Wow.

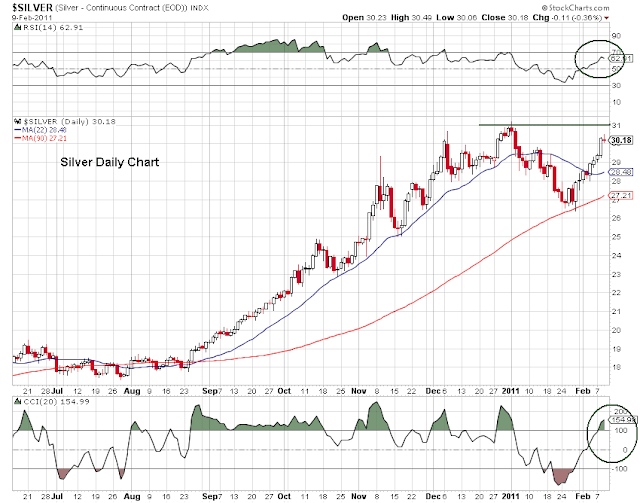

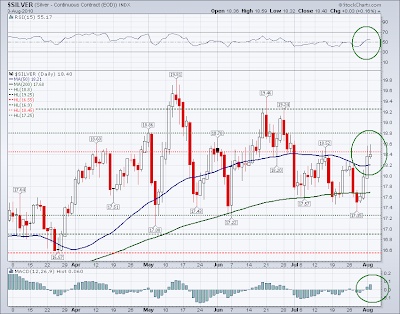

Silver is amazing. Its upward moves are iconic, a short squeeze that doesn't know when to quit. And the equity markets are no slouches either. Is that you blowing a bubble again Benny?

The miners are lagging and at some point soon they should catch up, especially the juniors. I think a lot of people do not believe the metals move is for real and so are playing paired trades and some assets become individually mispriced.

I feel like we are in the Jurassic Park movie, seeing the water glasses on the dashboard shaking, with the heavy footfalls of T-Rex and the sounds of its breathing moving around us in the night. We just do not know which direction it is coming from, and where it is going.

I took some paired positions into the weekend, I just could not resist. I have a weak spot for long holiday weekends in which Asia is open and the west is closed. Let's see if any of the China rumours with regard to the reminbi are valid.

Have a happy holiday weekend everyone, and see you at the late show Sunday night.

Metal's breaking out. Timmy's at the wheel, with Jamie and Blythe in the back seat. Ben is the goat.