15 February 2013

14 February 2013

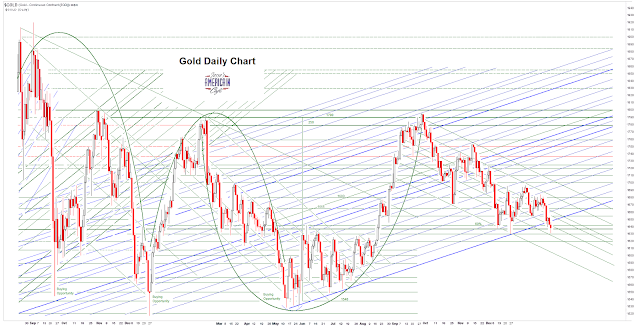

Gold Daily and Silver Weekly Charts - The Art of Currency War

“Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.”

Carroll Quigley, Tragedy and Hope, p. 278

"Of course, convergence of finance and monopoly capitalism with monopoly communism was always the long-range goal of the Money Power, as William Gladstone called them...

The conflict between the East and West was designed to scare the people of the world into accepting a convergence of these two monopoly systems of authoritarian power. The end result was to be a new Imperial Order and a New World Empire run by an elite self-perpetuating oligarchies from the leading nations of the earth."

Carroll Quigley, Tragedy and Hope, p. 860

Crazy, huh? Quigley was a professor of history at Georgetown University, and was a mentor to Bill Clinton, having recommended him for his Rhodes scholarship.

It seems a bit less crazy today than it did when I first read this in the 1990's.

Speaking of quotes, this particular quote came to mind today as I thought about the metals markets.

“Appear weak when you are strong, and strong when you are weak.”Why the big show of control over the markets? It is fairly obvious if you watch the daily action on the tape.

Sun Tzu, The Art of War

I *think* that the financial system is quietly unraveling behind the scenes again, and that at some point this great complacency is going to break, and hard. But the gaming will continue until something provokes a change in the short term equilibrium, which I believe is false.

I will not be surprised to see a final big move to run the stops to the downside in the precious metals, and take additional shares and units of paper claims before the markets break free.

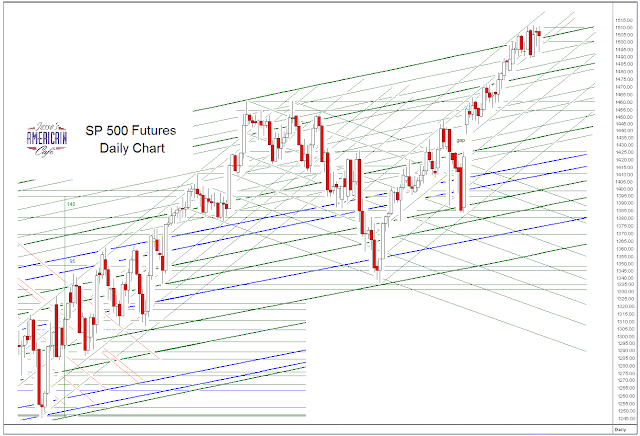

SP 500 and NDX Futures Daily Charts - Option Expiration

"Another cause of today’s instability is that we now have a society in America, Europe and much of the world which is totally dominated by the two elements of sovereignty that are not included in the state structure: control of credit and banking, and the corporation.

These are free of political controls and social responsibility and have largely monopolized power in Western Civilization and in American society. They are ruthlessly going forward to eliminate land, labor, entrepreneurial-managerial skills, and everything else the economists once told us were the chief elements of production.

The only element of production they are concerned with is the one they can control: capital."

Carroll Quigley, Oscar Iden Lecture Series 3, 1976

The equity markets are awash in liquidity, but it remains somewhat narrow, its success due to the 'lack of selling' moreso than a breadth of participation. In other words, well-heeled banks and hedge funds are gaming the system higher, using levered instruments like the SP 500 futures for example.

