The premiums in the Sprott Funds remain tight, but certainly not as expansive as we had seen in the prior bull market leg in the precious metals.

It was nice to see gold rebound so sharply after the FOMC antics earlier this week. Silver is lagging a bit.

If and when the bull market returns in metals I would expect silver to outperform gold just on the basis of its greater volatility.

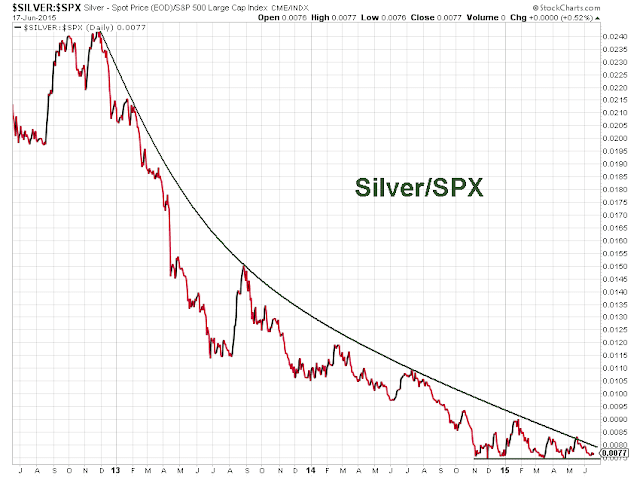

Last night I posted a few charts showing the extreme to which silver seems to have been driven. You may see them here. Others have written more eloquently and repeated about the expanding open interest in Comex silver on declining prices that suggests a shorting campaign by the bears.

If this is in fact the case, then they might very well get stuffed rather handily should silver turn and break out. But I suspect the ringleaders will have taken their gains by then and left some patsies holding the bag.

If this is in fact the case, then they might very well get stuffed rather handily should silver turn and break out. But I suspect the ringleaders will have taken their gains by then and left some patsies holding the bag.

The spread between price and NAV widened back out on the Central Gold Trust (GTU) after having narrowed with the announcement of the Sprott offer. Not quite sure exactly what to make of it, except that perhaps holds of the unitholders are not favorably viewing the offering which is intended to decrease the discount to NAV. I don't think it is a reversal of the arbitrage which we had seen narrow it down to around 4 percent.