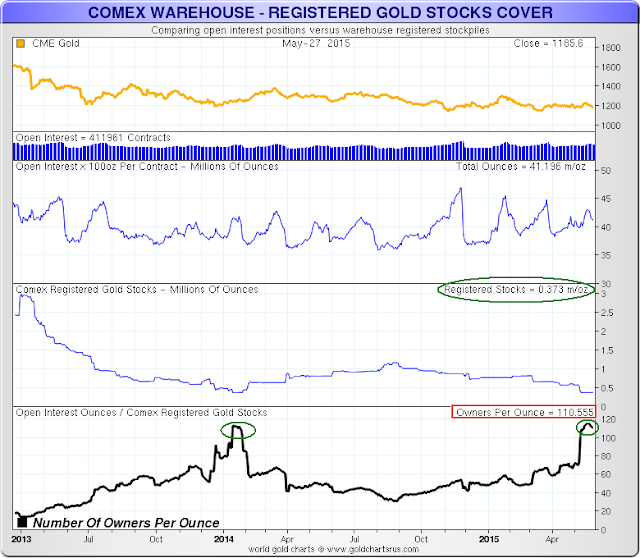

With a potential 111 claims per ounce of gold marked 'registered' for delivery at these prices, one might expect to see quite a move higher in prices to reach a market clearing price, and perhaps even a significant short squeeze.

But we probably will not see any such short squeeze, and maybe not even a breakout from this price range, unless something unusual happens outside of the New York and London markets.

The Comex, aka The Bucket Shop on the Hudson, does not set prices in the usual supply and demand dynamics. And London and New York are playing a tag team with any number of markets these days, from forex to LIBOR to bonds.

Gold could break out in a big way. It would not take all that much for a large hedge fund, or even a well-heeled world class individual, to turn about three thousand of those contracts in for delivery AND take the gold bullion out of the warehouses, moving them to Asia and pocketing a substantial profit on the gain.

This assault on an unsustainable price peg is how Soros and associates in Zurich took the Bank of England for over a billion in their selling of the pound against an unrealistic price point.

Why doesn't anything like this happen?

Is it because people do not have the money to do it? In times of billion dollar art auctions and $500M homes being built on spec? Don't make us laugh.

Is it because people do not want gold bullion? The Shanghai Gold Exchange is routinely moving physical thirty to forty tonnes per week out of its warehouses. Thirty tonnes is about 965,000 troy ounces, about three times the total deliverable at the Comex now in total.

No, it will probably not happen because the big money has been warned off the Banks' turf, and their game is to keep the wash and rinse price cycles running to provide a steady profit as long as they can.

As long as price is the 'only component' in the market dynamics, with demand and supply artificially dampened by a 'no withdrawals' house rules, the liar's pokers carney games based on very loosely regulated price action can continue.

It is not all that dissimilar to a poker game in which there are unlimited raises, the rule of table stakes does not apply, and one does not have to show their cards, and can only be called if the house allows it. Those with the biggest wallets can keep selling paper gold as long as they wish at whatever price they wish, and never have to even show their cards, and cannot effectively be called unless they permit it.

I know this example is a bit rough, but not all that much. It almost looks like a scam, rigged in favor of the deepest pocketed players, doesn't it? And what if they get additional information about the hands of the other players and the size of their wallets. Well, now you know why I consider those smaller players who keep coming back to the action in that casino to be a bit out of touch.

So the bullion banks and their friends can keep cranking out steady profits while holding bullion prices within a range that is a comfort to the nervous money printers in the Federal Reserve. This keeps the government happy, the regulators off their backs so to speak, and the wash and rinse cycles rolling.

The reason why this sort of imbalance could get sorted out in the currency markets but not in commodities is illustrated by the relative experiences of George Soros and the Hunt Brothers.

Lucky for Soros that the forex markets are so broad and deep that no single group of cronies can control the exchange rules in the 'cash markets' to suit their plays. Yes some central banks can make it quite risky, even painful, but the solution is not so neat as what happened in with the Hunt Brothers and silver. There the exchange the US regulators just changed the rules of the game and that was that.

If one were to do something about a price imbalance in a commodities market, as opposed to an unregulated global market, you would tend to wish to do it off exchange by slowly accumulating a large portion of the available global supply, as quietly as possible. This only works obviously with a commodity that has inherently has a relatively stable supply.

The spoiler in the gold paper game might then be expected to be those 'outside' the range of the gold pool. They are those who do not do their business primarily in the betting parlors of New York and London.

If one cannot secure a sizable portion of supply via paper on the exchange where the cronies make the rules, one just cuts out the middlemen and buys it directly, and it works as long as they do it off exchange and have an unimpeachable line of credit. And then one would keep stacking their physical metal while enjoying what they think are very attractive prices.