Conversely, the metals markets are being used like their personal ATM.

Let's see how long they can keep this up, before we see another 'wash and rinse' cycle.

As a reminder, Monday 18 February is a national holiday in the US.

13 February 2013

Echoes of the Past In The Economist - The Return of the Übermenschen

"There is not a more perilous or immoral habit of mind than the sanctifying of success."

Lord Acton

Just when you think the oligarchy could not become any more audacious.

'Slow mobility' as used in this essay from this recent issue of The Economist implies a natural class structure amongst people.

It suggest that a child would only slowly, and not usually, rise above the station of their parents and grandparents, presumably in terms of wealth, education, and opportunity. If you are born to poor parents, you are likely of an inferior genetic quality, poor stock, your success unlikely, and your servile station or poverty pre-destined.

The reason for this is because the children of 'the elite' will have 'inherited the talent, energy, drive, and resilience to overcome the many obstacles they will face in life.'

These inherited gifts are supplemented, of course, by the easy opportunities, valuable connections, and access to power. And a virtual freedom from prosecution does not hurt either, in case they have inherited a penchant for sociopathy, or something worse, along with their many gifts.

And by inference, the children of the poor will not do well, because they are genetically inferior. These are the pesky 47% who deserve to be cheated and robbed by the elite, because of the inherent superiority of the one percent. There is no fraud in the system, only good and bad breeding, natural predator and prey.

This line of thinking rests on the assumption that society today is a naturally efficient meritocracy, despite the enormous advantages of the children of 'the elite,' because they would have succeeded anyway.

I succeed, therefore I am. And if you do not, well, we shall have to do something about that drag on the efficiency of the economy and the maximization of profits. Ah, the burdens of the aristocracy, and their far flung sahibs.

This essay concerns me greatly, because such thoughts echo throughout the Anglo-American culture of late. They are whispered in the evolving mythos of those favored few who enjoy certain völkisch advantages, presumably justified by the nature of their blood.

We have seen this kind of sociology before, as the justification for the widespread looting of wealth, the ransacking of nations, and the neglect, ghetto-ization, and murder of marginalized people.

Never again. Until we allow it, because we think it serves our purposes. But the madness serves none but itself.

"Many commentators automatically assume that low intergenerational mobility rates represent a social tragedy. I do not understand this reflexive wailing and beating of breasts in response to the finding of slow mobility rates.

The fact that the social competence of children is highly predictable once we know the status of their parents, grandparents and great-grandparents is not a threat to the American Way of Life and the ideals of the open society.

The children of earlier elites will not succeed because they are born with a silver spoon in their mouth, and an automatic ticket to the Ivy League.

They will succeed because they have inherited the talent, energy, drive, and resilience to overcome the many obstacles they will face in life. Life is still a struggle for all who hope to have economic and social success. It is just that we can predict who will be likely to possess the necessary characteristics from their ancestry."

Greg Clark, The Economist, 13 Feb. 2013

Mr. Clark is now a professor of economics and department chair until 2013 at the University of California, Davis. His areas of research are long term economic growth, the wealth of nations, and the economic history of England and India.

"During this time, a growing professional class believed that scientific progress could be used to cure all social ills, and many educated people accepted that humans, like all animals, were subject to natural selection. Darwinian evolution viewed humans as a flawed species that required pruning to maintain its health. Therefore negative eugenics seemed to offer a rational solution to certain age-old social problems."

David Micklos, Elof Carlson, Engineering American Society: The Lesson of Eugenics

“With savages, the weak in body or mind are soon eliminated; and those that survive commonly exhibit a vigorous state of health. We civilised men, on the other hand, do our utmost to check the process of elimination; we build asylums for the imbecile, the maimed, and the sick; we institute poor-laws; and our medical men exert their utmost skill to save the life of every one to the last moment.

There is reason to believe that vaccination has preserved thousands, who from a weak constitution would formerly have succumbed to small-pox. Thus the weak members of civilised societies propagate their kind. No one who has attended to the breeding of domestic animals will doubt that this must be highly injurious to the race of man.

