Coiling for a move, pretty much as expected.

Watch out for the debt ceiling battle. It could be a wild ride.

"Evil when we are in its power is not felt as evil but as a necessity, or even a duty. As soon as we do evil, the evil appears as a sort of duty. Once a certain class of people has been placed by the authorities outside the ranks of those whose life has value, then nothing comes more naturally to men than murder. As soon as men know they that they can kill without fear of punishment or blame, they kill; or at least they encourage killers with approving smiles."

Simone Weil, 1947

"My own view is that I was willing to go over the brink on the fiscal cliff, but not here, for three reasons.So allowing the debt ceiling to come, which is NOT a default on debt since interest can still be paid, which Clinton had done quite successfully as I recall, is to be feared to the point of doomsday. But using a dodgy method of overtly monetizing the debt, which has existed as an idea on the fringes until a month ago and has never been done before, is much less risky and will bother nobody. Are you kidding me?!

First, this is seriously risky business. The fiscal cliff would have been a known quantity: basically, a negative Keynesian shock to the economy, which is something we understand quite well, and furthermore something that would have built only gradually over time. The risks, in short, were somewhat contained.

By contrast, nobody really knows what happens if America defaults, even briefly. The whole structure of world financial markets is built around the use of Treasury bills as the ultimate safe asset; what happens if they lose that status? It would certainly be an interesting experiment, but one best carried out if you have plenty of bottled water and spare ammunition in your basement."

Paul Krugman, Thinking About the Brink

...For many people on the right, value is something handed down from on high It should be measured in terms of eternal standards, mainly gold; [Because something is not purely arbitrary does not require that it be divine - Jesse] I have, for example, often seen people claiming that stocks are actually down, not up, over the past couple of generations because the Dow hasn’t kept up with the gold price, never mind what it buys in terms of the goods and services people actually consume.

And given that the laws of value are basically divine, not human, any human meddling in the process is not just foolish but immoral. Printing money that isn’t tied to gold is a kind of theft, not to mention blasphemy. [Again, the intolerance of the ideologue, who is so far over on the continuum that they can only look across and see their other extreme, entirely overlooking the middle - Jesse]

For people like me, on the other hand, the economy is a social system, created by and for people. Money is a social contrivance and convenience that makes this social system work better — and should be adjusted, both in quantity and in characteristics, whenever there is compelling evidence that this would lead to better outcomes. [Money is just another tool, a cool toy, to the financial engineers who govern the economy like a benevolent elite. They do not understand value and consequences as they tinker and experiment, hoping for better luck next time. And amongst financial engineers, Greenspan was Dr. Frankenstein. - Jesse]

It often makes sense to put constraints on our actions, e.g. by pegging to another currency or granting the central bank a high degree of independence, but these are things done for operational convenience or to improve policy credibility, not moral commitments — and they are always up for reconsideration when circumstances change. [The ruling übermenschen are above conventional morality in their arcane knowledge. And how does one measure 'better outcomes?' For at the end of the day, economics is no pure science, but a social science of a certain class of policies, and policy has its roots in 'justice.' This is why the financiers must operate in secret, like the great Wizard of Oz. Because they have no science, but do not wish to be encumbered by anything, and especially something as inconvenient as justice, as they conduct their experiments. - Jesse]

Now, the money morality types try to have it both ways; they want us to believe that monetary blasphemy will produce disastrous results in practical terms too. But events have proved them wrong. [Yes that's right. The credit bubble, tech bubble, and housing bubbles have been benign and not based on policy errors. All of them were facilitated by economic quackery from both sides. But the would be elite can admit no error. - Jesse]

And I do find myself thinking a lot about Keynes’s description of the gold standard as a “barbarous relic”; it applies perfectly to this discussion. The money morality people are basically adopting a pre-Enlightenment attitude toward monetary and fiscal policy — and why not? After all, they hate the Enlightenment on all fronts. [As he cries for more leeches to bleed the patient... - Jesse]

The bottom line is that we aren’t really having a rational argument here. Nor can we: rationality has a well-known liberal bias. [The hubris of an ideology or a professional class in failure knows no bounds. - Jesse]

Paul Krugman, Barbarous Relics

I think that the fact that this nonsense is being discussed by Very Serious People demonstrates how far off the cliff of reason our financial and political systems have already gone. Let's hope China et al. are willing to view America's antics with the same jolly forbearance.

