29 May 2015

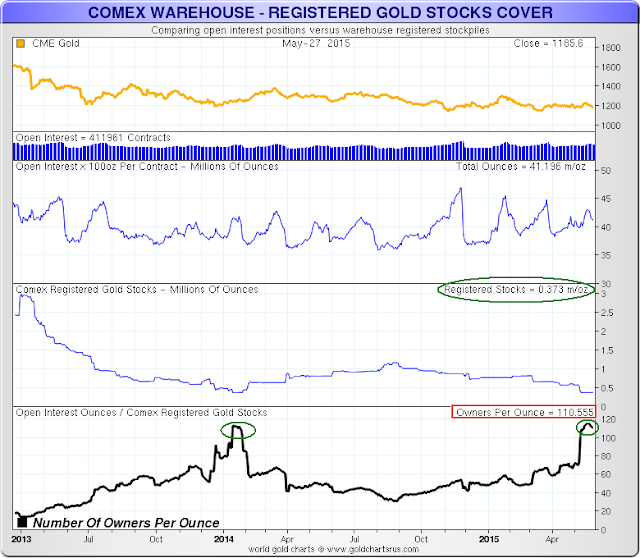

Currency Wars, Gold Pools, and Comex Potential Claims Per Deliverable Ounce

22 April 2013

Big Commodity Trading Firms Took $250 Billion in Profit Since 2003

This sort of outsized profit obtained from gaming the system is a tax on the real economy.

The price distortions they create disrupt legitimate business, and harm the ability of the economy to produce and distribute key resources.

And it is a trade that goes deep and far, with nothing sacred. Witness the havoc that Enron was able to wreak on the energy markets, causing rolling brownouts, while the regulators turn a blind eye.

And as the Chairman of the multinational Nestlé recently observed, access to safe water is 'not a public right.' And the public sources of water should be privatized. And opened up to speculative excess no doubt.

Is it so really hard to understand that widespread corruption and fraud is not productive, and that no amount of austerity or even well-intentioned stimulus given to the corrupt financial system can fix this?

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

06 June 2009

Is the USO Oil Fund "Like a Pyramid Scheme?"

Some very hard words being said about the USO Oil Fund ETF, sparked by comments from the Schork Report.

Some very hard words being said about the USO Oil Fund ETF, sparked by comments from the Schork Report.

Certainly the USO oil fund has not been tracking the performance of the commodity it attempts to represent, and has severely lagged the recent rally in West Texas Intermediate Crude.

This is in contrast to ETFs which target a percentage of the continuous commodity contract such as GLD or SLV. However, one should never mistake the commodity for what is essentially a derivative position, with little or no underlying guarantee of taking delivery of the commodity, as opposed to the futures markets.

This is different from the issue with levered ETFs which we reported on back in December, which reset their basis every day. But we think they also are contributing to volatility particularly in the last hour of trade.

Here is the information on USO. We do not believe in holding the ETFs for long periods of time, which in our lexicon is more than a couple of weeks. We understand that the CFTC is setting revised rules for "commodity pool operators."

"So how is this like a pyramid scheme? A pyramid scheme is funded by a constant flow of dollars into the venture by new investors. The second investor knowingly and willingly pays the first investor on the assumption he will get paid by the third investor… and so on. It’s similar to a Ponzi/Madoff scheme, with the key difference, investors don’t know (or don’t want to know as long as those alleged returns keep rolling in) they are being scammed.

The USO is being funded by a proliferation of new retail investors looking to diversify into “alternative investments” (which as far as we have been able to ascertain, alternative investment is a euphemism for Las Vegas style bets on commodities by retail investors tired of watching their 401Ks drop). More importantly, these investors are obviously out of their league, i.e. taking buy-and-hold positions in a contango which raises their cost basis every month they roll into the higher priced deferred contract.

We assume they are buying the USO because they are bullish. But in a peculiar way, their actions could be helping to prevent the market from rallying. These new investors are not funding a pyramid per se, but they are helping to fund storage. That is to say, with global demand in the doldrums, the contango will persist. And, as long as it lasts, traders will continue to front-run the rolls, which in turn will exacerbate the contango, which will then incentivize storage builds further, which will then ultimately weigh..."

USO: A Self-Propelled Pyramid? - Financial Times

USO Oil Fund or Just a Pyramid Scheme? Stockmaster.com

USO Oil Fund: All of the Drop and Some of the Gain - Phil's Stock World

Special thanks to Ilene over at Phil's Stock World for the comparison chart. We also enjoyed this quote from their article.

"In fact, it’s very possible that if you did an proper investigation (perhaps a Congressional one) you would find that MOST of the oil traded on the NYMEX has nothing to do with real demand at all but is pure speculation that is sold to retail investors as "commodity investing" or "inflation hedging" but what kind of inflation hedging loses 33% a year PLUS TRANSACTION FEES before a profit can be made? Oh and a funny note - who handles USOs cash and places trades on the ICE and NYMEX for them? Aw, you guessed it - Goldman Sachs!

So here you are giving your money to an ETF that gives its money to the biggest shark in the ocean, who chews off your legs in transaction fees and contango spreads BEFORE they even bother to circle around for the kill by gaming the market. NOT ONLY THAT, but the idiotic rules of the fund lead them to PUBLISH THE DAYS THEY ARE ROLLING IN ADVANCE so every little shark in the sea knows exactly when and where to feast on your bloody, bobbing carcas this month - and the next and the next and the next. Don’t worry though, once you are chewed up and digested, there will be a fresh round of suckers herded back into commodities and the commodity pushing stocks and ETFs every time GS, MS or Cramer need another payday. "

Should a bank guaranteed by public funds and the FDIC be active operators in speculative markets? Or should they be confined to the more conservative realms of commercial banks as they were under the Glass - Steagall regime?

We think the answer is obvious, especially given the fact that a great deal of the problems we face today are a direct result of the repeal of Glass-Steagall and the mixing of public funds with private greed in a coopted political and regulatory regime.