It is surprising how soon a want of care, or care wrongly directed, leads to the degeneration of a domestic race; but excepting in the case of man himself, hardly any one is so ignorant as to allow his worst animals to breed.

The aid which we feel impelled to give to the helpless is mainly an incidental result of the instinct of sympathy, which was originally acquired as part of the social instincts, but subsequently rendered, in the manner previously indicated, more tender and more widely diffused. Nor could we check our sympathy, if so urged by hard reason, without deterioration in the noblest part of our nature. The surgeon may harden himself whilst performing an operation, for he knows that he is acting for the good of his patient; but if we were intentionally to neglect the weak and helpless, it could only be for a contingent benefit, with a certain and great present evil.

Hence we must bear without complaining the undoubtedly bad effects of the weak surviving and propagating their kind; but there appears to be at least one check in steady action, namely the weaker and inferior members of society not marrying so freely as the sound; and this check might be indefinitely increased, though this is more to be hoped for than expected, by the weak in body or mind refraining from marriage.”

Charles Darwin, The Descent of Man

Category:

Aktion T4,

audacious oligarchy,

banality of evil,

Eugenics,

one percent,

Power Elite

Gold Daily and Silver Weekly Charts

“We Americans are not usually thought to be a submissive people, but of course we are.

Why else would we allow our country to be destroyed? Why else would we be rewarding its destroyers? Why else would we all — by proxies we have given to greedy corporations and corrupt politicians — be participating in its destruction?

Most of us are still too sane to piss in our own cistern, but we allow others to do so and we reward them for it. We reward them so well, in fact, that those who piss in our cistern are wealthier than the rest of us.”

Wendell Berry

12 February 2013

State of the Union Message: Tonight Was the Wish List

Tonight's State of the Union was the 'wish list.'

And there were some very fine and workable ideas contained in that avalanche of possibilities.

Tomorrow begins the hard work of coming up with a 'prioritized list.'

And the shame is that many of the good ideas are not constrained so much by budget, or capability, but by special interests and ideologies, and petty jealousies and in-fighting.

And I hate to say, a growing mindset amongst the powerfully fortunate that if something does not directly benefit them in the short term by increasing their wealth and power, then it must be stopped no matter what, and the rest be damned.

And that, ladies and gentlemen, is the essence of politics, at its worst in dysfunctional organizations, companies and countries that are set against themselves, in all its inglorious ugliness. And it is a deadly entangling embrace, given the fallen state of the human condition, and the pure damned cussedness of people.

Let the games begin.

Gold Daily and Silver Weekly Charts - Plus Ca Change...

"The greatest triumph of the banking industry wasn’t ATMs or even depositing a check via the camera of your mobile phone. It was convincing Treasury and Justice Department officials that prosecuting bankers for their crimes would destabilize the global economy.”

Barry Ritholtz

As a reminder, this is a stock option expiration week.

Obama's State of the Union message this evening. Regards to the staffers watching their bosses at Bullfeathers.

There was a hit on the metals but they clawed their way back.

I include the VIX here just to show the complacency and the likely cause for the divergence between stocks and the metals. Its a 'risk on' thing and its has been going on since the Republicans blinked on the fiscal cliff.

SP 500 and NDX Futures Daily Charts - Complacency By the VIX

"The man who knows the truth and has the opportunity to tell it, but who nonetheless refuses to, is among the most shameful of all creatures."

Theodore Roosevelt

VIX is back to the lows, and SP back to new highs, although the NDX remains a big 'non-confirm.'

Japan's Finance Minister says he would like to see a 17% rally on the Nikkei by the end of March.

I suspect that Bernanke is already doing his thing and inflating another asset bubble. The only question is how long can it last, and ignore the lack of recovery.

State of the Union tonight. Set your expectations low.

As a reminder this is a stock option expiration week.