Some analysts think that they know 'what China wants.' Who is China? Have the Chinese had a meeting and hammered out a single, unified policy plan? How about the Americans, and the Russians? Or are there various competing domestic factions in every country? And even more significantly perhaps, are there special interest groups, a self-defining elite, without preferences except for themselves? As you can see this is a complex scenario with many variables.

And in compressing the complexity of the scenario, we lose information and applicability, always, and sometimes intentionally. Simple sells, and is successful depending on your sales objective. Nothing was simpler and more powerful than the efficient markets hypothesis with perfectly rational actors. It led to an otherworldly market ideology that caused one of the greatest financial crises in history.

This is not the first time we have seen such a de facto pooling arrangement. There was the London Gold Pool, which sought to 'stabilize the gold price' at $35 dollars from 1961 until it collapsed in 1968. That mispricing caused a 'run' on the gold in the US, and led to the Nixon shock in 1971, the closing of the gold window, and the eventual rise in the price of gold to $850 in 1980.

Or we could point to the long bear market in gold, which reached its trough with the sale of England's gold in Brown's Bottom around $250 between 1999-and 2002, This was resolved with the so-called Washington Agreement, which provided a plan for more measured selling and leasing of Western central bank gold to control the price of bullion largely amongst the Europeans.

Their intention was to have had this agreement continue until 2009, but alas, the rising economies of Asia and the BRICS were not sharing their vision of the future. And so the purchasing of central bank gold reserves turned positive for the first time in over twenty years around 2006-7, ahead of the collapse of the US housing and credit bubble.

As you may recall, gold subsequently rose to around $1900 in a fairly short period of time, and has now fallen back to the current price range in dollars of $1180-1230.

And where are we now?

The BRICS are still buying. There is quite a bit of secrecy and jawboning surrounding the actual levels of bullion available and unencumbered in the Western central banks. The IMF, a ringmaster for the States if you will, has offered (threatened) to sell the same gold on about ten occasions.

Not all the Western banks are holding to plan. Some are even taking the unusual steps of repatriating their gold from the Anglo-American vaults where it has been since the Second World War. They fear that if things go off the rails, and there is a reckoning of ownership claims, possession will once again be nine-tenths of the law.

It will be interesting to see where the market forces take us eventually, if they are allowed to do so. I do not assume necessarily that they will.

However the fact remains that the existing 'Bretton Woods II' de facto reserve currency arrangement for global trade, based on a fiat US dollar, which was unilaterally put in place by the US in 1971 on the closing of the gold window, has reached its point of unsustainability.

I do not believe that there has ever been a purely fiat global currency of this magnitude before in recorded history. So we should not be too surprised if the situation seems to evolve rather slowly,

There is already a great deal of posturing by cross national special interest groups, with 'negotiation' on multiple levels from financial to diplomatic. We may even expect the abusive use of the military to push certain proposals forward rather forcefully.

Bureaucrats can become quite draconian when their schemes for personal power go awry. And in my own monetary thinking a purely fiat currency for international trade ultimately implies the development, or imposition, of a global government controlled by the monetary authority, whatever they may choose to call themselves. The imposition of fiat valuation relies on control, which means power, and often plenty of it.

The future composition of any world government is a very open question. There is very obviously an Anglo-American faction for 'the New American Century.' But there are also Pan-Asian, Pan-Pacific, sub-Saharan, Eurasian and Pan-European elements as well. Although it is most likely a bit of a reach, one has to wonder if this odd construction of the European Monetary Union is not some sort of a testbed for the future cooperation of regional oligarchies.

I am not saying that there is 'A Plan' but there are certainly plans that some groups are clearly pushing towards their own objectives and agendas, and have been doing so for some time. Professor Carroll Quigley, Bill Clinton's mentor at Georgetown, has been instructive on this subject.

We are in exciting times with history being made it seems. There are a number of possible outcomes, which quite frankly no one can accurately forecast at this point. There are too many degrees of freedom, so they literally cannot. But they can throw up theories and strawmen of what may happen, and charge you to read about it. It is an honest source of income, rather like writing racing forms or novellas, or the weather report in the 1950's. And it is fun to talk about while we watch things develop.

But make no mistake, when some of these fellows overreach with their claims of certainty, if they really knew what will happen they would not be telling it to you. They would be playing with their own money in the casino, for all they were worth. Or running funds that increased their leverage for their theories, while providing a steady management income. This is a longer term play after all, and so speculative leverage is a short term risk to be managed. Banks like to catch the players indisposed.

And then, alas, there are those who play for pay, who promulgate their ideas for the special interests, spreading disinformation. Or just make the most dramatic sort of stuff up, selling a kind of financial pornography.

This landscape is what I, and several others some more notable certainly, have called The Currency Wars.