending 16th January - Third Highest Ever

"It is the Soviet Union that runs against the tide of history by denying human freedom and human dignity to its citizens."Ronald Reagan, Speech to the British House of Commons, 8 June 1982"The center of world power is the unchallenged superpower, the United States, attended by its Western allies...For a small but growing chorus of Americans this vision of a unipolar world led by a dynamic America is a nightmare...Our best hope...is in American strength and will-- the strength and will to lead a unipolar world, unashamedly laying down the rules of world order and being prepared to enforce them."Charles Krauthammer, The Unipolar Moment, 1990"The enormous gap between what US leaders do in the world and what Americans think their leaders are doing is one of the great propaganda accomplishments of the dominant political mythology."Michael Parenti"The genius of American power is expressed in the movie The Godfather II, where, like Hyman Roth [Meyer Lansky!], the United States has always made money for its partners. America has not turned countries in which it intervened into deserts; it enriched them. Even the Russians knew they could surrender after the Cold War without being subjected to occupation."Robert Kagan, July 17, 2003

Robert Kagan is a famous neo-con figure in US government circles. He is the husband of Victoria Nuland. Nuland, as Assistant Secretary of State for Europe, is famed for her partnering skills and diplomatic insights, summing up concerns for collateral damage from the crisis in the Ukraine with 'f*uck the EU.'

China withdraw around 70 tonnes of gold bullion from the Shanghai Gold Exchange for the week ending 16th January.

This is the third highest amount of gold offtake from Shanghai ever.

As a result of price rigging, gold is flowing steadily from West to East. Because, whether the public realizes it or not, the world is very actively engaged in the evolution of the monetary basis of world trade, which has been referred to here and other places as the currency wars.

I have little doubt that the Western central banks think that their triumph is unstoppable, an inevitability. And so they firmly stand against all evolution and change, preferring to fight tooth and nail to maintain the US dollar supremacy.

I believe that this currency war has its genesis in the grandiose schemes of the highly influential neo-cons and financiers in the Clinton, Bush, and Obama administrations, together with their attendant counterparts overseas.

I suspect that they may be in for a surprise. Events have a way of rising to an occasion of hubris.

Now, putting aside any moral or practical political discussions about this, let us just consider one thing. Let us assume for a moment that all this circumstantial and direct evidence is correct, and there is a currency war underway. And that the Banks have been engaged, for many years, in the systematic rigging of the price of gold.

This is not impossible, a conspiracy fantasy, or even all that improbable for that matter, since we know that many of these same actors did a similar thing for much the same motives in the famous London Gold Pool.

Assuming that this is true: what is likely to happen if this gold currency rig fails again?

Chart courtesy of data wranger Nick Laird at goldchartsrus.com.

History shows again and again, how nature points out the folly of men.

Have a pleasant weekend.

Related: Will Gold Be Part of a New International Monetary System, Koos Jansen

The Creature from Jekyll Island - lolz

Category:

currency wars,

London gold pool,

Shanghai Gold Exchange

16 January 2015

03 January 2015

China Takes 57.6 Tonnes of Gold In the Week Ending December 26th.

China took out 57.655 tonnes of gold bullion through Shanghai for the week ending Dec 26th.

That makes it 2089 tonnes for the year so far.

There are a number of groups executing their 'game plans' here for what I call the currency war.

China's and Russia's very obviously involves gold in some way.

2015 will be a very interesting year, with a strong touch of the surreal.

As you know I think in 2016, or perhaps a little earlier, there will be a significant amount of turmoil and a stretching of the social fabric, unless cooler heads prevail. I really don't see that happening.

The moral hazard is so thick you can cut it with a knife. And nothing succeeds in destroying itself like arrogance.

As you know I think in 2016, or perhaps a little earlier, there will be a significant amount of turmoil and a stretching of the social fabric, unless cooler heads prevail. I really don't see that happening.

The moral hazard is so thick you can cut it with a knife. And nothing succeeds in destroying itself like arrogance.

Category:

Shanghai Gold Exchange

28 November 2014

21 November 2014

China SGE Gold Withdrawals For Week 52 Tonnes

The Shanghai Gold Exchange withdrawals were 52.26 tonnes for the week ending 14 November.

To put this into perspective, there are a total of 27 tonnes of gold bullion in the registered 'deliverable' at these prices category in all the Comex warehouses now.

That's only a few days supply work in Shanghai.