11 February 2013

Gold Daily and Silver Weekly Charts - G7 'All Is Well' - Raid in Honor of Chinese New Year

Obama will deliver the State of the Union address tomorrow.

This week is a stock market expiration week.

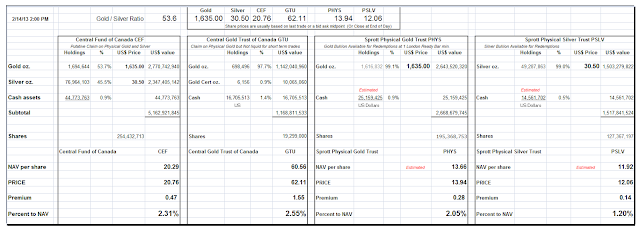

Eric Sprott sees the gold scrap market drying up, and a default coming on the COMEX.

The G7 issued a statement ahead of their meeting in Moscow saying that there would be no escalation in the currency war.

To paraphrase Orwell, economic language 'is designed to make lies sound truthful and to give an appearance of solidity to pure wind.'

When the G7 show us a workable, sustainable solution to the reserve currency crisis, that is acceptable to the world at large including the BRICs, perhaps one might tend to take their diplomatic dispatches more seriously.

Meanwhile, the currency war continues as the Anglo-American economic empire, its multinational companies, and its client states resist change and reform at every opportunity in order to support a broken and corrupt financial system.

Expecting the Unexpected: A Litany In Times of Plague - Diogenes the Dog

Caroline Baum has an interesting interview with economist Edmund Phelps titled, Expecting the Unexpected.

I have linked to it, but given the dismal sounding nature of the topic I suspect many would bypass it.

It is one of the better pieces by Caroline Baum which I have seen. Perhaps it is because she allows Phelps to speak in his own words at such length, and asks her questions well and in deference to the knowledge of the speaker, probingly.

I find it a bit discouraging that there is no mention of the tremendous effort that is made to hide information and to distort it wilfully, to manage perception, and to circumvent the rules through fraudulent behaviour. And as we have seen,

That seems a little worse than naive, given that we live in the shadow of a pandemic of fraud and manipulation in the markets, from CDO to LIBOR. I think it is a mistake to assume good faith and an excess of virtue when very large sums of money are involved, especially in a relativistic culture where greed speaks lies to deceit.

This trend to faux arithmetic determinism by making reality crushing assumptions in economics has been cited by many including Nassim Taleb of course, and mathematician Benoit Mandelbrot in The Misbehaviour of Markets. which pretty well takes some of the pretensions of the Chicago School apart, piece by piece.

Here are a few interesting excerpts.

Expecting the Unexpected: An Interview With Edmund Phelps

By Caroline Baum

Feb 11, 2013

In 2006, the Royal Swedish Academy of Sciences awarded the Nobel Memorial Prize in Economic Sciences to Edmund Phelps "for his analysis of intertemporal tradeoffs in macroeconomic policy." Phelps showed that, contrary to the original Phillips curve, there is no long-run trade-off between inflation and unemployment, only a short-term one. Translated into lay speech: You can fool some of the people some of the time and reduce unemployment by paying workers what looks like a higher wage. Eventually, they wise up to the fact that their higher nominal wage is a function of higher inflation, not a higher real wage. Unemployment reverts to its so-called natural rate.

Phelps is the director of Columbia University's Center on Capitalism and Society. I talked with him over the phone on Jan. 25 and Feb. 4 about his views on rational expectations: the notion that people’s expectations of economic outcomes are generally right and policy makers can’t outsmart the public....

Q: So how did adaptive expectations morph into rational expectations?

A: The "scientists" from Chicago and MIT came along to say, we have a well-established theory of how prices and wages work. Before, we used a rule of thumb to explain or predict expectations: Such a rule is picked out of the air. They said, let's be scientific. In their mind, the scientific way is to suppose price and wage setters form their expectations with every bit as much understanding of markets as the expert economist seeking to model, or predict, their behavior. The rational expectations approach is to suppose that the people in the market form their expectations in the very same way that the economist studying their behavior forms her expectations: on the basis of her theoretical model.

