Joe Stiglitz describes the current financial crisis and prospective recovery quite well, and the conclusions he draws are remarkably similar to our own which is gratifying.

Joe Stiglitz describes the current financial crisis and prospective recovery quite well, and the conclusions he draws are remarkably similar to our own which is gratifying.

It's good to hear these things from a distinguished Nobel laureate, and not just from your humble Propriétaire, while puttering over his daily bread.

Bloomberg

Stiglitz Says U.S. Economic Recovery May Not Be ‘Sustainable’

By Michael McKee

Sept. 4 (Bloomberg) -- The U.S. economy faces a “significant chance” of contracting again after emerging from its worst recession since the 1930s, Nobel Prize-winning economist Joseph Stiglitz said.

“It’s not clear that the U.S. is recovering in a sustainable way,” Stiglitz, a Columbia University professor, told reporters yesterday in New York.

Economists and policy makers are expressing concern about the strength of a projected economic recovery, with Treasury Secretary Timothy Geithner saying two days ago that it’s too soon to remove government measures aimed at boosting growth.

Stiglitz said he sees two scenarios for the world’s largest economy in coming months. One is a period of “malaise,” in which consumption lags and private investment is slow to accelerate. The other is a rebound fueled by government stimulus that’s followed by an abrupt downturn -- an occurrence that economists call a “W-shaped’ recovery.

“There’s a significant chance of a W, but I don’t think it’s inevitable,” he said. The economy “could just bounce along the bottom.”

Stiglitz said it’s difficult to predict the economy’s trajectory because “we really are in a different world.” He said the crisis of the past year was made worse by lax regulation that allowed some financial firms to grow so large that the system couldn’t handle a failure of any of them.

Big Banks

“These institutions are not only too big to fail, they are too big to be managed,” he said.

Finance ministers and central bankers from the Group of 20 nations meet in London Sept. 4-5 to lay the groundwork for a summit in Pittsburgh later this month, where leaders will consider measures to overhaul supervision of the financial system...

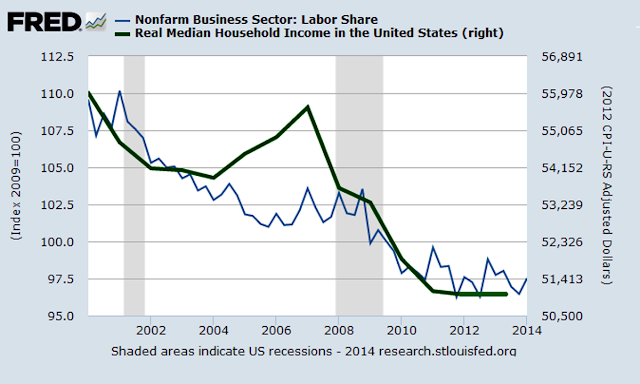

With so much excess capacity, the American economy faces a short-term threat of disinflation and possibly deflation, Stiglitz said. Wages may even decline, given recent high productivity and the likelihood of an extended period of high unemployment, he said.

Longer term, he said the Fed’s aggressive monetary policy will mean inflation becomes the greater threat. “With the magnitude of the deficits and the balance sheet of the Fed having been blown up, it’s understandable why there are anxieties about inflation,” he said.

While the Fed says it has the tools to deal with it, there are still concerns, Stiglitz said. Because monetary policy takes six to 18 months to have its full effect, the central bank will have to begin withdrawing monetary stimulus on the basis of forecasts.

The Fed’s record on its economic forecasts isn’t enough to reassure investors and, as a result, the U.S. currency may suffer, he said.

Dollar ‘Weakness’

“Whether or not they’re able to do it, the uncertainty today about whether they can do it can contribute to the weakness of the dollar,” Stiglitz said. “That’s one of the reasons there is increasing interest around the world in discussing alternatives to the dollar system.”

Stiglitz, who is a member of a United Nations commission that will study the global financial system and currency regimes, said “the logic is compelling” for a new global currency.

The current system creates instability, weakens global confidence, and is fundamentally unfair to developing countries that are in essence lending the U.S. trillions of dollars and bearing the risk, he said.

“In most quarters, there is a feeling we should move away from the dollar system. The question is do we do it in an orderly way, or a chaotic way,” Stiglitz said. “The size of the deficit and the size of the balance sheet of the Fed have just increased the anxiety and the desire that something be done.”

While some think it would hurt the U.S. to no longer be able to borrow cheaply in dollars, “that era is over,” he said. “We’re moving to a more multi-polar world.”

Between the fall of the Berlin Wall and the collapse of Lehman Brothers was “the short period of American triumphalism, where we dominated the global scene. That period is over,” Stiglitz said.