The point of this, of course, is that as a price discovery mechanism the Comex hardly merits the title anymore relative to the new physical markets in Asia since so little bullion is actually changing hands and being withdrawn, and their leverage is so high.

Compared to China it is like a game of Liar's poker. And how apt that comparison might be.

Category:

Shanghai Gold Exchange

24 October 2014

Shanghai Posts 51.5 Tonnes of Gold For the Week: How Long Can the Gold Pool Be Sustained

"For 'tis the sport to have the engineerHoist with his own petard: and it shall go hardBut I will delve one yard below their mines,And blow them at the moon."William Shakespeare, Hamlet

The Shanghai Gold Exchange, where investors actually take their bullion rather than just play liar's poker with multiple paper claims for the same ounces, saw 51.5 tonnes of gold bullion taken in the latest week.

The trend of physical deliveries has been rising the last 12 weeks.

To put this in perspective, if there are 32,150.75 troy ounces of gold in a metric tonne, then the Comex has a total of just under 28 tonnes of registered (deliverable) gold in all of its warehouses.

What is that, about three days supply in Shanghai? Not to mention the other gold bullion markets around the world.

Sounds more symbolic, than practical. Well, there can be great power in symbols— until long abused belief begins to falter, and confidence frays. And then one risks the danger of using too much force one too many times, and losing the faithful obedience of the public. And with it everything that allows a minority to govern.

There are another 239 tonnes in storage in all the Comex vaults, in the proper bullion eligible format, but not listed as deliverable at these prices. Sometimes owners feel comfortable keeping the bullion there for storage, eliminating the need to have the bullion assayed if they ever wish to sell it.

So what does this all mean? It means that the unsustainable will not be sustained.

Some day the price of gold will likely be whatever China, Russia and like minded bullion markets say it is, the paper pushers in New York and London notwithstanding. The tangled web of free trade and globalization, ain't it a bitch?

It would already be so, except for the tired efforts of Wall Street's central banking friends and their access to leasing other people's bullion in a misguided effort to influence markets and rig their prices.

China and the rest of the world are apparently not yet tired of buying gold on the cheap.

But make no mistake: Shanghai talks, and Wall Street walks.

This chart from the data wrangler Nick Laird at Sharelynx.com.

Category:

London gold pool,

Shanghai Gold Exchange

23 August 2013

The Center of the Gold Trading World Is Now In Shanghai

"If once you forfeit the confidence of your fellow citizens, you can never regain their respect and esteem."

Abraham Lincoln

"It is lack of confidence, more than anything else, that kills a civilisation. We can destroy ourselves by cynicism and disillusion, just as effectively as by bombs."

Kenneth Clark

"At the root of America's economic crisis lies a moral crisis: the decline of civic virtue among America's political and economic elite. A society of markets, laws, and elections is not enough if the rich and powerful fail to behave with respect, honesty, and compassion toward the rest of society and toward the world."

Jeffrey Sachs

Shanghai is emerging as the new center of the gold trading world, as the price shenanigans of London and New York discredit their exchanges, and accelerate the flow of gold from west to east.

The volumes on the LBMA and the COMEX are larger but misleading, because for the most part they represent the passing around of paper claims, at a leverage of 50 to 1 or more, against a diminishing pile of actual gold bullion. They are now running on custom and momentum, but losing substance and confidence with every passing day.

This is the direct result of not allowing the market to set the price, and the moral hazard of not restraining overly cynical, if not overtly fraudulent, representations of value and risk.

The market operation that took down the price of gold which we saw earlier this year on the COMEX was so blatant, so heavy handed, so patently obvious that it jarred the world markets, and had the opposite effect to which one might presume it was intended. It was a bureaucratic over-reaction, panic more precisely, to the Bundesbank's request for the return of their national gold.

If the Anglo-Americans did not use this opportunity to secure the return of the gold bullion which had been leased out, it was a strategic blunder of epic proportion. It may be viewed in retrospect as the watershed moment in which London and New York squandered away the confidence of the world. In their cynical and amoral self-delusion, and a contempt for other people, they assumed that maintaining public confidence is a function of being bolder and more skillful liars. Nicely played, gentlemen.

Integrity is the prerequisite for confidence, and bad behavior drives out the good. A loss of confidence after repeated abuse is a genuine risk whether one properly accounts for it or not.

Weighed, and found wanting.

The original article from which this chart has been taken can be found here.

Category:

German Gold,

gold manipulation,

Shanghai Gold Exchange

Subscribe to:

Posts (Atom)