Q: And what's the consequence of this putsch?

A: Craziness for one thing. You’re not supposed to ask what to do if one economist has one model of the market and another economist a different model. The people in the market cannot follow both economists at the same time. One, if not both, of the economists must be wrong. Another thing: It’s an important feature of capitalist economies that they permit speculation by people who have idiosyncratic views and an important feature of a modern capitalist economy that innovators conceive their new products and methods with little knowledge of whether the new things will be adopted -- thus innovations. Speculators and innovators have to roll their own expectations. They can’t ring up the local professor to learn how. The professors should be ringing up the speculators and aspiring innovators. In short, expectations are causal variables in the sense that they are the drivers. They are not effects to be explained in terms of some trumped-up causes.

Q: So rather than live with variability, write a formula in stone!

A: What led to rational expectations was a fear of the uncertainty and, worse, the lack of understanding of how modern economies work. The rational expectationists wanted to bottle all that up and replace it with deterministic models of prices, wages, even share prices, so that the math looked like the math in rocket science. The rocket’s course can be modeled while a living modern economy’s course cannot be modeled to such an extreme. It yields up a formula for expectations that looks scientific because it has all our incomplete and not altogether correct understanding of how economies work inside of it, but it cannot have the incorrect and incomplete understanding of economies that the speculators and would-be innovators have...

Q: One of the issues I have with rational expectations is the assumption that we have perfect information, that there is no cost in acquiring that information. Yet the economics profession, including Federal Reserve policy makers, appears to have been hijacked by Robert Lucas.

A: You’re right that people are grossly uninformed, which is a far cry from what the rational expectations models suppose. Why are they misinformed? I think they don’t pay much attention to the vast information out there because they wouldn’t know what to do what to do with it if they had it. The fundamental fallacy on which rational expectations models are based is that everyone knows how to process the information they receive according to the one and only right theory of the world. The problem is that we don't have a "right" model that could be certified as such by the National Academy of Sciences. And as long as we operate in a modern economy, there can never be such a model...

Q: In the world envisioned by rational expectations, there would be no hyperinflation, no panics, no asset bubbles? Is that right?

A: When I was getting into economics in the 1950s, we understood there could be times when a craze would drive stock prices very high. Or the reverse: An economy in the grip of weak business confidence, weak investment, would lead to loss of jobs in the capital-goods sector. But now that way of thinking is regarded by the rational expectations advocates as unscientific.

By the early 2000s, Chicago and MIT were saying we've licked inflation and put an end to unhealthy fluctuations –- only the healthy “vibrations” in rational expectations models remained. Prices are scientifically determined, they said. Expectations are right and therefore can't cause any mischief.

At a celebration in Boston for Paul Samuelson in 2004 or so, I had to listen to Ben Bernanke and Oliver Blanchard, now chief economist at the IMF, crowing that they had conquered the business cycle of old by introducing predictability in monetary policy making, which made it possible for the public to stop generating baseless swings in their expectations and adopt rational expectations. My work on how wage expectations could depress employment and how asset price expectations could cause an asset boom and bust had been disqualified and had to be cleansed for use in the rational expectations models.

Read the entire interview here.

The Tale of Alexander and Diogenes

There is a famous and almost certainly apocryphal story about the cynic philosopher, Diogenes, which was related to us by Plutarch.

As you know, Diogenes believed in the mastery of the self. He was considered to be eccentric and did outlandish things such as walking about Athens in the daytime with a lit lamp, 'looking for an honest man.'

"According to one story, Diogenes went to the Oracle at Delphi to ask for its advice and was told that he should 'deface the currency.' Following the debacle in Sinope, Diogenes decided that the oracle meant that he should deface the political currency rather than actual coins.He was said to have lived simply, 'like a dog,' and that this is how the Cynic school of philosophy received its name.

