skip to main |

skip to sidebar

Silver got a very stiff gutcheck from the wiseguys when it hit resistance at 29 intraday. Gold followed it down on the same bear raid. It could not have been more obvious. Someone came into a thin market and started dumping contracts.

Tomorrow is the Non-Farm payrolls report and those that follow these things know that the metals are often hit around this event. Don't ask me why, as it makes less sense than the same sort of action around delivery dates and options expiration.

Perhaps this is about perception management. Some of the economic analysts talk as those perception were everything, all that really matters, as if they were from the Fernando Lamas School of Financial Management.

"It is better to LOOK good than to feel good, and dahling, you look MARVELOUS."

And so we are witnessing the Persecution and Assassination of the Middle Class as Performed by the Inmates of the US Financial System under the Direction of the Wall Street Banks.

When appearance finally meets reality the dissonance it throws out will shake the world's financial markets to their very foundations.

Mundus vult decipi, ergo decipiatur. T. Petronius

(The world wills itself to be deceived, so let it be deceived.)

As they said on Bloomberg TV today, 'the haves are doing very well.'

China seems to be encouraging gold and silver ownership amongst its people as a matter of policy, the better to cushion them against a bubble and collapse. This is also a means of diversifying their reserves without engaging the US and the fiat countries directly through more official actions with their banking reserves.

It also appears that the other BRIC countries are doing similar things as a response to a perception that rogue elements in the US and UK have co-opted the US financial system, and therefore the dollar reserve currency and the multinational banks for their own personal gain. This has been previously seen in more select economic gambits, generally in the Third World, referred to colloquially as the work of the economic hitmen.

To that point, China Stock Crash Reportedly Caused By Bank Manipulation

I was also struck by this historical quote from a recent piece in the Financial Times by Tom Palley titled: Deaf to History's Rhyme: Why President Obama Is Failing.

“For 12 years this nation was afflicted with hear-nothing, see-nothing, do-nothing government. The nation looked to government but the government looked away. Nine mocking years with the golden calf and three long years with the scourge! Nine crazy years at the ticker and three long years in the breadlines! Nine mad years of mirage and three long years of despair! Powerful influences strive today to restore that kind of government with its doctrine that that government is best which is most indifferent.”

Franklin D. Roosevelt, October 1936

An indifferent government, one that is either lax or complicit with powerful private interests, is the ally of the frauds and schemes and abuses that proliferated over the last twenty years. But control frauds, being an unproductive transferal of wealth, are based on growth and new victims, and so the impulse to find new venues is strong by necessity as the old haunts are drained of their economic vitality.

The rhyme of history being what it is, the hard money versus soft money wars have not gone away and seem to be heating up.

From Goldcore:

"China's growing importance to the precious metal markets was underlined by the news that Chinese imports have surged by more than 500% due to increased investment demand. Incredibly, China's gold imports were five times higher in the first ten months than in the whole of last year. Imports hit 209 tonnes compared to 45 tonnes for all of 2009, according to the Shanghai Gold Exchange. Trading volume of gold on the exchange in the first 10 months rose 43 percent from a year earlier to 5,014.5 tonnes.

Chinese buyers are concerned about inflation and the depreciation of the fiat yuan/renminbi and looking to gold as a store of value. Chinese people do not have trust in paper currencies due to their experiences with authoritarian government and hyperinflation.

Most of the 1.3 billion people in China only began to acquire and own gold in 2003 as gold ownership was banned from 1945 to 2003. The gold market was liberalised in 2003 and their demand is increasing from a near zero base. This means that the increase in demand is very sustainable and will likely continue. Concerns of an overheating economy, inflation and a housing bubble will lead to further Chinese diversification into gold."

What I find most disturbing are the actions of the English speaking peoples, who seem to be falling in line and marching off at the direction of their handlers without any meaningful protest.