I think that the fact that this nonsense is being discussed by Very Serious People demonstrates how far off the cliff of reason our financial and political systems have already gone. Let's hope China et al. are willing to view America's antics with the same jolly forbearance.“The burning question that I always have, I’m amazed at their ongoing willingness to continue to accumulate, and hold, such large amounts of US denominated bonds. It’s been my view that they are basically playing a Ponzi scheme.

I’ve had that confirmed when I’ve had long discussions with different sovereign wealth funds and different government agencies around the world. They’ve been willing to play this game, but more and more now, as their domestic economies have grown and the US portion of their exports becomes smaller, and with the amount of T-Bills that they have (already) accumulated, I believe they’ve reached the boiling point where they are really going to be unwilling to grow their reserves (of US Treasuries).

Just the process of not growing their reserves is going to be very disruptive. If they are not willing to accumulate more T-Bills, this is going to force the trade deficit closed. I think that is really going to rock the financial world at some point in the near future..."

Sprott President Kevin Bambrough in today's KWN Interview

"Well, the trillion-dollar-coin thing — deal with the debt ceiling by exploiting a legal loophole to have the Treasury mint one or more large-denomination coins, deposit them at the Fed, and use the cash in the new account to pay bills — has really taken off. Last month I spoke with a senior Fed official who had never heard of the idea; these days it’s all over. [It has been around for quite some time in monetary theory circles, where P.K. apparently does not dally - Jesse]

There seem to be two kinds of objections.

One is that it would be undignified. Here’s how to think about that: we have a situation in which a terrorist may be about to walk into a crowded room and threaten to blow up a bomb he’s holding. It turns out, however, that the Secret Service has figured out a way to disarm this maniac — a way that for some reason will require that the Secretary of the Treasury briefly wear a clown suit. (My fictional plotting skills have let me down, but there has to be some way to work this in). And the response of the nervous Nellies is, “My god, we can’t dress the secretary up as a clown!” Even when it will make him a hero who saves the day?

[Is that like 'The Committee to Save the World?' I would not call it disarming the maniac so much as shooting the hostage to nullify the maniac's leverage. And the clown suits have already seen quite a bit of wear by economic policy whizkids in the past twenty years. Have you ever heard the one about how a US housing bubble is impossible? Or that markets do not need regulation because they are naturally efficient? Or that economics is, as Jamie K. Galbraith said, a 'disgraced profession?' - Jesse]

The other objection is the apparently primordial fear that mocking the monetary gods will bring terrible retribution. [There are no methods of argument so childish and often viciously petty than those that roam the halls of university departments, or talk radio. - Jesse]

Joe Weisenthal says that the coin debate is the most important fiscal policy debate of our lifetimes; I agree, with two slight quibbles — it’s arguably more of a monetary than a fiscal debate, [I can't believe you went there to grab a cheap point but one must do what one must when they don't have anything else. - Jesse] and it’s really part of the broader debate that has been going on ever since we entered the liquidity trap. [It has been going on for time immemorial, for those that have looked at the history of money more deeply than the pages of the NY Times. - Jesse]

What the hysterics [DeLong derided them as 'puritans' when they brought up the moral hazard of TARP, and they were right - Jesse] see is a terrible, outrageous attempt to pay the government’s bills out of thin air. This is utterly wrong, and in fact is wrong on two levels.

The first level is that in practice minting the coin would be nothing but an accounting fiction, [a fiction has more weight than thin air? - Jesse] enabling the government to continue doing exactly what it would have done if the debt limit were raised."

Paul Krugman, Rage Against the Coin, 8 January 2013

"...the Federal Reserve is not obliged to tie the dollar to anything. It can print as much or as little money as it deems appropriate."This is correct, but one must add, subject to the valuation assigned to that money by those portions of the marketplace that the monetary authority cannot otherwise intimidate, manipulate, or control, if confidence unravels.

“If you can feel that staying human is worth while, even when it can't have any practical result whatsoever, you've beaten them.”

George Orwell

"We who lived in concentration camps can remember the men who walked through the huts comforting others, giving away their last piece of bread. They may have been few in number, but they offer sufficient proof that everything can be taken from a man but one thing: the last of the human freedoms -- to choose one's attitude in any given set of circumstances, to choose one's own way.”