He traveled to Athens and made it his life's goal to challenge established customs and values. He argued that instead of being troubled about the true nature of evil, people merely rely on customary interpretations."

The name Cynic derives from ancient Greek κυνικός (kynikos), meaning "dog-like", and κύων (kyôn), meaning "dog."In his later life Diogenes was visited in Corinth by Alexander the Great, the king of Macedonia, who would go on to conquer Egypt and India.

Diogenes had been sitting in the sunshine, when Alexander walked up to him and asked what he might do for him, given his deprived state, because he owned only his cloak, having discarded his bowl when he saw a child drinking from cupped hands.

Diogenes looked up at Alexander and said, "You can stand aside, so as not to rob me of the light by your shadow."

Alexander's guards and followers were scandalized at such blatant disrespect for a king.

And Diogenes asked them, 'Is your lord a good man or a bad man?' 'Good!' they said. 'Then my request is reasonable,' said Diogenes.

And the guards were ready to deal with him harshly, because the implication was that Alexander stood between the people and their natural lives by his own willful pursuit of wealth and power, which was a favorite theme of Diogenes.

But Alexander intervened on the philosopher's behalf, saying, 'If I were not Alexander, I would be Diogenes,' to which Diogenes replied, 'If I were not Diogenes, I should also wish to be Diogenes.'

Diogenes died at age 89, owning little more than his cloak and his reputation.

After leaving Greece, Alexander went on to conquer most of the known world, and took the Persian title, King of Kings. Alexander died of an unknown illness, perhaps caused by drinking too much, or poison, or his recurrent malaria, in the palace of Nebuchadrezzar II of Babylon, a few months short of age 33.

There is another version of the meeting between Alexander and Diogenes. In it, Diogenes was staring at a pile of human bones when Alexander approached, and asked him what he was doing. "I am searching for the bones of your father," said Diogenes, "but cannot distinguish them from those of a slave.”

The Corinthians built a pillar in Diogenes memory, on the top of which was a dog made of Parian marble.

And so passed the glory of Greece, and the grandeur of Rome.

09 February 2013

Neil Barofsky: Extended Interview On the Daily Show

And as an extra here is Neil Barofsky's Bloomberg interview on S&P's Corrupt Business Model.

And below the Extended Two Part interview on the Daily Show.

08 February 2013

Gold Daily and Silver Weekly Charts - Risk On

As they were saying on financial television today, stocks are the great play for the hot money, risk-eating crowd. And There Is No Alternative (TINA) so you have to be a big money playah and an aspiring rentier in this economy.

It's blue skies for the one percent.

Have a pleasant weekend.

07 February 2013

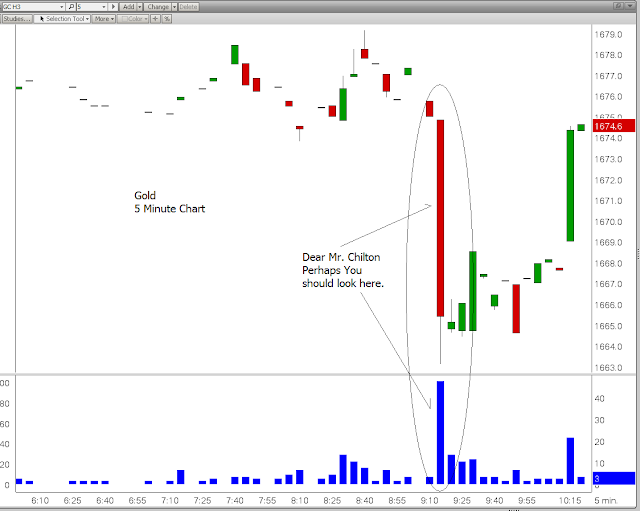

Gold Daily and Silver Weekly Charts - CFTC Finally Does Something About Market Manipulation

Intraday commentary about that very clumsy Dr. Evil style hit on the open of the gold market here.