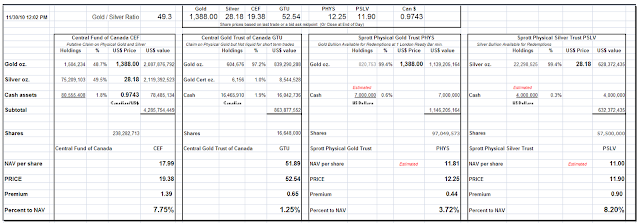

One of the more interesting things that happened recently was the decoupling of gold and silver bullion from the equity market and the US dollar.

This is most likely an example of the primary trend reasserting itself after a short term period of artificial price manipulation for option expiration and the first week of the important December delivery at the Comex.

Another way of saying this is that in the short term markets often trade on 'technical factors,' that is, one group of market players may take an overweight position, as we saw this week in the put-call ratio in stocks. So today we had a sharp short covering rally.

Does that really mean anything fundamentally changed? Well, the spinsters can always find 'a reason' for the short term moves in stocks, but it is hard to imagine that what was a disaster last week suddenly becomes all wine and roses this week. Real economies do not shift gears that quickly, thank God. But the wiseguys will use their market positioning, news sources, and rumours to 'manage perception' as do other powerful groups such as the government.

By the way, I hope you have noticed that much of what you hear on the mainstream and from 'experts and analysts' verges on pure propaganda these days. Bloomberg has gotten so outrageous that I can barely stand to watch their shows during the day.

Today for example a nice young lady came in and explained how Social Security was really broke as of 2015 because 'the money was not really there.' Her point was that the trust fund is in US special obligations and since the government spent the money on general things (like tax cuts for the wealthy) it is gone and so cuts must be made.

Well, the US has also spent all the money it is using to pay the interest and redeem the principal on US Treasuries, and so by the same reasoning it ought to cavalierly default on those obligations as well. In fact it ought to default on those obligations first because a Trust is senior as a pre-allocated fund to a non-specific general obligation. But of course that never came up. But that is in effect what is happening with the Fed's quantitative easing. And this is making those who recently looted the system nervous because they have not yet had the opportunity to transfer their dollars into other hard assets and rents producing property.

The problem is that the system has never been reformed, and the money is not reaching the real economy, but merely being used to bail out the creditors who were principally responsible for the financial fraud and subsequent crisis in the first place.

Let's see how this plays out. But expect things to get more disruptive and blatantly unjust because of a lack of moral leadership from the top down and a general deterioration in the concept of duty, honor, and obligation to country and the people in our national leaders and the pampered princes of the 'me generation.'

Postnote: I have subsequently updated these charts to show the early action for Thursday 2 December. It appears to me that the market will either reestablish a trading range or make a breakout play to the higher targets around 1250 into the year end, setting up an early 2011 decline.

I have put up a longer term silver chart with an Inverse H&S formation that calls out 30.50 to 31 as a minimum measuring objective.

Gold is still struggling with the option expiration and a large overhang of potential orders that could stand for delivery at the Comex. Gold is a political metal, feared by the Central Banks of the developed nations, so the outcome is a little less predictable than might be otherwise.

Silver on the other hand is a dreadnought that takes no prisoners. Why is it able to shake off the kind of paper manipulation that seems to plague gold so often? It is because the central banks do not own any to lend on the cheap to their friends.

It seems only a matter of time until the exchange suspends trading and manages (forces) a cash settlement to bailout the big short interest held by the TBTF-who-must-not-be-maimed. That still will not resolve the artificial shortage that has been developing over the past twenty years or so. It requires time and effort to build mining capacity, and it appears that the preoccupation of the capital allocation has been slanted away from the production of real things, towards the development of better and faster systems of perception management, crowd control if you will, and wealth transference, from the many to the few.

This reminds of the famous anecdote that Boswell recorded, in which Samuel Johnson reacts to Bishop Berkeley's 'ingenious sophistry:'

"After we came out of the church, we stood talking for some time together of Bishop Berkeley's ingenious sophistry to prove the nonexistence of matter, and that every thing in the universe is merely ideal. I observed, that though we are satisfied his doctrine is not true, it is impossible to refute it. I never shall forget the alacrity with which Johnson answered, striking his foot with mighty force against a large stone, till he rebounded from it -- 'I refute it thus.'"

