“Bizarrely, it’s precisely the jobs that shift money around – creating next to nothing of tangible value – that net the best salaries. The Machiavellis are one step ahead. They have the ultimate secret weapon to defeat their competition. They’re shameless.”

Rutger Bregman, De Meeste Mensen Deugen, September 2019

"The light has come into the world, and people love the darkness rather than light, because their deeds are evil."

John 3:19

"The great banks and insurance houses where surplus wealth is kept among us. That surplus wealth, produced by the cheap labor of 'peasants', must now be protected from the peasants by law and by military force. We labor and labor and labor for stuff that never satisfies us. The market ideology is now the new form of imperial power and many of us, without any critical reflection, have signed onto that, and organized our lives in that way so we do not have any time, energy or capacity for the things that are rightly important to us, our humanness."

Walter Brueggemann, Truth To Power, 2013

"America is caught in a confidence or credibility trap, in which the changes, investigations, and reforms necessary to restore trust to an economy or market are rendered unlikely because doing so would expose a pervasive corruption that the principals fear would destroy any remaining trust. It could also endanger the careers of politicians and business people who may have permitted and even appeared to facilitate the control fraud that caused the financial crisis in the first place. Personal risk trumps public stewardship. The fraudulent activity is covered up and therefore continues, crowding out most productive business investment and activity which cannot possibly hope to compete with the highly profitable fraudulent activity and asset bubbles under such opaque and uncertain circumstances."

Jesse, America Is Caught in a Credibility Trap, 22 January 2011

"The ultimate purpose of crime is to establish an endless empire. It seeks a state of complete insecurity and anarchy, founded upon the tainted ideals of a world thought doomed to annihilation. When humanity, subjugated by the terror of crime, has been driven mad by fear and horror, and when chaos has become the supreme law, then the time for the empire of lawlessness will have come."

Friedrich Rudolf Klein-Rogge, Das Testament des Dr. Mabuse, 1933

There was an interesting divergence, almost schizoid in its magnitude, in the markets today.

The Non-Farm Payrolls report came in much more strongly than expected.

And because of this interest rates rose, the Dollar strengthened, and the precious metals were hit hard.

But at the same time risk assets like stocks rallied, after an initial plunge, and the VIX fell.

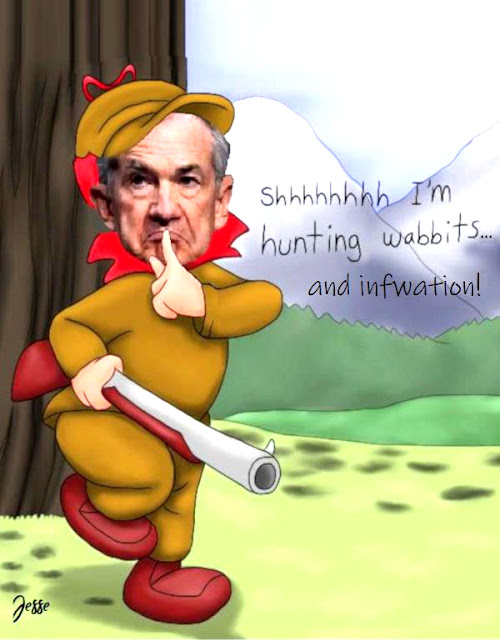

The trope being parroted among the spokesmodels was a 'pivot party.' This is the expectations that the Fed will start cutting rates again sooner rather than later.

And those who would think themselves wise nod their heads knowingly. The public obviously does not share in their gnosis, their financial enlightenment, as inferior beings.

Wealth is not created at the top, flowing down to the public. Rather, the prosperity of the real economy is lured to the top, to be devoured.

These are not wealth creators. They are deceivers and destroyers, wielding enormous influence and power.

The madness advances, slowly, but with a purpose.

The US chose to use its veto power at the Security Council today to block the call by the UN for a humanitarian ceasefire in Gaza.

The wash is nearly done.

Nemesis awaits.

But things are so confusing. You say this, but look at that, and that, and what this one says.

What is truth?

And so of course I send these things to my friends and children, just so they can be informed.

You know exactly what to do, explicitly. But you choose as you will. And you close your ears and willfully harden your hearts, and refuse to serve.

"The Lord requires you to act justly, and to love kindness and mercy, and to walk humbly with your God."

Micah 6:8

If you make this your guiding light, your measure of what is good, you will not fall away.

But if you choose to serve what you love the most, the darkness in yourself, then you will find that you may be free, and that your house is now yours, but is made desolate. And in misery you wallow among swine.

Time to come home.

Have a pleasant weekend.