12 December 2008

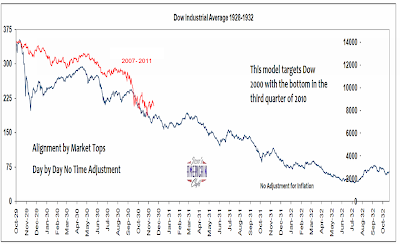

Comparison of 1928-32 and 2007-11

There are important differences in the nature of the declines. The current series looks like a bear market in the form of 1973-4 whereas 1929-32 was much more precipitous. This may be attributed to the extraordinary actions of the FED and Treasury. However, this may only soften the blow and not the outcome, most likely adjusted for inflation.

The Intraday Volatility matches up nicely so far as we have aligned them Peak to Peak without regard to pricing. It will be in the market action going forward where the model will be assessed here.

If You Use Levered ETFs Read This

Thanks to Paul Kedrosky for a clear and useful analysis.

Levered ETFs, with the various targeted multipliers, reset their basis at the end of each trading day, which means that you are levered up only for that day.

This can have some remarkable and counter-intuitive results over a trend.

There is also a signficant amount of intraday slippage in volatile markets.

More Fun with Levered ETFs - Paul Kedrosky - Seeking Alph