Viktor E. Frankl

"Upon her recent passing at the age of 76, I took the opportunity to reread Bubby's memoirs. In four different instances, my grandmother had stood—amid the smoke of the crematoriums, the barking dogs, the trampling boots and swinging clubs—on the infamous "selection line" at the head of which Mengele and his minions stood, pointing left and right, sentencing some to back-breaking labor, and sending others to the gas chambers. In each of those instances, somebody would come along and say or do something that would change Bubby's fate from certain death to tenuous life. In one such incident, she already had been sent to the line of those marked for death when a man appeared as if from nowhere, physically removed her from that line and shoved her into the other, without saying a word.

Indeed, the miracles and the mysteries of the events of those days abound along with the horrors and the tragedies. In contrast to the vile actions of the "Angel of Death" were the noble and heroic actions of many "Angels of Life" who stood ready to risk their own lives for the sake of saving that of a stranger.

It is thanks in no small part to "Angels" like these, who stepped out from behind their own misery and grief to come to the aid of others, that generations now live on to tell the story. How clearly we see the infinite ripple effects of single acts of kindness and compassion, even if accomplished in a split second..."

Yossi Refson, Angels of Light

"Maximilian Kolbe, a Polish Franciscan friar, provided shelter to refugees from Greater Poland, including 2,000 Jews whom he hid from Nazi persecution in his friary in Niepokalanów. He was also active as a radio amateur, with Polish call letters SP3RN, vilifying Nazi activities through his reports.

On February 17, 1941 Kolbe was arrested by the German Gestapo and imprisoned in the Pawiak prison, and on May 25 was transferred to Auschwitz I as prisoner #16670.

In July 1941 a man from Kolbe’s barracks vanished, prompting SS-Hauptsturmführer Karl Fritzsch, the deputy camp commander, to pick 10 men from the same barracks to be starved to death in Block 13 (notorious for torture), in order to deter further escape attempts. One of the selected men, Franciszek Gajowniczek, cried out, lamenting his family ["My poor wife! My poor children! What will they do?"], and Kolbe volunteered to take his place.

During the time in the cell he led the men in songs and prayer. After three weeks of dehydration and starvation, only Kolbe and three others were still alive. Finally he was murdered with an injection of carbolic acid [14 August 1941] ...

Kolbe is one of ten 20th-century martyrs from across the world who are depicted in statues above the Great West Door of Westminster Abbey, London."

Jewish Virtual Library, Maximilian Kolbe

“So comes snow after fire, and even dragons have their endings.”

J.R.R. Tolkien, The Hobbit

"This empire, unlike any other in the history of the world, has been built primarily through economic manipulation, through cheating, through fraud, through seducing people into our way of life, through the economic hit men."

John Perkins

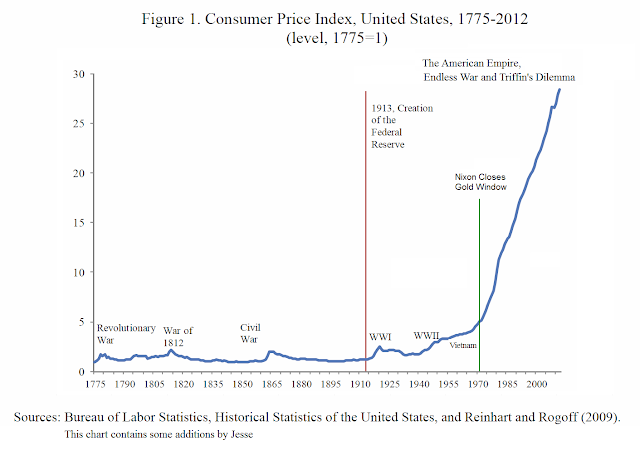

Shifting Mandates: The Federal Reserve’s First Centennial

Carmen M. Reinhart and Kenneth S. Rogoff

For presentation at the American Economic Association Meetings, San Diego,

January 5, 2013

Session: Reflections on the 100th Anniversary of the Federal Reserve

Read the entire paper in PDF form here.

h/t Bill P and Business Insider

"The current world monetary system assigns no special role to gold; indeed, the Federal Reserve is not obliged to tie the dollar to anything. It can print as much or as little money as it deems appropriate [History suggests that while they technically can print as much as they wish, there is an effective upper bound along with a law of diminishing returns in there somewhere. Weimar and John Law, amongst others, tended to show that. - Jesse]

There are powerful advantages to such an unconstrained system. Above all, the Fed is free to respond to actual or threatened recessions by pumping in money. To take only one example, that flexibility is the reason the stock market crash of 1987—which started out every bit as frightening as that of 1929—did not cause a slump in the real economy.