Speaking of the CFTC, it appears that those fine fellows have finally done something about the obvious and blatant manipulation that all too often plagues the futures markets in commodities.

That's right, the CFTC is joining a defense motion to dimiss the $30 million fine levied against the Amaranth trader who was caught manipulating the natural gas market. Why?

Because the CFTC and the trader's defense attorneys contend that the Federal Energy Regulatory Commission should not be investigating market manipulation in futures, because not doing anything about it is within the jurisidction of the CFTC.

Hey, nobody can touch our crooks but us, and we're too busy and understaffed to do it. Now that's industry friendly!

Ex-Amaranth Trader, CFTC Unite to Ask Court to Toss Fine

By Tom Schoenberg & Brian Wingfield

Feb 7, 2013

A former natural-gas trader at Amaranth Advisors LLC, backed by the U.S. Commodity Futures Trading Commission, asked a federal appeals court to overturn a $30 million fine imposed by another regulator over alleged manipulation of the gas-futures market.

In a case that could determine the limits of the Federal Energy Regulatory Commission’s power to punish market manipulation, a lawyer for Brian Hunter told a three-judge panel in Washington today that the CFTC has sole jurisdiction over futures trading on the New York Mercantile Exchange. The CFTC, which filed papers supporting Hunter, also argued today.

“There was no notice, much less fair notice, to Brian Hunter that his conduct was being regulated by FERC,” Hunter’s lawyer, Michael Kim of Kobre & Kim LLP, said during the 40- minute argument.

The dispute highlights FERC’s growing role as a regulatory enforcer. Congress beefed up the agency’s powers in 2005 to ensure order in the energy trading markets after Enron Corp. traders triggered California blackouts earlier in the decade. Since January 2011, the commission has publicly disclosed 13 investigations it has conducted of alleged market manipulation....

Read the rest here.

Dear Mr. Chilton, RE the Gold Market In NY This Morning

"If you follow issues like Too-Big-To-Fail or Wall Street corruption long enough, you realize that the reason things don't get done about them by our government has very little to do with ideology or even politics, in the way most of us understand politics.

Instead, it's a bizarre, almost tribal mentality that rules our capital city – a kind of groupthink that makes extreme myopia and a willingness to ignore the tribe's ostensible connection to the people who elected them a condition for social advancement within."

Matt Taibbi, Neil Barofsky's Adventure in Groupthink

Personally I think this is the corrosive influence of the credibility trap, the amorality of careerism, and of course, an ambivalence towards white collar corruption as the inherent entitlement of privilege. There seems to have been a shift in perspective amongst the new ruling class from noblesse oblige to droit du seigneur. This is what Robert Johnson calls 'the audacious oligarchy.'

While it is recovering much of this sudden, five minute loss even now, with spot back to 1680 already, the hit on the gold market in the New York trade this morning was fairly blatant.

Perhaps it was just some innocent who had the desire to drop a boatload of contracts into a quiet market, and knock the price down while maximizing their selling loss. Or another 'fat finger' mishap, which seem to happen quite a bit around option expiration for example.

Or perhaps it was some wiseguy trader who looked at the market, having some advantageous insight into the order books, and decided to 'run the stops.'

Thank God the US has the CFTC, whose job it is to look at this sort of thing and to tell us whether it was legitimate, or not.

And we should hear back about this, perhaps as early as January, 2017. And maybe even sooner on this one: 24 Tonnes of Paper Gold Dumped at Market

But it is nice to see that the CFTC is doing something. They are asking the court to overturn the $30 million fine on the Amaranth trader who was caught manipulating the natural gas market, because another regulator did their job for them.

And how is that MF Global investigation going by the way?

Category:

audacious oligarchy,

bart chilton,

Dr. Evil,

gold manipulation

Subscribe to:

Comments (Atom)