Many will obtain a similar object lesson for themselves the hard way over the next few years, of the essential difference between the paper money that primarily has come to serve the bloated frauds and sordid schemes of a decaying financial elite that no longer represents accountability, equity, or sustainability, and the enduring value of real money that exists of its own accord, standing firm as the passing constructs and vain devices of men founder against it. There will doubtless be more ebb and flow, but in sum the resulting clash will be nothing short of epic, indeed.

The market is likely to chop ahead of the Jobs Report on Friday 3 December.

Post market note: It appears the perceived support at the 50 DMA was well founded and provided an opportunity for the boys to bounce it higher and sweep the small bear specs out of the way. This will likely continue at least until 'something happens.' Will it be the Jobs Report on Friday? What can one really say about such pervasive malinvestment and fraud.

"And I set my heart to know wisdom and to know the madness and folly of men. I perceived that this too is grasping after the wind. For in much wisdom is much grief, and he who increases knowledge increases sorrow." Ecclesiastes 1:17-18

Gold is hanging at the 1375 resistance, the former target of the breakout from the big cup and handle formation. It may take a little while, but if the markets hold together and gold can clear this level it may romp higher and reach our intermediate target more handily than most imagine, with perhaps some additional hesitation around the psychologically important 1400 level.

Silver may take the lead again once this option expiration and holiday shortened week is done.

But I think gold will tend to do better in a crisis, better than stocks and silver at least. So let's see what happens.

Banks Feel Threatened By the Bullion Bulls - Stills

The support levels in stocks are rather obvious. You might wish to keep an eye on the techs which are following but with some reluctance. The support on the NDX futures is 2100.

The metals action is remniscent of the other failed option expiration stuffing that backfired on the bears as we had noted last week. The difference is that silver has relinquished its leadership role to gold at least for today.

A whiff of cordite has caused gold and stocks and to some extent silver to diverge today significantly, but tomorrow is another day. The call holders will convert to futures and their positions, leverage and will to hold them might be tested.

These markets are riddled with control frauds, but they are the works of men. So while they can be oppressive, they are hardly omnipotent.

Interesting action in the precious metals ahead of the gold and silver Comex option expiration.

"Now listen, you wealthy, weep and wail because of the misery that is coming on you. Your wealth is rotting, and moths have eaten your clothes. Your gold and silver positions are false. Their corrosion will testify against you and eat your flesh like fire." James 5:1-3

Personally I would hope they do not even allow them to pass anything but a pro forma budget and then show them the door, because everything they do is tainted.

The elections will be a referendum on the financial corruption between the banks and the government elites in Ireland as they were in Iceland.

Why the Irish would yoke themselves and their children for years to save the multinational banks is puzzling. But it will not have been the first time that the Irish people were sold by their leaders to the monied powers in foreign lands, and it likely will not be the last.

Bloomberg

Euro Drops as Irish Government Plans to Dissolve After Budget

By Catarina Saraiva

November 22, 2010, 3:20 PM EST

Nov. 22 (Bloomberg) -- The euro fell for the first time in four days versus the dollar and yen after Ireland’s government started to unravel and Moody’s Investors Service said it may lower the nation’s credit rating by more than one level.

The dollar and yen advanced against most of their major counterparts as a drop in stocks encouraged investors to seek refuge from Europe’s financial crisis. The euro slid from a one- week high against the dollar as Ireland’s Prime Minister Brian Cowen said a day after asking for European aid that the government will resign following passage of the nation’s budget.

“Political uncertainty in Ireland could risk the timely implementation of the new budget and the austerity measures required to bring the deficit down,” said Omer Esiner, chief market analyst in Washington at Commonwealth Foreign Exchange Inc., a currency brokerage. “That’s a large negative for the euro.”

Éirinn go brách