While a freely floating national money has advantages, however, it also has risks. For one thing, it can create uncertainties for international traders and investors. Over the past five years, the dollar has been worth as much as 120 yen and as little as 80.

The costs of this volatility are hard to measure (partly because sophisticated financial markets allow businesses to hedge much of that risk) [O brave New World, that has such derivative sophisticates in it. - Jesse] but they must be significant. Furthermore, a system that leaves monetary managers free to do good also leaves them free to be irresponsible—and, in some countries, they have been quick to take the opportunity." [Yes, THOSE countries may experience a financial collapse because of a monetary credit bubble, no doubt because of a lack of economic sophisticates. - Jesse]

Paul Krugman, The Goldbug Variations, 22 November 1996

Be Ready To Mint That Coin

By Paul Krugman

January 7, 2013

Should President Obama be willing to print a $1 trillion platinum coin if Republicans try to force America into default? Yes, absolutely. He will, after all, be faced with a choice between two alternatives: one that’s silly but benign, the other that’s equally silly but both vile and disastrous. The decision should be obvious.

For those new to this, here’s the story. First of all, we have the weird and destructive institution of the debt ceiling; this lets Congress approve tax and spending bills that imply a large budget deficit — tax and spending bills the president is legally required to implement — and then lets Congress refuse to grant the president authority to borrow, preventing him from carrying out his legal duties and provoking a possibly catastrophic default.

And Republicans are openly threatening to use that potential for catastrophe to blackmail the president into implementing policies they can’t pass through normal constitutional processes.

Enter the platinum coin. There’s a legal loophole allowing the Treasury to mint platinum coins in any denomination the secretary chooses. Yes, it was intended to allow commemorative collector’s items — but that’s not what the letter of the law says. And by minting a $1 trillion coin, then depositing it at the Fed, the Treasury could acquire enough cash to sidestep the debt ceiling — while doing no economic harm at all...

Read the rest here.

"In case you're not familiar with this idea: In general, the Treasury Department is not allowed to just print money if it feels like it. It must defer to the Federal Reserve's control of the money supply. But there is an exception: Platinum coins may be struck with whatever specifications the Treasury secretary sees fit, including denomination.Currently it is against the laws of the land for the Treasury to issue debt, and for the Fed to buy it directly, as opposed to running that debt through the test and discipline of the markets. I researched this a number of years ago, and do not recall the particular law offhand, but in effect the Treasury cannot sell debt directly to the Fed. It must pass through the marketplace first to be valued.

This law was intended to allow the production of commemorative coins for collectors. But it can also be used to create large-denomination coins that Treasury can deposit with the Fed to finance payment of the government's bills, in lieu of issuing debt."

Rolling Stone

Secret and Lies of the Bailout

By Matt Taibbi

January 4, 2013

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you'd think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we've been told, but the money has all been paid back, and the government even made a profit. No harm, no foul – right?

Wrong.

It was all a lie – one of the biggest and most elaborate falsehoods ever sold to the American people. We were told that the taxpayer was stepping in – only temporarily, mind you – to prop up the economy and save the world from financial catastrophe. What we actually ended up doing was the exact opposite: committing American taxpayers to permanent, blind support of an ungovernable, unregulatable, hyperconcentrated new financial system that exacerbates the greed and inequality that caused the crash, and forces Wall Street banks like Goldman Sachs and Citigroup to increase risk rather than reduce it. The result is one of those deals where one wrong decision early on blossoms into a lush nightmare of unintended consequences. We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

How Wall Street Killed Financial Reform

But the most appalling part is the lying. The public has been lied to so shamelessly and so often in the course of the past four years that the failure to tell the truth to the general populace has become a kind of baked-in, official feature of the financial rescue. Money wasn't the only thing the government gave Wall Street – it also conferred the right to hide the truth from the rest of us. And it was all done in the name of helping regular people and creating jobs. "It is," says former bailout Inspector General Neil Barofsky, "the ultimate bait-and-switch."

The bailout deceptions came early, late and in between. There were lies told in the first moments of their inception, and others still being told four years later. The lies, in fact, were the most important mechanisms of the bailout. The only reason investors haven't run screaming from an obviously corrupt financial marketplace is because the government has gone to such extraordinary lengths to sell the narrative that the problems of 2008 have been fixed. Investors may not actually believe the lie, but they are impressed by how totally committed the government has been, from the very beginning, to selling it.

THEY LIED TO PASS THE BAILOUT

Today what few remember about the bailouts is that we had to approve them. It wasn't like Paulson could just go out and unilaterally commit trillions of public dollars to rescue Goldman Sachs and Citigroup from their own stupidity and bad management (although the government ended up doing just that, later on). Much as with a declaration of war, a similarly extreme and expensive commitment of public resources, Paulson needed at least a film of congressional approval. And much like the Iraq War resolution, which was only secured after George W. Bush ludicrously warned that Saddam was planning to send drones to spray poison over New York City, the bailouts were pushed through Congress with a series of threats and promises that ranged from the merely ridiculous to the outright deceptive. At one meeting to discuss the original bailout bill – at 11 a.m. on September 18th, 2008 – Paulson actually told members of Congress that $5.5 trillion in wealth would disappear by 2 p.m. that day unless the government took immediate action, and that the world economy would collapse "within 24 hours."

To be fair, Paulson started out by trying to tell the truth in his own ham-headed, narcissistic way. His first TARP proposal was a three-page absurdity pulled straight from a Beavis and Butt-Head episode – it was basically Paulson saying, "Can you, like, give me some money?" Sen. Sherrod Brown, a Democrat from Ohio, remembers a call with Paulson and Federal Reserve chairman Ben Bernanke. "We need $700 billion," they told Brown, "and we need it in three days." What's more, the plan stipulated, Paulson could spend the money however he pleased, without review "by any court of law or any administrative agency."

The White House and leaders of both parties actually agreed to this preposterous document, but it died in the House when 95 Democrats lined up against it. For an all-too-rare moment during the Bush administration, something resembling sanity prevailed in Washington.

So Paulson came up with a more convincing lie. On paper, the Emergency Economic Stabilization Act of 2008 was simple: Treasury would buy $700 billion of troubled mortgages from the banks and then modify them to help struggling homeowners. Section 109 of the act, in fact, specifically empowered the Treasury secretary to "facilitate loan modifications to prevent avoidable foreclosures." With that promise on the table, wary Democrats finally approved the bailout on October 3rd, 2008. "That provision," says Barofsky, "is what got the bill passed."

But within days of passage, the Fed and the Treasury unilaterally decided to abandon the planned purchase of toxic assets in favor of direct injections of billions in cash into companies like Goldman and Citigroup. Overnight, Section 109 was unceremoniously ditched, and what was pitched as a bailout of both banks and homeowners instantly became a bank-only operation – marking the first in a long series of moves in which bailout officials either casually ignored or openly defied their own promises with regard to TARP.

Congress was furious. "We've been lied to," fumed Rep. David Scott, a Democrat from Georgia. Rep. Elijah Cummings, a Democrat from Maryland, raged at transparently douchey TARP administrator (and Goldman banker) Neel Kashkari, calling him a "chump" for the banks. And the anger was bipartisan: Republican senators David Vitter of Louisiana and James Inhofe of Oklahoma were so mad about the unilateral changes and lack of oversight that they sponsored a bill in January 2009 to cancel the remaining $350 billion of TARP.

So what did bailout officials do? They put together a proposal full of even bigger deceptions to get it past Congress a second time. That process began almost exactly four years ago – on January 12th and 15th, 2009 – when Larry Summers, the senior economic adviser to President-elect Barack Obama, sent a pair of letters to Congress. The pudgy, stubbyfingered former World Bank economist, who had been forced out as Harvard president for suggesting that women lack a natural aptitude for math and science, begged legislators to reject Vitter's bill and leave TARP alone.

In the letters, Summers laid out a five-point plan in which the bailout was pitched as a kind of giant populist program to help ordinary Americans. Obama, Summers vowed, would use the money to stimulate bank lending to put people back to work. He even went so far as to say that banks would be denied funding unless they agreed to "increase lending above baseline levels." He promised that "tough and transparent conditions" would be imposed on bailout recipients, who would not be allowed to use bailout funds toward "enriching shareholders or executives." As in the original TARP bill, he pledged that bailout money would be used to aid homeowners in foreclosure. And lastly, he promised that the bailouts would be temporary – with a "plan for exit of government intervention" implemented "as quickly as possible."

The reassurances worked. Once again, TARP survived in Congress – and once again, the bailouts were greenlighted with the aid of Democrats who fell for the old "it'll help ordinary people" sales pitch. "I feel like they've given me a lot of commitment on the housing front," explained Sen. Mark Begich, a Democrat from Alaska...

Read the rest here.